Press release

Catana Capital launches Data Intelligence Fund

- Combination of Big Data analysis and Artificial Intelligence forms basis of investment decision- Selective investment in European Large Cap stocks

- Attractive risk-return profile due to management of exposure level via index futures

Frankfurt am Main, 04. December. The Frankfurt based Asset Manager Catana Capital launches the Data Intelligence Fund (DE000A2H9A68), an innovative UCITS fund, that relies entirely on Big Data and Artificial Intelligence (AI).

For the investment decisions, internet data on securities and financial markets are automatically collected, filtered, weighted and analysed in seven countries and in three languages. In this way, almost two million capital market-related news items are evaluated in real time every day. Using this algorithm, buy and sell recommendations for European large cap stocks and index futures are generated in a purely data-based process. "The aim of the fund is to achieve a positive return that exceeds the long-term average return of the DAX index. At the same time, the aim is not to generate negative annual returns," says Bastian Lechner, Managing Director of Catana Capital. The target group includes both professional and private investors.

Via the Big Data analysis more than 45.000 securities are covered in real-time. „The key question is: Who says what to which security? In a first more than 5 terabyte of information are collected per month. This is more than 21 messages per second. In a second step, the algorithm evaluates the information“, Lechner continues. The system assigns to every security a preliminary positive or negative signal based on the collected information. Though, before a final trading signal is generated, the AI analyses how a security has performed in the past after such a positive or negative signal. Only with a high success probability, a trading signal is generated. The new decision and its performance result are added to the database and therefore included for future trading signals going forward – the system is self-learning on an automated basis.

"The stock selection approach is supplemented by an asset allocation component. If the overall assessment of the equity market is negative, the risk is reduced by index futures and can even be net short," says Lechner. "Especially in phases of corrections and downturns in equity markets, the algorithm has shown its strength and reduced risks at an early stage. As a result, we achieve a high diversification effect, limit risks and dependence on volatile capital markets and can achieve attractive results even in a challenging environment," explains Lechner.

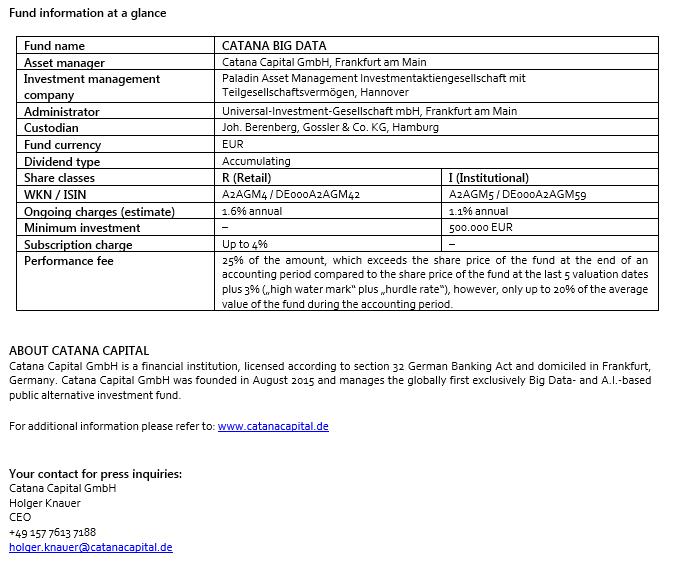

FUND INFORMATION AT A GLANCE

Fund name: Data Intelligence Fund

Advisor: Catana Capital GmbH

Administrator: Ampega Investment GmbH

Custodian: Hauck & Aufhäuser Privatbankiers AG

Currency: EUR

Dividend type: Accumulating

Share classes: P (Retail)

WKN / ISIN: A2H9A6 / DE000A2H9A68

Management Fee: 1.88%

TER (estimate): 2.12 %

Minimum investment:–

Up-front charge: up to 5.25 %

Share classes: I (Institutional)

WKN / ISIN: A2H9A7 / DE000A2H9A76

Management Fee: 1.35%

TER (estimate): 1.59 %

Minimum investment: 1,000,000 EUR

Up-front charge: up to 1.25%

Performance fee: 20% of the amount by which the fund price at the end of a settlement period exceeds the fund price on the valuation date of the last 5 years ("high water mark"), but not more than a total of 15% of the average value of the fund in the settlement period.

Catana Capital GmbH is a financial institution, licensed according to section 32 German Banking Act and domiciled in Frankfurt, Germany. Catana Capital GmbH was founded in August 2015 and manages the Data Intelligence Fund, an exclusively Big Data- and A.I.-based public UCITS fund.

