Press release

Global Usage Based Insurance Market Trends, shares and business Growth Strategies By 2026 - Key Players are Allianz, AXA, Progressive Insurance, Allstate, Desjardins, Generali, MAPFRE, Metromile, Aviva, Admiral Group Plc,Ageas Group, Aviva Canada, AXA US

Global Usage-Based Insurance Research for a Leading company is an intelligent process of gathering and analyzing the numerical data related to services and products. This Research Give idea to aims at your targeted customer understands needs and wants. Also, reveals how effectively a company can meet their requirements. The market research collects data about the customers, marketing strategy, competitors. The Usage-Based Insurance industry is becoming increasingly dynamic and innovative, with more number of private players entering the industry.The Usage-Based Insurance industry is largely based on the driver and the usage of his vehicle and the way he drives. The premium is calculated on these factors which induces lower insurance premium and motivates the user to drive safer. These factors are driving the market and growing the market value from an estimated value of USD 21 billion in 2017 to an estimated value of USD 87.32 billion by 2025, also registering a CAGR of 19.5%.

Try a FREE | Sample Report At https://databridgemarketresearch.com/request-a-sample/?dbmr=global-usage-based-insurance-market

Key Players/Companies: Global Usage-Based Insurance

Company profiled in this report based on Business overview, Financial data, Product landscape, Strategic outlook & SWOT analysis:

Allianz, AXA, Progressive Insurance, Allstate, Allstate Canada, Desjardins, Generali, MAPFRE, Metromile, Aviva, Admiral Group Plc,Ageas Group, Octo Telematics, TomTom Telematics, Liberty Mutual Insurance, Intelligent Mechatronic Systems – IMS, Mitsui Sumitomo Insurance Co. (Europe) Ltd, Watchstone Group plc, Allianz Australia, Aviva Canada, Allianz Asia Pacific, AXA Insurance Company, AXA US, Aviva Asia, AXA Italia, AXA UK, Ageas UK, Liberty Mutual Insurance Europe Limited

Research Methodology: Global Usage Based Insurance Market

• Primary Respondents: OEMs, Manufacturers, Engineers, Industrial Professionals.

• Industry Participants: CEO’s, V.P.’s, Marketing/Product Managers, Market Intelligence Managers and, National Sales Managers

Global Usage-Based Insurance: Table of Contents

1. Executive Summary

2. Scope/opportunities of the Report

3. Research Methodology

4. Market Landscape

• Market ecosystem

• Market characteristics

• Market segmentation analysis

5. Pipeline Analysis

• Pipeline analysis

6. Market Sizing

• Market definition

• Market sizing

• Market size and forecast

7. Porter’s Five Forces Analysis

• Bargaining power of buyers

• Bargaining power of suppliers

• Threat of new entrants

• Threat of substitutes

• Threat of rivalry

• Market condition

8. Market Segmentation

• Segmentation

• Comparison

• Market opportunity

9. Customer Landscape

10. Regional Landscape

• Geographical segmentation

• Regional comparison

• Europe

• MEA

• APAC

• North America

• South America

• Market opportunity

11. Business Decision Framework

12. Drivers And Challenges

• Market challenges

• Market drivers

13. Market Key Trends

14. Players Landscape

• Overview

• Landscape disruption

15. Players Analysis

• Players covered

• Players classification

• Market positioning of Players

16. Appendix

• List of abbreviations

Try a FREE TOC at https://databridgemarketresearch.com/toc/?dbmr=global-usage-based-insurance-market

Market Drivers and Restraints: Global Usage-Based Insurance

• Reduced Premium costs in comparison to normal automotive insurance, also increase in the vehicle sales has raised the demand for insurance of vehicles.

• Government regulations are not clear on Usage-Based Insurance, which makes the whole process complicated as no clear regulations are set for the users.

• Technology is projected to advance in the coming years and hence, Usage-Based insurance which is majorly dependent on the technological aspect is projected to register significant market growth.

• Usage-Based Insurance is dependent on the driving score. The technology used to calculate these driving scores is expected to be expensive in future; therefore, increasing the cost of the insurance will be a major restraining factor.

