Press release

Cyber Insurance Market Size, Share, Growth| Mojar Key Players Company American International, Chubb, Zurich Insurance, XL Group, Berkshire Hathaway, Allianz Global Corporate & Specialty, Munich Re, Lloyds

Cyber Insurance Market Report, published by Allied Market Research, forecasts that the global market is expected to garner $14 billion by 2022, registering a CAGR of nearly 28% during the period forecast 2022. North America constituted the largest cyber insurance market share in 2015 and it would continue to dominate the market during the forecast period. Growth in the region is supplemented by enforcement of data protection regulations in U.S. Moreover, increase in levels of liability and legislative developments accelerate the market growth.Access Full Report Summary: https://www.alliedmarketresearch.com/cyber-insurance-market?utm_source=OpenPR

Increase in awareness about cyber risks from boardroom to data centers owing to the rising number of cyber-attacks in the past 23 years is the prime factor that drives the market. However, complex and changing nature of cyber risks limits cyber insurance market growth. Low market penetration of cyber insurance policies in developing countries offers promising business opportunity for market players.

The global cyber insurance market is segmented based on industry verticals, company size, and geography. Based on industry verticals, the market is segmented into healthcare, retail, financial services (BFSI), information technology and services, others (utilities, energy, manufacturing, construction, and transportation). BFSI and information technology sector were the early adopters of cyber liability insurance policies to protect their data. Although, as per the study, Healthcare vertical generates around one-third of the premium as these companies possess huge third-party data such as personal details of consumers, employment details and cyber criminals can easily misuse this data to make money. For instance, in U.S., around 78% of hospitals are secured under cyber insurance.

Based on revenue generated by companies, cyber insurance market is categorized as very small-sized (2.5 million to 99 million), small-sized (100 million-299 million), medium-sized (300 million to 1billion), and large companies (1 billion and above). Despite the fact that cyber security and cyber risks are acknowledged as serious threat, several companies do not purchase cyber insurance policies. However, the market has witnessed a change in the scenario. Companies of all sizes tend to purchase cyber insurance policies, owing to legal developments. Large companies contribute significantly, i.e., around 70% of the overall cyber insurance market in 2015, as loss of any kind of data has negative repercussions on their businesses.

North America dominates the cyber insurance market and accounts for around 87% of the overall cyber insurance market in 2015. Mandatory legislation regarding cyber security in several U.S. states has led to higher penetration of cyber liability insurance policies. The U.S. cyber insurance industry has become mature, and growth of the cyber insurance industry is projected to decrease owing to rising adoption of cyber liability insurance policies. Europe has very less penetration of cyber insurance liability policies as compared to that of the U.S. The European council has recently passed regulations regarding data protection and security, which are projected to be brought into effect in 2018. These regulations would oblige companies to purchase cyber insurance policies. Though Asia-Pacific accounts for negligible percentage share, it is expected to grow at a significant CAGR during the forecast period owing to a significant increase in ransomware attacks.

Download Sample Copy Here: https://www.alliedmarketresearch.com/request-sample/1705?utm_source=OpenPR

Key Findings of the Cyber Insurance Market:

•North America generated highest revenue in 2015 and will continue to lead the market during the forecast period.

•Europe is projected to grow at the highest rate.

•Large companies contribute significantly in generation of cyber insurance premium.

•Healthcare industry was the major buyer of cyber insurance policies in 2015 and will continue to lead the market during the forecast period.

Key companies profiled in the report are American International Group, Inc. (U.S.), The Chubb Corporation (U.S.), Zurich Insurance Co. Ltd (Switzerland), XL Group Ltd (Republic of Ireland), Berkshire Hathaway (U.S.), Allianz Global Corporate & Specialty (Germany), Munich Re Group (Germany), Lloyds (U.K.), Lockton Companies, Inc. (U.S.), and AON PLC (U.K.).

Enquiry Report: https://www.alliedmarketresearch.com/purchase-enquiry/1705?utm_source=OpenPR

Allied Market Research, a market research and advisory company of Allied Analytics LLP, provides business insights and market research reports to large as well as small & medium enterprises. The company assists its clients to strategize business policies and achieve sustainable growth in their respective market domain.

Allied Market Research provides one stop solution from the beginning of data collection to investment advice. The analysts at Allied Market Research dig out factors that help clients to understand the significance and impact of market dynamics. The company amplies client’s insight on the factors, such as strategies, future estimations, growth or fall forecasting, opportunity analysis, and consumer surveys among others. As follows, the company offers consistent business intelligent support to aid the clients to turn into prominent business firm.

