Press release

Will 2019 be the year of the STO?

Disclaimer: Article inspired from InWara. This is not financial advice.STO: Security Token Offering

Security token offering (STO) is a fundraising tool similar to an ICO, but with certain regulations that hold the token issuers accountable for their actions.

The relatively quick success of ICOs has established them as a viable method of crowdfunding. While ICOs have helped a lot of startups raise a great deal of money, the fundraising method also paved way for a variety of scams as there were little or no regulations involved.

Decoding Security Token Offerings (STOs)

Blockchain technology has been evolving ever since it has gained popularity which was mostly due to Bitcoin in the early stages. Now, with the developments in the smart contracts, security tokens have come into existence with the sole purpose of establishing themselves as the new use case for real-time digital assets that operate within the legal boundaries.

4 Layers in STOs

Blockchain Protocols

Security Tokens are not entitled to their own protocol technology. but are constructed on existing protocols with Etherum being the most popular in the space currently. However, it is not the only option as there are more protocols entering the space.

Smart Contracts

However spiffy the term might sound, this doesn’t have any relations whatsoever with smart contracts being the same as legal bonds. They are basically programming languages set by the blockchain protocol. Ideally, they are supposed to have a utility and therefore a value which is why they are named utility tokens.

Issuance Platforms

These platforms create and distribute the utility tokens and are also responsible for having compliant, regulated smart contracts for the token issuance.

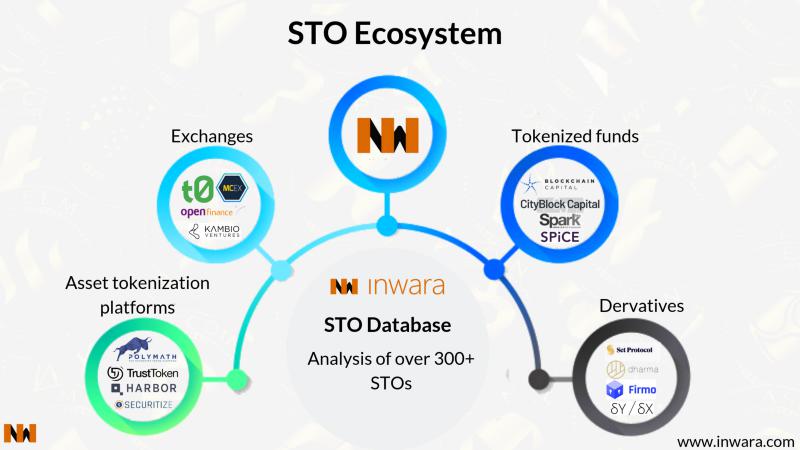

Exchanges

The most essential component in the digital asset ecosystem as they facilitate trading, therefore, providing the liquidity in the equation. Without them, there is no worth of the token except if someone else is ready to pay for them.

Reason behind Regulations

SEC’s cracking down on fraudulent and non-compliant ICOs has initiated a shift in the fraternity from ICOs towards STOs.

STOs because of the underlying asset backing in the form of regulations and compliance’s in most jurisdictions and hold companies behind the projects accountable to their investors.

STOs swiftly replacing ICOs

October 2018 has seen the most number of STOs than ever before. This noticeable shift from ICOs to STOs is largely driven due to the recent bottoming of the retail market (both Bitcoin and Ethereum) and softening demand from retail investors for ICOs.

The crackdown has also resulted in investor confidence erosion and this prompted the investors to change their preference to STOs.

STO Landscape

Investments and Trading takes the lead with the most number of STOs so far, contributing to over 20% of total STOs. Financial Services leads the pack in ICOs numbers but for STOs, the sector takes a step back.

STOs fueled an influx of investment into real off-chain businesses that provide equity/stake in exchange for capital.

Token standard followed by STOs

Ethereum’s ERC 20 is dominating the space with 68% token adoption by STOs.

Polymath, one of the first companies to bolster the notion of STOs takes the next biggest share of 23% with its ST-20 token standard.

Securitize has developed four digital security issuers namely Spice venture capital, Blockchain capital, 22X, and Augmate exclusively for STOs. The adoption of these tokens is not quite common in the space for now, but the growing rage for STOs can increase the adoption rate for Securitize tokens.

When it comes to digital currency investments, STOs are considered to have a low appetite for risk because of the diversity in the security token issuance Platforms when compared to ICOs. ERC 20 undeniably leads with over 90% tokens adoption rate in ICOs space which is why the market trend in ICOs is skewed due to the event like XRP overtaking ETH as the second largest alt coin in terms of total market capitalization.

Also, Ethereum is coming up with a unique token standard. ERC-1400 specifically for security tokens. It is currently under testing phase by the Ethereum community. The goal is to make Security Tokens more credible by having certain specifications added to the existing ones that will potentially make ERC-1400 comply with ERC-777 and ERC-20 standards.

Simple Agreement of Future Tokens (SAFT)

The number of SAFT entries with SEC has been significantly rising with SEC’s actions against fraudulent issuers. Recent reports indicate that the SEC may be working on a systematic investigation of all projects working under the simple agreements for future tokens (SAFTs) framework.

STOs going strong with a success rate of 99% so far

We are now witnessing an increasing number of STOs as the there are over 60% STOs that are either active or upcoming. Also, the companies intending to raise funds are starting to realize that the interests of a sophisticated and/or accredited investors and funds are more inclined towards “security” tokens instead of “utility tokens”, due to values possessed by the security tokens.