Market Segmentation: Global Usage-Based Insurance

Based on region, the market split into

• North America,

• Europe,

• Asia-Pacific, and

• Middle East & Africa, and

• South America

The geographical regions are further segmented into 24 major countries such as U.S. Canada, Mexico, Germany, France, U.K., Belgium, Switzerland, Belgium, Turkey, Japan, China, Singapore, Brazil, India, Russia, South Africa and many others.

U.S. is expected to dominate the market due to the rising pool of elderly population and chronic disease patient pool. Telehealth will help to U.S. healthcare model to shift from episodic model to dynamic continuous monitoring, leading to betterment of healthcare.

By Package Type

• Pay-As-You-Drive (PAYD)

• Pay-How-You-Drive (PHYD)

• Manage-How-You-Drive (MHYD)

By Electric & Hybrid Vehicles

• Hybrid Electric Vehicle (HEV)

• Plug-In Hybrid Electric Vehicle (PHEV)

• Battery Electric Vehicle

By Technology

• On-board Diagnostics-II

• Smartphone

• Embedded System

• Black Box

By Device

• Bring Your Own Device

• Company Provided

By Vehicle Age

• New Vehicles

• On-Road Vehicles

By Vehicle Type

• Light-Duty Vehicle

• Heavy-Duty Vehicle

Customization of the Report

This report can be customized to meet the client’s requirements. Please connect with our sales team (sopan.gedam@databridgemarketresearch.com), who will ensure that you get a report that suits your needs.

About Data Bridge Market Research:

Data Bridge Market Research set forth itself as an unconventional and neoteric Market research and consulting firm with unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process.

Contact:

Data Bridge Market Research

Tel: +1-888-387-2818

Email: sopan.gedam@databridgemarketresearch.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Global Usage Based Insurance Market Trends, shares and business Growth Strategies By 2026 - Key Players are Allianz, AXA, Progressive Insurance, Allstate, Desjardins, Generali, MAPFRE, Metromile, Aviva, Admiral Group Plc,Ageas Group, Aviva Canada, AXA US here

News-ID: 1517136 • Views: …

More Releases from Data Bridge Market Research

Vitamin K Market IS growing at a CAGR of 6.8% during the forecast period of 2023 …

Vitamin K Market Analysis and Size

The essential factors contributing to the growth of the market in the forecast period of 2023 to 2020 include growing demand for vitamin supplements, changing dietary patterns, and rising health consciousness.

Data Bridge Market Research analyses that the global vitamin K market, which was USD 841.47 million in 2022, is expected to reach USD 1,410.20 million by 2030, growing at a CAGR of 6.8% during the…

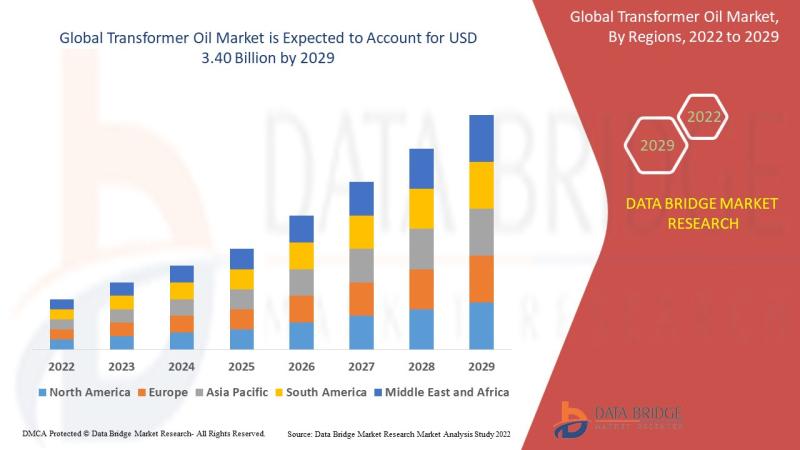

Transformer Oil Market is expected to undergo a CAGR of 7.55% by 2029

Transformer Oil Market Analysis and Size

Transformers are almost everywhere, and every power and distribution transformer is filled with the dielectric insulating fluid, which consists high resistance to electricity and cools the transformer. The "bio based oil" is the highest growing type segment because it has better resistance to fire as compared to other oil over the forecast period. Furthermore, the growth of electric grids in developing economies and the upgradation…

