Press release

Worldwide Payment Security Service Market Size 2018-2023: Braintree, Cyber Source Corporation, Elavon, Index, Ingenico ePayments Intelligent Payments

The report studies the global market and presents a thorough 2018-2023 overview of the market. The historical growth trail of the market is scrutinized in detail in the report and reliable forecasts regarding the market’s growth from 2018 to 2023 are provided to help readers formulate competitive strategies based on a solid databaseGet Sample Payment Security Service Market Report at https://www.researchreportsinc.com/sample-request?id=68096

The companies include:

Braintree (Illinois, US), CyberSource Corporation (California, US), Elavon (Georgia, US), Index (Nevada, US), Ingenico ePayments (Hoofddorp, Netherlands), Intelligent Payments (Gibraltar), GEOBRIDGE C et al.

A new report titled “Global Payment Security Service Market” has been added to the vast company database, thus adding value to the overall understanding of this market. The report has been drafted for the period 2018 to 2023

The information for each competitor includes:*Company Profile*Main Business Information*SWOT Analysis*Sales, Revenue, Price and Gross Margin*Market Share

Grab 20% Discount Offer at https://www.researchreportsinc.com/check-discount?id=68096

There are 3 key segments covered in this report: geography segment, end use/application segment and competitor segment.

For geography segment, regional supply, application-wise and type-wise demand, major players, price is presented from 2013 to 2023. This report coverss following regions:

*North America

*South America

*Asia & Pacific

*Europe

*MEA (Middle East and Africa)

Browse Complete Research Report Copy at https://researchreportsinc.com/product/2018-global-payment-security-service-industry-report-history-present-and-future/

TABLE OF CONTENTS

Chapter 1 Executive Summary

Chapter 2 Abbreviation and Acronyms

Chapter 3 Preface

3.1 Research Scope

3.2 Research Methodology

3.2.1 Data Collection

3.2.2 Data Analysis

3.2.3 Data Validation

3.3 Research Sources

3.3.1 Primary Sources

3.3.2 Secondary Sources

3.3.3 Assumptions

Chapter 4 Market Landscape

4.1 Market Overview

4.2 Classification/Types

4.3 Application/End Users

Chapter 5 Market Trend Analysis

5.1 Introduction

5.2 Drivers

5.3 Restraints

5.4 Opportunities

5.5 Threats

Chapter 6 Industry Chain Analysis

6.1 Upstream/Suppliers Analysis

6.2 Payment Security Service Analysis

6.2.1 Technology Analysis

6.2.2 Cost Analysis

6.2.3 Market Channel Analysis

6.3 Downstream Buyers/End Users

Chapter 7 Latest Market Dynamics

7.1 Latest News

7.2 Merger and Acquisition

7.3 Planned/Future Project

7.4 Policy Dynamics

Chapter 8 Trading Analysis

8.1 Export of Payment Security Service by Region

8.2 Import of Payment Security Service by Region

8.3 Balance of Trade

Chapter 9 Historical and Current Payment Security Service Market in North America (2013-2018)

9.1 Payment Security Service Supply

9.2 Payment Security Service Demand by End Use

9.3 Competition by Players/Suppliers

9.4 Type Segmentation and Price

9.5 Key Countries Analysis

Chapter 10 Historical and Current Payment Security Service Market in South America (2013-2018)

10.1 Payment Security Service Supply

10.2 Payment Security Service Demand by End Use

10.3 Competition by Players/Suppliers

10.4 Type Segmentation and Price

10.5 Key Countries Analysis

Chapter 11 Historical and Current Payment Security Service Market in Asia & Pacific (2013-2018)

11.1 Payment Security Service Supply

11.2 Payment Security Service Demand by End Use

11.3 Competition by Players/Suppliers

11.4 Type Segmentation and Price

11.5 Key Countries Analysis

Chapter 12 Historical and Current Payment Security Service Market in Europe (2013-2018)

12.1 Payment Security Service Supply

12.2 Payment Security Service Demand by End Use

12.3 Competition by Players/Suppliers

12.4 Type Segmentation and Price

12.5 Key Countries Analysis

Chapter 13 Historical and Current Payment Security Service Market in MEA (2013-2018)

13.1 Payment Security Service Supply

13.2 Payment Security Service Demand by End Use

13.3 Competition by Players/Suppliers

13.4 Type Segmentation and Price

13.5 Key Countries Analysis

Chapter 14 Summary for Global Payment Security Service Market (2013-2018)

14.1 Payment Security Service Supply

14.2 Payment Security Service Demand by End Use

14.3 Competition by Players/Suppliers

14.4 Type Segmentation and Price

Chapter 15 Global Payment Security Service Market Forecast (2019-2023)

15.1 Payment Security Service Supply Forecast

15.2 Payment Security Service Demand Forecast

15.3 Competition by Players/Suppliers

15.4 Type Segmentation and Price Forecast

Chapter 16 Company Profile(Braintree (Illinois, US), CyberSource Corporation (California, US), Elavon (Georgia, US), Index (Nevada, US), Ingenico ePayments (Hoofddorp, Netherlands), Intelligent Payments (Gibraltar), GEOBRIDGE C et al.)

