Press release

Neo and Challenger Bank Market to Grow at CAGR of 50.6% by 2020: Growth Drivers and Global Industry Analysis

Digital challenger banks are simplifying the financial world, creating a customer centric approach to services, and transforming the way banking is viewed by the public and the market. In return, they endeavor to deliver larger returns on equity as compared to those offered by prominent traditional banks. They strive to offer greater flexibility when it comes to lending through streamlined operations and costs.Download Sample Report - https://www.alliedmarketresearch.com/request-for-customization/1798

The global Neo and Challenger Bank market is, growing at a CAGR of 50.6% during the period 2017 - 2020. Neo and challenger bank market trends are expected to be progressive in coming years. China is expected to witness the highest growth rate during the forecast period, owing to the large pool of underbanked consumers and surge in online and mobile banking users.

The global market is driven by factors such as government regulations, convenience offered to consumers, and low interest rates as compared to traditional banks. However, acquisition of customers and profitability are major challenges faced by these banks. Increase in penetration of smartphone and internet in the emerging economies are expected to offer lucrative opportunities for market growth. Recent approvals of MYBank and WeBank by the Chinese authorities have provided opportunities to digital-only banks to expand their presence in China.

Segment Review-

The report analyses the neo and challenger bank market in terms of customer base based on bank type and country. On the basis of bank type, the market is segmented into neo and challenger bank. The report provides the market analysis of key countries namely, U.S., UK, Germany, China, and Australia. Neo banks lead the market in terms of customer base, and are expected to maintain their dominance throughout the forecast period.

Get Discount UP To 25%* (Offer Till 31st Jan 2018)

Buy Now: https://www.alliedmarketresearch.com/checkout/972253

Challenger banks are expected to witness rapid growth in customer base in the near future due to favorable regulatory norms and enhanced convenience offered by these banks. Moreover, high prevalence of mobile and online banking in regions such as U.S., UK, and Australia is expected to drive the market in the coming years. In addition, increase in investments by angel investors and venture capitalists in fintech startups would aid these banks to sustain the competition. Furthermore, widespread launch of digital subsidiaries by traditional banks and large customer base of these banks are expected to supplement the market growth.

Convenience offered to consumers:

Traditional banks offer banking services to businesses and consumers through their branches and other online channels. The emerging trend of neo and challenger banks offering their banking services through digital channels (online or mobile app banking) in Europe and U.S. is expected to boost the market growth. Moreover, customers do not have to visit bank branches for opening bank accounts and processing their loans, which supplement the market growth. Thus, enhanced convenience offered by these banks for such services is expected to increase the customer base and boost the market growth.

Regulations supporting market growth:

Approvals and granting of banking licenses by financial authorities have increased over the past few years. This has supplemented the market growth and offered opportunities for development. For instance, Financial Conduct Authority (FCA) and Prudential Regulation Authority (PRA) have approved and granted licenses to neo and challenger banks, namely Atom Bank in June 2015, Tandem Bank in December 2015, Starling Bank in July 2016, and Monzo Bank in August 2016. In addition, German Banking Authority, BaFin, has granted licenses to Fidor Bank in 2009, and N26 bank in 2016. Chinese authorities have approved and granted licenses to WeBank and MyBank to cater to the financial needs of small entrepreneurs. This is expected to positively impact the market growth.

Request for Customization - https://www.alliedmarketresearch.com/request-for-customization/1798

About Us:

Allied Market Research (AMR) is a full-service market research and business consulting wing of Allied Analytics LLP based in Portland, Oregon. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of "Market Research Reports" and "Business Intelligence Solutions." AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

We are in professional corporate relations with various companies and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Each and every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

Contact:

David Correa

5933 NE Win Sivers Drive

#205, Portland, OR 97220

United States

Toll Free (USA/Canada):

+1-800-792-5285, +1-503-894-6022, +1-503-446-1141

UK: +44-845-528-1300

Hong Kong: +852-301-84916

India (Pune): +91-20-66346060

Fax: +1-855-550-5975

help@alliedmarketresearch.com

Web: https://www.alliedmarketresearch.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Neo and Challenger Bank Market to Grow at CAGR of 50.6% by 2020: Growth Drivers and Global Industry Analysis here

News-ID: 1492019 • Views: …

More Releases from Allied Market Research

Community Based Tourism Market Expected to Surge to $2136.8 Billion by 2032, Dri …

According to a new report published by Allied Market Research, titled, "Community Based Tourism Market Size, Share, Competitive Landscape and Trend Analysis Report by Age, by Traveler Type, by Sales Channel : Global Opportunity Analysis and Industry Forecast, 2023-2032." The report offers an in-depth examination of key investment areas, successful strategies, drivers, opportunities, market size estimations, competitive landscape, and evolving market trends. 𝐓𝐡𝐞 𝐜𝐨𝐦𝐦𝐮𝐧𝐢𝐭𝐲 𝐛𝐚𝐬𝐞𝐝 𝐭𝐨𝐮𝐫𝐢𝐬𝐦 𝐦𝐚𝐫𝐤𝐞𝐭 𝐰𝐚𝐬 𝐯𝐚𝐥𝐮𝐞𝐝 𝐚𝐭…

K-pop Events Market Expected to Surge to $20 Billion by 2031, Driven by 7.3% CAG …

