Press release

What is Foreign Earned Income Exclusion?

If you’re living or working in a country outside of the United States, then you might be paying foreign taxes. There are some taxes, like foreign property taxes, that you’ll probably have to pay in conjunction with your United States federal income tax.The Foreign Earned Income Exclusion (FEIE) is a U.S. tax law that ensures that qualifying U.S. citizens and residents can reduce the amount they owe in federal taxes to the IRS on the income they earn while living in another country. It provides tax benefits for individuals and married couples, so find out when it applies and how to take advantage of the exclusion when it comes time to file your own taxes.

Understanding How to Qualify for FEIE

First, it is important to understand who is eligible for the exclusion. There are two terms to familiarize yourself with:

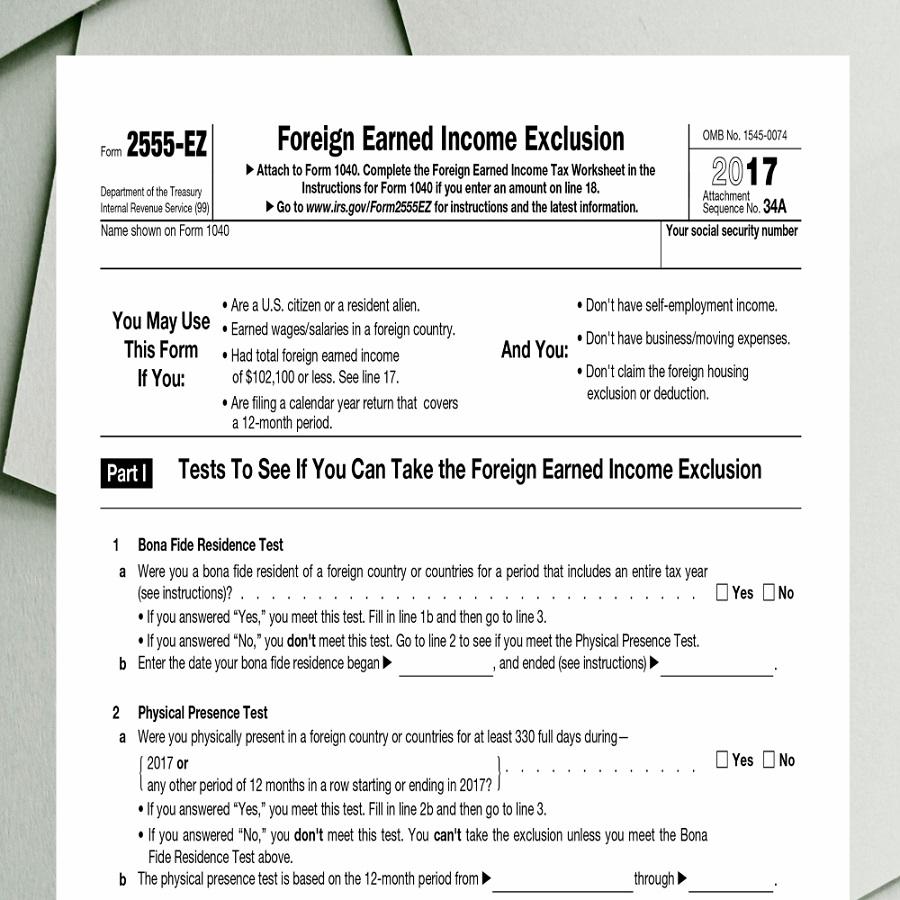

Bona fide residence test – an individual must reside in a foreign country for an uninterrupted period of time that includes the entire tax year, or

Physical presence test – an individual must be physically present in a foreign country for 330 full days during a time period of 12 consecutive months that begins or ends in the tax year.

According to the Internal Revenue Service (IRS), in order to qualify for FEIE, your tax home must be in a foreign country and you must be one of the following:

*A U.S. citizen who is a bona fide resident of a foreign country or countries for an uninterrupted period that includes an entire tax year,

*A U.S. resident alien who is a citizen or national of a country with which the United States has an income tax treaty in effect and who is a bona fide resident of a foreign country or countries for an uninterrupted period that includes an entire tax year, or

*A U.S. citizen or a U.S. resident alien who is physically present in a foreign country or countries for at least 330 full days during any period of 12 consecutive months.

Getting Relief on Federal Tax Liability

While you are taxed on your total income regardless of where you live, FEIE allows you to exclude some of this income up to a certain amount of earning. This amount is adjusted each year for inflation and the 2018 allowance is $104,100.

If you qualified for FEIE, the first $104,100 of the income you earn while living abroad can be excluded from your U.S. Federal tax return. Married couples can double the exemption as long as both individuals qualify for the FEIE.

This earned, or “active” income are the wages you work toward earning. However, “passive” income, or any money you earn from stock trading, pensions, IRAs, real estate transactions, etc., fall outside of the FEIE regulation.

It makes sense to pay taxes in a foreign country where you’re living, driving on roads, and otherwise using the infrastructure. But, as long as you are a U.S. citizen or a green card holder, you have to pay Uncle Sam as well. Fortunately, the FEIE provides qualifying individuals some form of tax relief.