16.1 Company A

16.1.1 Company Profile

16.1.2 Main Business and Payment Security Service Information

16.1.3 SWOT Analysis of Company A

16.1.4 Company A Payment Security Service Sales, Revenue, Price and Gross Margin (2013-2018)

16.2 Company B

16.2.1 Company Profile

16.2.2 Main Business and Payment Security Service Information

16.2.3 SWOT Analysis of Company B

16.2.4 Company B Payment Security Service Sales, Revenue, Price and Gross Margin (2013-2018)

16.3 Company C

16.3.1 Company Profile

16.3.2 Main Business and Payment Security Service Information

16.3.3 SWOT Analysis of Company C

16.3.4 Company C Payment Security Service Sales, Revenue, Price and Gross Margin (2013-2018)

16.4 Company D

16.4.1 Company Profile

16.4.2 Main Business and Payment Security Service Information

16.4.3 SWOT Analysis of Company D

16.4.4 Company D Payment Security Service Sales, Revenue, Price and Gross Margin (2013-2018)

16.5 Company E

16.5.1 Company Profile

16.5.2 Main Business and Payment Security Service Information

16.5.3 SWOT Analysis of Company E

16.5.4 Company E Payment Security Service Sales, Revenue, Price and Gross Margin (2013-2018)

16.6 Company F

16.6.1 Company Profile

16.6.2 Main Business and Payment Security Service Information

16.6.3 SWOT Analysis of Company F

16.6.4 Company F Payment Security Service Sales, Revenue, Price and Gross Margin (2013-2018)

16.7 Company G

16.7.1 Company Profile

16.7.2 Main Business and Payment Security Service Information

16.7.3 SWOT Analysis of Company G

16.7.4 Company G Payment Security Service Sales, Revenue, Price and Gross Margin (2013-2018)

Research Reports Inc. is one of the leading destinations for market research reports across all industries, companies, and technologies. Our repository features an exhaustive list of market research reports from thousands of publishers worldwide.

US / Canada Toll Free: +18554192424, UK :+4403308087757 | Email: info@researchreportsinc.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Worldwide Payment Security Service Market Size 2018-2023: Braintree, Cyber Source Corporation, Elavon, Index, Ingenico ePayments Intelligent Payments here

News-ID: 1417198 • Views: …

More Releases from Research Reports Inc.

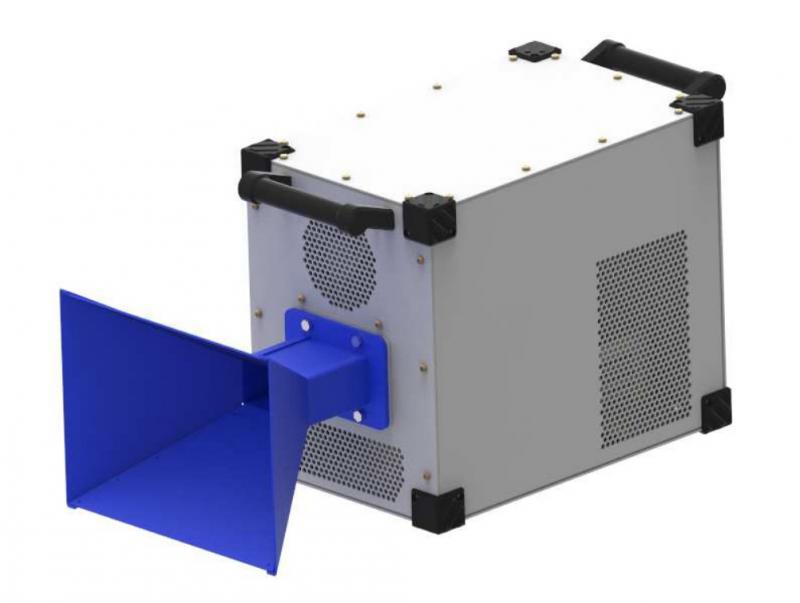

Microwave Generators Market Share And SWOT Analysis By 2021: DARE Instruments, C …

The Microwave Generators market report contains a study on the change within the dynamics of competition. It also delivers specific awareness that helps you select the proper business executions and steps. The Microwave Generators market report systematically presents information within the sort of organizational charts, facts, diagrams, statistical charts, and figures that represent the state of the relevant trading on the worldwide and regional platform. Additionally, the report comprises the…

Mini Data Center Market SWOT Analysis By 2021: Schneider Electric, Hewlett, IBM, …

The Mini Data Center market report contains a study on the change within the dynamics of competition. It also delivers specific awareness that helps you select the proper business executions and steps. The Mini Data Center market report systematically presents information within the sort of organizational charts, facts, diagrams, statistical charts, and figures that represent the state of the relevant trading on the worldwide and regional platform. Additionally, the report…

Contact Lenses Market Share, Trends and SWOT Analysis By 2021: Novartis, Menicon …

Contact Lenses market competitive insights provide details by a competitor. Details included are market overview, company financials, revenue generated, market potential, Porter’s analysis, investment in research and development, drivers and restraints, new market initiatives, company strengths, overview, and weaknesses, regional presence, product launch, product width, and breadth, application dominance. The above data points provided are only related to the companies’ focus related to the Contact Lenses market.