According to a new report published by Allied Market Research, titled, "K-pop Events Market by Type (Rock, Jazz, Pop, Others), by Revenue Source (Tickets, Sponserships, Others), by Gender (Male, Female): Global Opportunity Analysis and Industry Forecast, 2021-2031". The report offers an extensive analysis of changing market trends, key segments, top investment pockets, regional scenario, Porter's Five Forces, and competitive scenario. 𝐓𝐡𝐞 𝐤-𝐩𝐨𝐩 𝐞𝐯𝐞𝐧𝐭𝐬 𝐦𝐚𝐫𝐤𝐞𝐭 𝐰𝐚𝐬 𝐯𝐚𝐥𝐮𝐞𝐝 𝐚𝐭 $𝟖.𝟏 𝐛𝐢𝐥𝐥𝐢𝐨𝐧 𝐢𝐧…

Music Event Market Size Value US$ 481.4 Billion by 2031, with a CAGR of 9.7% Rec …

𝐓𝐡𝐞 𝐦𝐮𝐬𝐢𝐜 𝐞𝐯𝐞𝐧𝐭 𝐦𝐚𝐫𝐤𝐞𝐭 𝐰𝐚𝐬 𝐯𝐚𝐥𝐮𝐞𝐝 𝐚𝐭 $𝟏𝟓𝟐.𝟐𝟎 𝐛𝐢𝐥𝐥𝐢𝐨𝐧 𝐢𝐧 𝟐𝟎𝟐𝟏 𝐚𝐧𝐝 𝐢𝐬 𝐞𝐬𝐭𝐢𝐦𝐚𝐭𝐞𝐝 𝐭𝐨 𝐫𝐞𝐚𝐜𝐡 $𝟒𝟖𝟏.𝟒 𝐛𝐢𝐥𝐥𝐢𝐨𝐧 𝐛𝐲 𝟐𝟎𝟑𝟏, 𝐠𝐫𝐨𝐰𝐢𝐧𝐠 𝐚𝐭 𝐚 𝐂𝐀𝐆𝐑 𝐨𝐟 𝟗.𝟕% 𝐟𝐫𝐨𝐦 𝟐𝟎𝟐𝟐 𝐭𝐨 𝟐𝟎𝟑𝟏.

According to a new report published by Allied Market Research, titled "Music Event Market By Revenue Source, By Genre, By Type, By Age Group, By Gender: Global Opportunity Analysis and Industry Forecast, 2021-2031" The report provides a detailed analysis of the…

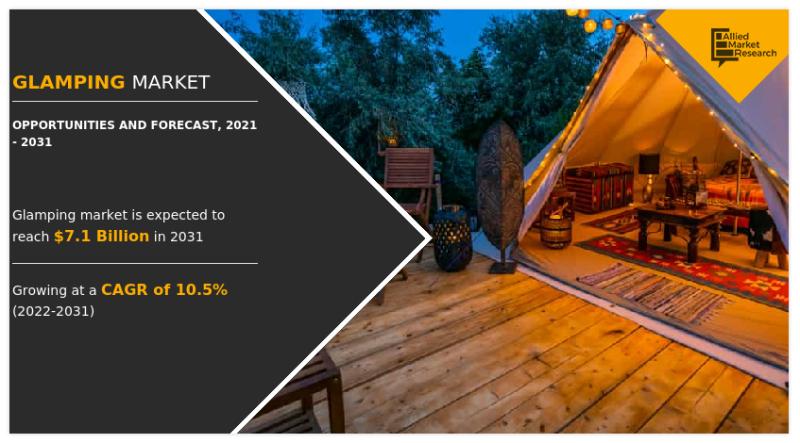

Glamping Market Projected to Worth US$ 7.11 Billion by 2031, Growth Rate (CAGR) …

According to a new report published by Allied Market Research, titled, "Glamping Market By Application, By Age Group, By Size, By End User, By Distribution Channel, By Product Type: Global Opportunity Analysis and Industry Forecast, 2021-2031". The report provides a detailed analysis of the top investment pockets, top winning strategies, drivers & opportunities, market size & estimations, competitive landscape, and changing market trends. 𝐓𝐡𝐞 𝐠𝐥𝐚𝐦𝐩𝐢𝐧𝐠 𝐦𝐚𝐫𝐤𝐞𝐭 𝐰𝐚𝐬 𝐯𝐚𝐥𝐮𝐞𝐝 𝐚𝐭 $𝟐.𝟔𝟖…

More Releases for Bank

Mortgage-Backed Security Market 2022: Industry Manufacturers Forecasts- Construc …

The Mortgage-Backed Security research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Mortgage-Backed Security market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers formulate effective…

Doorstep Banking Services Market Challenges and Opportunities in Banking Service …

Doorstep banking is a facility provided so that user don't have to visit bank branches for routine banking activities like cash deposit, cash withdrawal, cheque deposit, or making a demand draft. The bank extends these facilities at user work place by appointing a service provider on your behalf.

This service was earlier available only to senior citizens but it is available to everyone with nominal fee charges, depending on the type…

What's driving the Neo and Challenger Bank Market trends? Key Players are Hello …

This Global Neo and Challenger Bank market report studies the industry based on one or more segments covering key players, types, applications, products, technology, end-users, and regions for historical data as well as provides forecasts for next few years.

The global Neo and Challenger Bank market is highly competitive and fragmented due to the presence of numerous small vendors in the market. Atom Bank, WeBank (Tencent Holdings Limited), N26, Starling Bank…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank o …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance, regulatory, and other…