Press release

Open Banking | Rising Trends, Demand, New Technology, Growth with Leading Key Players- Banco Original, BBVA, Capital One, Chase, Credit Agricole, Danske Bank, DBS, Deutsche Bank

Regulatory and technological developments are driving the introduction of open banking, where consumers will have the power to grant third parties the right to access their account and transaction data. Banks that embrace the concept will be able to become one-stop shops for the best products on the market, crowdsource the development of new services, and generate revenue by selling access to their data and capabilities.Get Access to sample pages @ https://www.htfmarketreport.com/sample-report/1261888-open-banking-thematic-research

The single biggest factor that will determine the long-term success or failure of open banking is consumer adoption. Open banking has got off to a slow start, with low levels of public awareness and the failure of banks to meet the January deadline for API implementation limiting adoption to date.

Banks can employ a number of different strategies to exploit the opportunities afforded by open banking. Using the bank as a marketplace strategy, banks will transform themselves into portals, using their open APIs to allow third-party services to be accessed from within their own platforms.

Open banking widens out the lending value chain to encompass third party providers. These comprise both full-service lenders and specialists that deal with specific aspects of the lending process. They will use one of two key distribution strategies: either using a bank’s marketplace for third-party products or direct-to-consumer distribution.

Enquire for customization in Report @ https://www.htfmarketreport.com/enquiry-before-buy/1261888-open-banking-thematic-research

Scope:

This report provides a comprehensive analysis of open banking, including a detailed examination of the key players shaping the new environment. The report offers insight into -

- How open banking will disrupt existing value chains in retail banking

- The technological, macroeconomic, strategist, and regulatory factors that are driving open banking

- Which providers are currently taking a lead in exploiting the opportunities afforded by open banking.

Buy this research report @ https://www.htfmarketreport.com/buy-now?format=1&report=1261888

Reasons to buy

- Understand how open banking will affect how you can generate value in lending, payments, and the provision of account information services.

- Learn which of your competitors are leading the way in open banking and what they are doing.

- Equip yourself to deal with the disruption that open banking will cause in lending, savings and investments, credit scoring, account information services, payments, insurance, and loyalty schemes.

Companies mentioned in the Report

Banco Original, BBVA, Capital One, Chase, Credit Agricole, Danske Bank, DBS, Deutsche Bank, Fidor Bank, Monzo, Nordea, N26, OCBC, Starling Bank, UniCredit, Wells Fargo, Backbase, Finastra, FIS, IBM, OpenWrks, Railsbank, Silicon Valley Bank, solarisBank, Sutor Bank, Temenos, TrueLayer, Bud Financial, First Direct, Fractal Labs, HSBC, ING, Tink, Amazon, Apple, Citi, TransferWise, Chip, Moneybox, Raisin, Business Finance Compared, Funding Options, iwoca, Habito, SafetyNet Credit, Zopa, ClearScore, Credit Kudos, CreditLadder, Anorak, Kasko, Flux, Tail, Yoyo.

Read Detailed Index of full Research Study at @ https://www.htfmarketreport.com/reports/1261888-open-banking-thematic-research

Thanks for reading this article; you can also get individual chapter wise section or region wise report version like North America, Europe or Asia.

About Author:

HTF Market Report is a wholly owned brand of HTF market Intelligence Consulting Private Limited. HTF Market Report global research and market intelligence consulting organization is uniquely positioned to not only identify growth opportunities but to also empower and inspire you to create visionary growth strategies for futures, enabled by our extraordinary depth and breadth of thought leadership, research, tools, events and experience that assist you for making goals into a reality. Our understanding of the interplay between industry convergence, Mega Trends, technologies and market trends provides our clients with new business models and expansion opportunities. We are focused on identifying the “Accurate Forecast” in every industry we cover so our clients can reap the benefits of being early market entrants and can accomplish their “Goals & Objectives”.

Contact US :

Craig Francis (PR & Marketing Manager)

HTF Market Intelligence Consulting Private Limited

Unit No. 429, Parsonage Road Edison, NJ

New Jersey USA – 08837

Phone: +1 (206) 317 1218

sales@htfmarketreport.com

Connect with us at

https://www.linkedin.com/company/13388569/

https://www.facebook.com/htfmarketintelligence/

https://twitter.com/htfmarketreport

https://plus.google.com/u/0/+NidhiBhawsar-SEO_Expert?rel=author

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Open Banking | Rising Trends, Demand, New Technology, Growth with Leading Key Players- Banco Original, BBVA, Capital One, Chase, Credit Agricole, Danske Bank, DBS, Deutsche Bank here

News-ID: 1565064 • Views: …

More Releases from HTF Market Intelligence Consulting Pvt. Ltd.