Research Reports inc is…

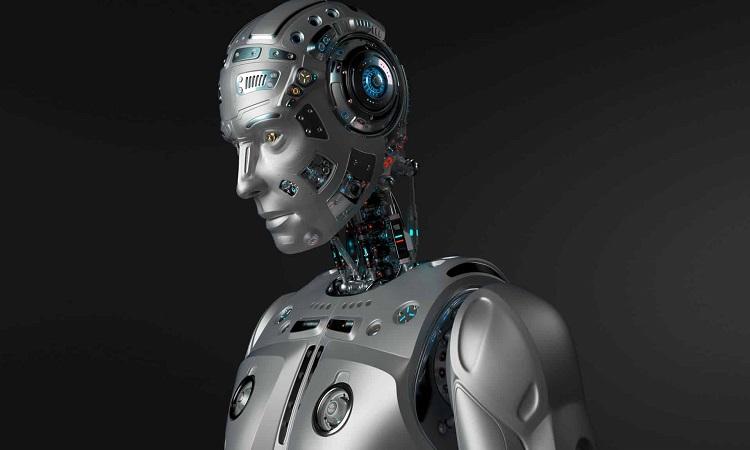

Robot Market Share and SWOT Analysis By 2021 Top Key Players: ABB, Ecovacs, Estu …

Robot market competitive insights provide details by a competitor. Details included are market overview, company financials, revenue generated, market potential, Porter’s analysis, investment in research and development, drivers and restraints, new market initiatives, company strengths, overview, and weaknesses, regional presence, product launch, product width, and breadth, application dominance. The above data points provided are only related to the companies’ focus related to the Robot market.

Get Free PDF Sample Copy of…

More Releases for Payment

Digital Payment Market by Component (Solutions (Payment Processing, Payment Gate …

Magarpatta SEZ, Pune, “ReportsnReports”, one of the world’s prominent market research firms has released a new report on Global Digital Payment Market. The report contains crucial insights on the market which will support the clients to make the right business decisions. This research will help both existing and new aspirants for Digital Payment Market to figure out and study market needs, market size, and competition. The report talks about the…

Online Payment Gateway Market Analysis By 2028 | Amazon.com, Avenues India Pvt. …

Future Market Insights (FMI) has recently published a new research report on the online payment gateway market titled “Online Payment Gateway Market: Global Industry Analysis (2013-2017) and Opportunity Assessment (2018-2028).” The report states that the growing prevalence of third party payment processes is expected to have a positive impact on the growth of the global market. Websites have always been a good source for channel merchants for generating revenue. Concentrating…

Payment Card Industry 2025 by Product (Contactless Payment, Card Contact Payment …

ReportsWeb.com has announced the addition of the “Global Payment Card Market Professional Survey Report 2018” ,provides a vital recent industry data which covers in general market situation along with future scenario for industry around the Globe.

Key Players -

MasterCard, Visa, American Express, Banco Itau, Bank of America Merrill Lynch, Bank of Brazil, Bank of East Asia, Chase Commercial Banking, Diner's Club, Hang Seng Bank, Hyundai, JP Morgan, SimplyCash, Sumitomo…

Payment Security Software Market 2018- Digital Transformation in Payment Methods …

Market Highlights

“The increasing number of cashless transactions is the main factor behind the rising demand for payment security software across the world,” says a FGR analyst. With the ongoing digital transformation, the payment market is witnessing a significant change in the pattern of financial transactions, which is shifting towards cashless increasingly.

The digitization across industries is leading to high investments in the development and the deployment of new technologies, encouraging…

Payment Gateway Industry Worth US$ 86.9 Billion By 2025 - Hosted Payment Gateway …

The merchants all over the globe are avidly willing to expand their businesses cross-border by adaption of a logical approach, by partnering with the payment gateways. With the help of this partnership, these merchants gain the advantage of tapping the opportunities created by the globalization of e-commerce. Majority of merchants today, are eyeing up global expansion and wish to grow at a faster pace, however, the last thing they would…

Contactless Payment Observe Huge Demand in Australia Payment Market

Pune, India, 04 December 2017: WiseGuyReports announced addition of new report, titled “Payments in Australia 2017: What Consumers Want”.

A 'payment system' is new technology that allows consumers, businesses, and many organizations to transfer money to a financial institution and vice versa. This includes Payment Instructions - Cash, Card, Check and Electronic Funds Transfer which customers use to pay - and generally unseen arrangements ensure that the funds move from one…