CATANA CAPITAL GmbH

p: +49 69 2561 7004

f: +49 69 9001 2974

e: info(at)catanacapital.de

Friedensstr. 7

60311 Frankfurt am Main

– Germany –

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Catana Capital launches Data Intelligence Fund here

News-ID: 1416101 • Views: …

More Releases from Catana Capital GmbH

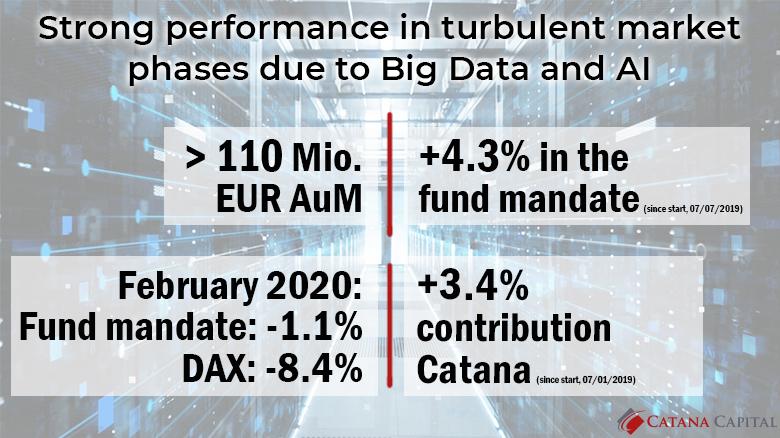

Catana Capital's overlay strategy with successful month in a turbulent market ph …

03/09/2020, Frankfurt: After Catana Capital successfully launched an overlay strategy for an existing fund in October 2019 and exceeding the EUR 100m AuM mark, the Frankfurt asset manager can now look back on a very positive month in an exceptionally turbulent market phase. While the German DAX index lost about five percent since start of the mandate in July 2019, the fund mandate with Catana's overlay strategy was able to…

Catana Capital: New collaboration with Life Science AI pioneer Innoplexus

Catana Capital partners with a leading provider of AI solutions in the Life Science sector

Frankfurt am Main, December 16, 2019: As a pioneer in the application of Big Data and AI for quantitative asset management, Catana Capital is always open to collaborate with other innovators in the space in order to develop new innovative investment strategies. After a successful first year of the Data Intelligence Fund and the recent launch…

Catana Capital launches overlay strategies and crosses EUR 100 million (AuM) lev …

Frankfurt am Main, October 09, 2019: Following the successful market launch of the Data Intelligence Fund (ISIN: DE000A2H9A68) by the innovative Asset Manager Catana Capital, the Frankfurt-based FinTech now offers additional customized overlay strategies for institutional clients to stabilize the performance of existing funds.

Within the framework of the overlay strategies, various sub-models of Catana Capital are applied and implemented via DAX Future Short positions. In order to meet customer requirements…

Worldwide first Big Data-based fund “CATANA BIG DATA“ is Germany's most inno …

- Catana's fund "CATANA BIG DATA" ranked first in the category "Fund Innovations" at the 2017 Fund Awards of FERI EuroRating Services

- Catana Capital was able to compete against well-known fund providers such as Credit Suisse, Deutsche Bank, Blackrock and LBBW

- Automated Big Data analysis forms basis of investment decision of the fund

- Focused investment strategy in DAX stocks and DAX futures without leverage allows market independent positioning

Frankfurt am Main,…

More Releases for Data

HOW TO TRANSFORM BIG DATA TO SMART DATA USING DATA ENGINEERING?

We are at the cross-roads of a universe that is composed of actors, entities and use-cases; along with the associated data relationships across zillions of business scenarios. Organizations must derive the most out of data, and modern AI platforms can help businesses in this direction. These help ideally turn Big Data into plug-and-play pieces of information that are being widely known as Smart Data.

Specialized components backed up by AI and…

Global Data Analytics Outsourcing Market |data analytics outsourcing, big data o …

Market Research Reports Search Engine (MRRSE) has been serving as an active source to cater intelligent research report to enlighten both readers and investors. This research study titled “Global Data Analytics Outsourcing Market “

The report on data analytics outsourcing market provides analysis for the period 2016 – 2026, wherein 2018 to 2026 is the forecast period and 2017 is the base year. The report covers major trends and technologies playing…

Test Data Management (TDM) Market - test data profiling, test data planning, tes …

The report categorizes the global Test Data Management (TDM) market by top players/brands, region, type, end user, market status, competition landscape, market share, growth rate, future trends, market drivers, opportunities and challenges, sales channels and distributors.

This report studies the global market size of Test Data Management (TDM) in key regions like North America, Europe, Asia Pacific, Central & South America and Middle East & Africa, focuses on the consumption…

Data Prep Market Report 2018: Segmentation by Platform (Self-Service Data Prep, …

Global Data Prep market research report provides company profile for Alteryx, Inc. (U.S.), Informatica (U.S.), International Business Corporation (U.S.), TIBCO Software, Inc. (U.S.), Microsoft Corporation (U.S.), SAS Institute (U.S.), Datawatch Corporation (U.S.), Tableau Software, Inc. (U.S.) and Others.

This market study includes data about consumer perspective, comprehensive analysis, statistics, market share, company performances (Stocks), historical analysis 2012 to 2017, market forecast 2018 to 2025 in terms of volume, revenue, YOY…

Long Term Data Retention Solutions Market - The Increasing Demand For Big Data W …

Data retention is a technique to store the database of the organization for the future. An organization may retain data for several different reasons. One of the reasons is to act in accordance with state and federal regulations, i.e. information that may be considered old or irrelevant for internal use may need to be retained to comply with the laws of a particular jurisdiction or industry. Another reason is to…

Data Quality and Data Governance Solution Market - Demand For Cost-Effective Dat …

In the enterprise data management ecosystem, data quality is a broad term which refers to the quality, integrity, and consistency of data and/or process etc. Data quality also implies the degree of data accuracy and consistency. On the other hand, data governance focusses on the management of data assets by assigning authority, control, and responsibility of data and encompasses three key areas: people, process, and technology.

Data quality and data governance…