As per Inwara, Neluns raised $136 million through STO highest till date, followed by Tzero with a raise $134.7 million.

SEC exhibiting stronghold in the equity financing space

SEC is making a statement to seek a balance between permissiveness and enforcement of “well-established” rules and regulations and is not hesitating to take legal actions against the foul play activities as it did with Paragon and Airfox.

Paragon and AirFox are two ICOs that have fallen prey to US regulators and SEC as they accepted to have engaged in the sale of unregistered securities for which SEC slapped them with a fine of $250,000.

To sum it up

In the not so distant future, STOs might completely overtake ICOs. They will be legal, regulated and one can invest in them with a genuine expectation of returns. Returns that aren’t influenced by the Bitcoin’s market price, but the positive cash flow of a business which is healthy for the digital economic ecosystem.

Where is this data coming from?

To leverage InWara’s STO database schedule your expert walkthrough on InWara's website.

Leader in ICO, Blockchain

and Cryptocurrency Data

Trusted, accurate and verified data preferred by

capital markets, industry and service providers.

2500 Plaza 5, Harborside Financial Center,

New Jersey, United States.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Will 2019 be the year of the STO? here

News-ID: 1444999 • Views: …

More Releases from InWara Inc

Inwara, the leading cryptocurrency data provider is contemplating a Securitized …

Leader in STO, ICO, Blockchain and Cryptocurrency Data, Inwara is trusted, accurate and verified data preferred by capital markets, industry and service providers.

New York, January 16, 2019

Established in 2017, Inwara has quickly become the data provider of choice for investors and other market participants in the cryptocurrency space. Inwara offers data and analysis across over 4000 ICOs, almost all STOs launched till date, Private funding rounds, Mergers and Acquisitions, Venture…

Is EOS ICO a scam? Once the top fundraiser, now faces collusion allegations

The highest record earning project, EOS is now facing speculations of being a scam since the leaking of a spreadsheet by Shi Feifei, a Huobi employee.

Everything about EOS

EOS is a decentralized project in the blockchain space that aims to radically improve what is already on the market. The decentralized operating system intends to provide an easy alternative for all the developers to design a dApp.

EOS became the talk of the town…

Ripple vs Ethereum

Ripple vs Ethereum

Ripple overtook Ethereum three times in the second half of September 2018 in terms of market capitalization. Although it was for a brief time, Ethereum lost its place as the 2nd largest cryptocurrency. Eventually, Ethereum powered back to re-take its position.

Let's analyze the cause and effect of this episode.

Cause:

Ethereum is an open-source, public, blockchain-based platform for dApps and Ripple is a real-time gross settlement system, currency exchange, and remittance network…

More Releases for STO

IWS FinTech Expand Security Token Offering (STO) Services into Different Milesto …

Singapore (15 March 2022) - IWS FinTech, an award winning and fast-growing start-up specialising in disruptive technologies such as blockchain and fintech, recently expanded one of their services into different milestones, demonstrating their commitment to innovation.

Security Token Offerings (STOs) are a new approach for start-ups and established businesses to raise funding. They are more secure than traditional initial coin offerings (ICOs) due to lower costs, improved security, more liquidity, and…

E-Commerce in Parcel Delivery Market Next Big Thing | STO Express, DHL, LSO

The Global E-Commerce in Parcel Delivery Market Report assesses developments relevant to the insurance industry and identifies key risks and vulnerabilities for the E-Commerce in Parcel Delivery Industry to make stakeholders aware with current and future scenarios. To derive complete assessment and market estimates a wide list of Insurers, aggregators, agency were considered in the coverage; Some of the top players profiled are OnTrac, Spee Dee Delivery Service, JD.com, STO…

KEEPP announces blockchain based equity-token crowdfunding (STO)

Keepp – a share company, registered in Latvia is announcing plans for equity crowdfunding campaign assisted by technology and compliance provider Fintelum (https://fintelum.com). In the unprecedented fundraise, Keepp will be issuing a security token on the Ethereum blockchain, representing the share ownership

The EU-based business Keepp (keepp.eu) aims to scale market-proven network of short- and long-term self-service storage facilities. In the first phase, the project plans to develop across Riga, Latvia.…

VINX Coin STO Launch

Vinito Capital Management releases VINX, its first fine wine and vineyard backed STO coin

A fine wine and vineyard investment company launches an asset backed Ethereum cryptocurrency token.

Monte Carlo; Today, Vinito Capital Management (VCM), a fine wine and vineyard investment company, is announcing the release of its first Security Token Offering (STO) coin called VINX, backed by assets worth EUR32 million. With this coin, investors can now purchase VCM shares on…

Future Currency of Health, HIT Foundation STO Begins 19th June 2019

18th June 2019, Switzerland – Following a venture round funding which raised over $500K CHF, HIT Foundation have announced details of their STO event commencing 19th June 2019, 00:00 CEST. Aiming to provide a decentralized platform for matching information seekers with individual and unlock the $536 billions worth of digital health market in 2025, HIT Foundation uses NEM blockchain technology and smart contracts to empower the individual to take back…

Global Mortar market 2017 - Materis, Sika, Henkel, Mapei, Sto, Ardex, BASF, Baum …

Apex Market Reports, recently published a detailed market research study focused on the "Mortar Market" across the global, regional and country level. The report provides 360° analysis of "Mortar Market" from view of manufacturers, regions, product types and end industries. The research report analyses and provides the historical data along with current performance of the global Mortar industry, and estimates the future trend of Mortar market on the basis of…