Press release

Mobile Payment Market to Reach $ 4,574 Billion by 2023 With CAGR 33.8% from 2017 to 2023 : Orange S.A., Vodacom Group Limited, MasterCard Incorporated.

The rise in demand for easy and hassle-free purchase of goods and services results in increased preference of consumers toward digital and cashless payments. Several global players, such as Apple and Samsung, have designed new strategies to expand their reach and gain a larger share in the global mobile payment market.The mobile payment market was valued at $601 billion in 2016, and is projected to reach $4,574 billion by 2023, growing at a CAGR of 33.8% from 2017 to 2023. The Asia-Pacific mobile payment industry segment is anticipated to grow at the highest rate during the forecast period.

Download report sample at: https://www.alliedmarketresearch.com/request-sample/1778?utm_source=as_opr

The Asia-Pacific generated the highest revenue in the mobile payment market in 2016 due to increase in number of youth population that is active on online media in India, growth in m-commerce, and introduction of innovative solutions by the key players in the region. The mobile payment market in LAMEA is expected to grow at the CAGR of 31.4% during the forecast period.

SMS segment generated maximum share of revenue in 2016 and is expected to dominate the market throughput the forecast period at the CAGR of 33.5%. Among applications, hospitality & transportation is expected to witness highest CAGR of 34.9% during the forecast period.

For purchase enquiry at: https://www.alliedmarketresearch.com/purchase-enquiry/1778?utm_source=as_opr

Prominent players profiled in the study are Orange S.A., Vodacom Group Limited, MasterCard Incorporated, Bharti Airtel Limited, MTN Group Limited, Safaricom Limited, PayPal Holdings, Inc., Econet Wireless Zimbabwe Limited, Millicom International Cellular SA, and Mahindra Comviva. Company overview, business performance, strategic moves and developments, and other key points are provided for the aforementioned companies. These players have expanded their market presence by adopting various business strategies such as acquisition, geographical expansion, product development, strategic alliance, and collaboration.

SMS payments are a way to pay for goods and services through a text message sent from a smartphone. The amount of the purchase is either added to the monthly bill of the customer or deducted from the prepaid balance by the phone operator.

SMS mode of payment is the most popular and preferred method of making mobile payment as users only need a smartphone with SMS capabilities. SMS payments are used more in Europe to pay for parking and buy buses and trams tickets as compared to U.S. As SMS payments are dominant in the mobile payment market, people use this service to buy food, drinks, and for taxi service. Nowadays, SMS payments are also used by customers to avail digital services and products such as ringtones or to do televoting by sending a premium rate SMS.

The report features a competitive scenario of the mobile payment industry and provides a comprehensive analysis of key growth strategies adopted by major players. The key players profiled in the study are Orange S.A., Vodacom Group Limited, MasterCard Incorporated, Bharti Airtel Limited, MTN Group Limited, Safaricom Limited, PayPal Holdings, Inc., Econet Wireless Zimbabwe Limited, Millicom International Cellular SA, and Mahindra Comviva. These players have adopted competitive strategies, such as geographical expansions, mergers & acquisitions, new product launches, and partnerships & collaborations, to augment the growth of the mobile payment market.

Access full summary report at: https://www.alliedmarketresearch.com/mobile-payments-market?utm_source=as_opr

The mobile payment market is in its maturity phase and is expected to grow at a CAGR of 33.8% during the forecast period. Increase is penetration of smartphones, growth in m-commerce industry, and rise in adoption of mobile payment in emerging economies drive the growth of the mobile payment market.

About Us:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Portland, Oregon. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of "Market Research Reports" and "Business Intelligence Solutions.” AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

We are in professional corporate relations with various companies and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Each and every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

Contact:

David Correa

5933 NE Win Sivers Drive

#205, Portland, OR 97220

United States

Toll Free: +1-800-792-5285

UK: +44-845-528-1300

Hong Kong: +852-301-84916

India (Pune): +91-20-66346060

Fax: +1?855?550-5975

help@alliedmarketresearch.com

Web: https://www.alliedmarketresearch.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Mobile Payment Market to Reach $ 4,574 Billion by 2023 With CAGR 33.8% from 2017 to 2023 : Orange S.A., Vodacom Group Limited, MasterCard Incorporated. here

News-ID: 1491896 • Views: …

More Releases from Allied Market Research

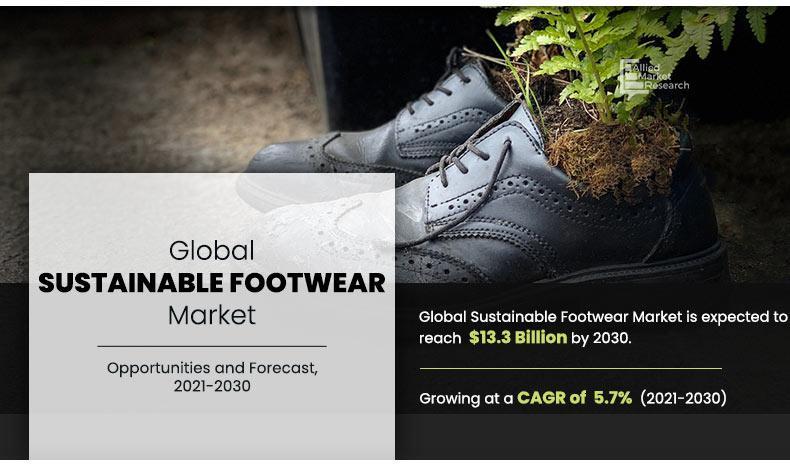

Sustainable Footwear Market is Projected to Rise $13.3 billion by 2030, Growing …

The global sustainable footwear market was valued at $7.7 billion in 2020, and is projected to reach $13.3 billion by 2030, registering a CAGR of 5.7% from 2021 to 2030.