Foreign Housing Exclusion

In addition to the Foreign Earned Income Exclusion, you’ll want to see if you qualify for the Foreign Housing Exclusion. If you qualify under the bona fide residence or physical presence test as described above, you can exclude part of your housing payments made in your foreign tax home as long as they are considered paid for with your taxable earned income.

The IRS further explains, “Your housing amount is the total of your housing expenses for the year minus the base housing amount. The computation of the base housing amount (line 32 of Form 2555) is tied to the maximum foreign earned income exclusion. The amount is 16% of the maximum exclusion amount (computed on a daily basis), multiplied by the number of days in your qualifying period that fall within your tax year.”

There are limitations placed on what can and cannot be included as part of housing expenses as well as how much can be excluded which is based on which foreign country you paid housing expenses in. The worksheet for computing and reporting this information is a part of the IRS Form 2555.

Other Applicable Foreign and Domestic Taxes

It’s important to note the FEIE only applies to federal income taxes. It has no bearing on your state and local tax liabilities. You will need to use Form 2555 or Form 2555-EZ to claim your exclusion. This form should be attached to your appropriate 1040 form when your taxes are filed.

The Foreign Earned Income Exclusion also has no impact on your tax responsibility to the foreign country in which you are living. For example, local property taxes or stamp duty taxes play no role in FEIE.

The future of FEIE and other tax laws could change, and soon so keep abreast of these changes to make sure you comply with the tax laws.

Belize Tax Advantages and FEIE

As a U.S. citizen or green card holder, paying taxes is part of life. However, understanding the tax code can help you to save money and avoid jail time. Look for guidance from trusted tax and financial advisors to assist you in legally retaining as much of your hard-earned income as possible.

When considering your foreign tax home, be sure to have Belize on your list. In addition to offering a beautiful place to live, Belize also provides tax advantages to foreign residents and expats. You may also take advantage of FEIE, Foreign Tax Credits, and other tax relief solutions.

Caye International Bank, on Ambergris Caye island in Belize, is known for its ethical behavior and business integrity and has been helping U.S. citizens establish the right types of offshore accounts for years. One of the experts at Caye can help you learn more about banking, finance, taxation, necessary tax forms, and more as part of living and earning income in Belize.

Contact Caye International Bank today to get the answers to your questions.

This article is copyright © 2019

Tags: Ambergris Caye, Belize, Caye International Bank, FEIE, Foreign Account Tax Compliance Act, Foreign Earned Income Exclusion, Foreign Housing Exclusion, International Living, Luigi Wewege, Senior Vice President

About Caye International Bank:

Caye is the only International Bank headquartered on the beautiful island of Ambergris Caye in Belize, Central America. The bank offers a full range of traditional and non-traditional financial services and accounts in multiple currencies. An application for account opening is a simple process and can be facilitated online from anywhere in the world.

About author - Luigi Wewege:

Luigi is the Senior Vice President of Caye International Bank in Belize, published author of The Digital Banking Revolution, has co-authored economic research which was presented before the U.S. Congress and currently serves as an Instructor at the FinTech School as well as a Speaker at the Silicon Valley Innovation Centre. He holds an Italian MBA with a major in International Business, as well as a BSBA with a triple major in Finance, International Business, and Management - cum laude from the University of Missouri-St. Louis.

P.O. Box 105, Coconut Drive

San Pedro Town, Ambergris Caye

Belize, Central America

notify@cayebank.bz

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release What is Foreign Earned Income Exclusion? here

News-ID: 1469705 • Views: …

More Releases from Caye International Bank

Thinking of Retiring to Belize? Keep These 7 Budgeting Tips in Mind

If you’re wondering if Belize is the ideal setting for your retirement years, don’t feel alone. There are many ex-pats who find that the climate, the cost of living, and the eclectic mix of cultures is to their tastes.

How do you know if this is the right choice for you? The only way to know for sure is to learn more about what to expect in terms of the general…

Do You Think Offshore Banking is Only for the Wealthy? Think Again!

With the mention of offshore banking, some have visions of mansions, traveling by private jet, and being driven around town in a limousine. That’s because some people assume that having offshore financial accounts requires having lots of money or because they’ve watched too many James Bond movies.

In reality, you don’t have to be rich in order to establish an offshore account.

People in many different lines of work have offshore…

Learn more about San Pedro – the true Isla Bonita

As the largest Belize island, Ambergris Caye is 25 miles long and filled with a plethora of lagoons, sandy beaches, and reefs to explore. Its major settlement is San Pedro Town, which has the highest concentration of accommodations and activities in the country.

Vacationers and retirees alike flock to the island because of its natural beauty and to experience a sophisticated lifestyle at an affordable cost. You, too, can enjoy the…

Find out about the seven trends in offshore banking

For many individuals and businesses, offshore banking is the ideal way to diversify assets and protect wealth. Whether you’re safeguarding assets for future generations, saving for retirement, or starting an international business, offshore banking can be the right choice.

Offshore banking varies from one jurisdiction to the next, and not all services are right for everyone. Staying ahead of trends in offshore banking can help you decide what is right for…