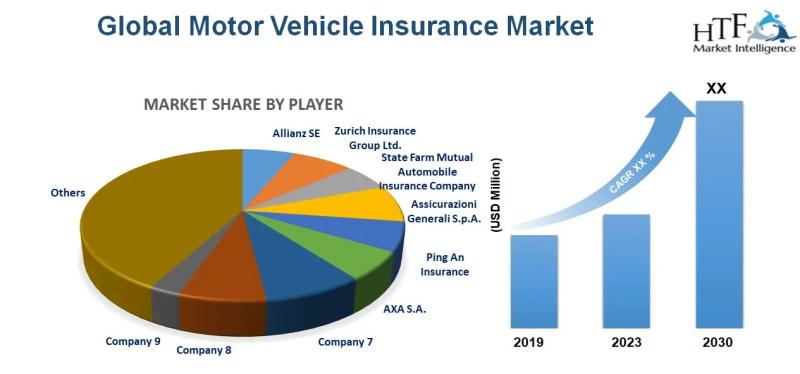

Motor Vehicle Insurance Market revenue is expected to grow by 4.5% from 2023 to …

HTF Market Intelligence recently released a survey document on Motor Vehicle Insurance market and provides information and useful stats on market structure and size.

The report is intended to provide market intelligence and strategic insights to help decision-makers take sound investment decisions and identify potential gaps and growth opportunities.

Additionally, the report also identifies and analyses changing dynamics, and emerging trends along with essential drivers, challenges, opportunities, and restraints in…

Language Editing Service Market constantly growing to See Bigger Picture| Elsevi …

The Latest published market study on Global Language Editing Service Market provides an overview of the current market dynamics in the Language Editing Service space, as well as what our survey respondents- all outsourcing decision-makers- predict the market will look like in 2029. The study breaks the market by revenue and volume (wherever applicable) and price history to estimate the size and trend analysis and identify gaps and opportunities. Some…

Agricultural Logistics Services Market Present Scenario and Growth Analysis till …

The Latest published market study on Global Agricultural Logistics Services Market provides an overview of the current market dynamics in the Agricultural Logistics Services space, as well as what our survey respondents- all outsourcing decision-makers- predict the market will look like in 2029. The study breaks the market by revenue and volume (wherever applicable) and price history to estimate the size and trend analysis and identify gaps and opportunities. Some…

Diamond Watch Market Demonstrates A Spectacular Growth By 2024-2030: Tiffany, Bu …

The Latest published market study on Global Diamond Watch Market provides an overview of the current market dynamics in the Diamond Watch space, as well as what our survey respondents- all outsourcing decision-makers- predict the market will look like in 2029. The study breaks the market by revenue and volume (wherever applicable) and price history to estimate the size and trend analysis and identify gaps and opportunities. Some of the…

More Releases for Bank

Mortgage-Backed Security Market 2022: Industry Manufacturers Forecasts- Construc …

The Mortgage-Backed Security research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Mortgage-Backed Security market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers formulate effective…

Doorstep Banking Services Market Challenges and Opportunities in Banking Service …

Doorstep banking is a facility provided so that user don't have to visit bank branches for routine banking activities like cash deposit, cash withdrawal, cheque deposit, or making a demand draft. The bank extends these facilities at user work place by appointing a service provider on your behalf.

This service was earlier available only to senior citizens but it is available to everyone with nominal fee charges, depending on the type…

What's driving the Neo and Challenger Bank Market trends? Key Players are Hello …

This Global Neo and Challenger Bank market report studies the industry based on one or more segments covering key players, types, applications, products, technology, end-users, and regions for historical data as well as provides forecasts for next few years.

The global Neo and Challenger Bank market is highly competitive and fragmented due to the presence of numerous small vendors in the market. Atom Bank, WeBank (Tencent Holdings Limited), N26, Starling Bank…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank o …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance, regulatory, and other…