Request The Sample PDF Of This Report: https://www.alliedmarketresearch.com/request-sample/A13792

Sustainable footwear is a type of footwear which is made by recycling waste and are manufactured by eco-friendly production process. In addition to this, surge in youth population, improved lifestyle,…

Wedding Services Market to Surge USD 414.2 billion by 2030, Size, Share, Emergin …

The wedding services market size was valued at $160,587.40 million in 2020, and is estimated to reach $414.2 billion by 2030, growing at a CAGR of 4.8% from 2021 to 2030.Catering services segment led in terms of market share in 2020 and is expected to retain its dominance throughout the forecast period.

Request The Sample PDF Of This Report @: https://www.alliedmarketresearch.com/request-sample/16233

Destination wedding is falling under wedding services market…

Global Supercapacitor Market: Examining the Profitable Opportunities in the Sect …

Allied Market Research recently published a report on the supercapacitor market which offers a comprehensive analysis of the industry for the 2020-2027 timeframe. As per this report, the global supercapacitor market accounted for $3.27 billion in 2019 and is set to garner $16.95 billion by 2027, thereby growing at a CAGR of 23.3% in the 2020-2027 timeframe. As part of the market analysis, the report classifies the industry into various…

Balsa Core Materials Market 2024: Exploring Applications, Trends and Opportuniti …

The global balsa core materials market was valued at $199 million in 2017, and is projected to reach $291 million by 2025, growing at a CAGR of 4.8% from 2018 to 2025.

The major companies profiled in this report are DIAB, Schweiter Technologies, BCOMP LTD., Carbon-Core Corp, Gurit Holding AG, Evonik Industries AG, I-Core Composites, LLC, CoreLite Inc., BONDi (Shandong) Environmental Material Company Limited, and Nord Compensati Spa.

Request Sample Report…

More Releases for Limited

Cold Chain Market in India 2020 | Snowman Logistics Limited, Coldstar Logistics …

Request Free sample on this latest research report @ https://www.marketreportsonline.com/contacts/requestsample.php?name=828960

Key Players: Snowman Logistics Limited, Coldstar Logistics Private Limited, Gati Kausar India Limited, Gubba Cold Storage Private Limited, Kool-ex Cold Chain Limited, Seabird Logisolutions Limited, DHL Logistics Private Limited, Kuehne + Nagel Private Limited

Cold chains provide storage and distribution services for products that are temperature-sensitive. Depending on the nature and purpose of storage application, cold chains have been categorized as frozen…

Power Sector in India 2021 | Adani Power Limited, CESC Limited, Damodar Valley C …

Request a FREE sample on this latest research report @ https://www.marketreportsonline.com/contacts/requestsample.php?name=837846

Companies covered: Adani Power Limited, CESC Limited, Damodar Valley Corporation (DVC), NHPC Limited, NTPC Limited, SJVN Limited, Suzlon Energy, Tata Power Limited, Websol Energy System Limited, Nuclear Power Corporation of India Limited (NPCIL)

The Indian power sector has undergone a significant transformation in terms of power supply, energy demand, fuel mix, and market operations. India appeared to be the third-largest power…

Financial Brokerage Market in India 2021 | Angel Broking Limited, Geojit Financi …

Request a sample on this latest research report @ https://www.marketreportsonline.com/contacts/requestsample.php?name=839020

The brokerage market was valued at INR 135.0 Bn in FY 2016. In FY 2020, it reached INR 210 Bn from INR 195 Bn in FY 2019, expanding at an annual growth rate ~7.69%.

Key Players: Angel Broking Limited, Geojit Financial Services Limited, ICICI Securities Limited, IIFL Finance Limited, Kotak Securities Limited, Motilal Oswal Financial Services Limited, Reliance Capital Limited, SMC Global…

Gin Market major keyplayers Tilaknagar Industries Limited, United Spirits Limite …

Future Market Insights (FMI) has published a new report, which is titled, “Gin Market: Driven By Changing Lifestyle and Expanding Urban Population - India Industry Analysis and Opportunity Assessment, 2015 – 2025.” The Indian gin market is witnessing a steady rise on account of the growing urban population and changing demographics. The change in outlook of the Indian society towards social consumption of alcohol is driving the growth of the…

Auto Ancillary Market In India And Top Key Players Are Amtek Auto Limited, Bhara …

The auto ancillary industry is the other side of the automotive industry, which deals with the manufacturing and selling of intermediate parts, equipment and chemicals among others. The auto ancillary supply chain members are original equipment manufacturers (OEMs), tier I, tier II, tier III manufacturers and intermediaries. OEMs deal in high-value instruments and dominate the market, while the unorganized sector serves the aftermarket and deals in low-value products.

Market segmentation

The Indian…

India footwear Market 2018-2025 Growth Analysis by Key Players, Khadim India Lim …

India footwear market

Currently, India is the second largest footwear manufacturer in the world after China. The footwear market consists of companies engaged in manufacturing, selling and marketing of different kinds of footwear and accessories to the end users, namely men, women and kids. Footwear has evolved from being a necessity, as protection for feet, to an accessory which has become a style statement for customers. The Indian footwear market…