Fatty Alcohols Market is expected to undergo a CAGR of 5.15% by 2029

Fatty Alcohols Market Analysis and Size

The rising demand of hygiene product coupled with growing consumer awareness is anticipated to drive the personal care industry and boost the growth of the fatty alcohols market. Fatty alcohols are used as emollients, emulsifiers and catalytic hydrogenation in cosmetics and beauty products. The "C11-C14 fatty alcohols" is the fastest growing product segment because it is used to produce sodium laureth ether sulphate (SLES), a major foaming agent…

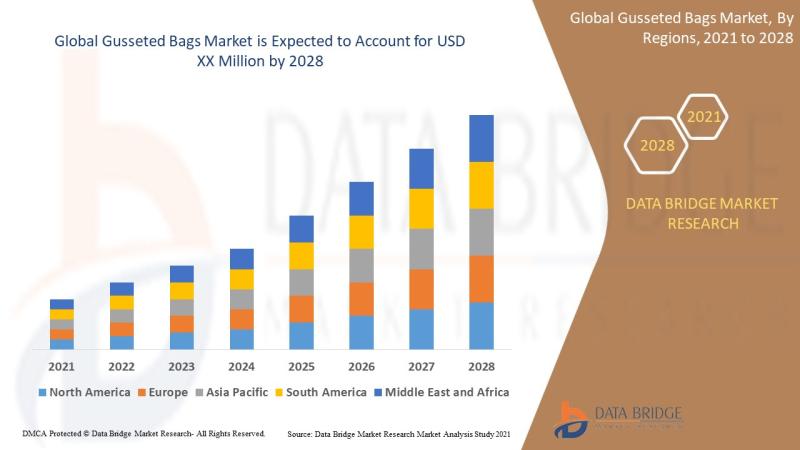

Exclusive Insights on Gusseted Bags Market Latest Trends, Drivers, Strategies an …

An important Gusseted Bags Market research report is produced by taking into account every requirement that organizations need to meet in order to expand successfully. This market report forecasts the market size based on data on major retailer sales, industry growth by upstream and downstream factors, industry advancement, major players, market segments, and application. When creating the reliable Gusseted Bags Market study, the goals of the marketing research are taken into…

More Releases for Insurance

Household Insurance market by top keyaplayers - Discount Insurance Home Insuran …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance marketgrowth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market have also been included in…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Non-Life Insurance Market :Health Insurance, Property Insurance, Cargo Insurance …

Non-Life Insurance Market Overview:

Summary:Excellence consistency maintains by Garner Insights in Research Report in which studies the global Non-Life Insurance market status and forecast, categorizes and Equipment market value by manufacturers, type, application, and region.

Get Access to Report Sample: http://bit.ly/2Q9Hd8z

Non-Life Insurance market was valued at Million US$ in 2017 and is projected to reach Million US$ by 2025, at a CAGR of during the forecast period. In this study, 2017 has been…

Agricultural Insurance Market 2018-2023: AnHua Agricultural Insurance, Anxin Agr …

A new research study titled, “Global Agricultural Insurance Market” has been added to the comprehensive repository of Orbis Research

Agricultural Insurance Market - Global Status and Trend Report 2018-2023 offer a comprehensive analysis of the Agricultural Insurance industry, standing on the readers’ perspective, delivering detailed market data and penetrating insights. No matter the client is the industry insider, potential entrant or investor, the report will provide useful data and information.

The…

Insurance Market-Saga’s Retail Broking Business Offers Motor Insurance, Pet In …

Orbis Research Market brilliance released a new research report of 33 pages on title ‘Insurance Company Profile: Saga’ with detailed analysis, forecast and strategies.

Insurance Company Profile: Saga", profile provides a comprehensive review of Saga and its UK business. This includes its strategy for growth and focus on digitization as well as its performance in the UK and marketing and distribution strategy.

Request a sample of this report at http://orbisresearch.com/contacts/request-sample/2026595

Saga…