Contact:

David Correa

5933 NE Win Sivers Drive

#205, Portland, OR 97220

United States

Toll Free (USA/Canada):

+1-800-792-5285, +1-503-894-6022, +1-503-446-1141

UK: +44-845-528-1300

Hong Kong: +852-301-84916

India (Pune): +91-20-66346060

Fax: +1⟨855⟩550-5975

help@alliedmarketresearch.com

Web: https://www.alliedmarketresearch.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Cyber Insurance Market Size, Share, Growth| Mojar Key Players Company American International, Chubb, Zurich Insurance, XL Group, Berkshire Hathaway, Allianz Global Corporate & Specialty, Munich Re, Lloyds here

News-ID: 1394330 • Views: …

More Releases from Allied Market Research

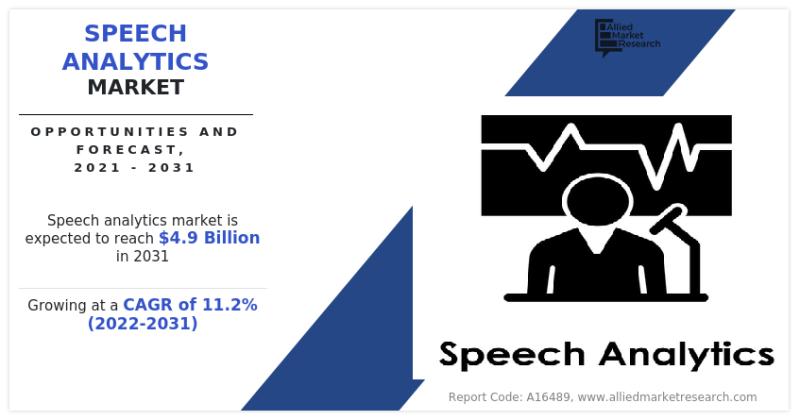

Speech Analytics Market Expected to Reach to USD 4.9 Billion by 2031, Key Factor …

Allied Market Research published a new report, titled, " The Speech Analytics Market Expected to Reach to USD 4.9 Billion by 2031, Key Factors behind Market's Exponential Growth." The report offers an extensive analysis of key growth strategies, drivers, opportunities, key segment, Porter's Five Forces analysis, and competitive landscape. This study is a helpful source of information for market players, investors, VPs, stakeholders, and new entrants to gain thorough understanding…

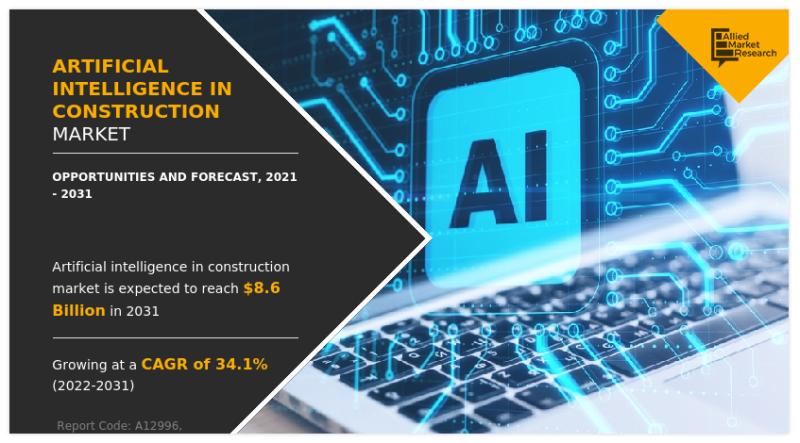

Artificial Intelligence in Construction Market Expected to Reach USD 8.6 Billion …

According to the report published by Allied Market Research, The Artificial Intelligence in Construction Market Expected to Reach USD 8.6 Billion by 2031, Growing with at a CAGR of 34.1%. The report provides an extensive analysis of changing market dynamics, major segments, value chain, competitive scenario, and regional landscape. This research offers valuable able guidance to leading players, investors, shareholders, and startups in devising strategies for sustainable growth and gaining…

Seaweed Extracts Market to See Competition Rise | $3.5 Billion by 2032

The seaweed extracts market was valued at $2 billion in 2022, and is estimated to reach $3.5 billion by 2032, growing at a CAGR of 6.1% from 2023 to 2032.

Request Sample PDF Of This Report: https://www.alliedmarketresearch.com/request-sample/A12569

Seaweed extracts refer to concentrated substances derived from different types of seaweed or marine algae. These extracts are obtained through various extraction methods, such as drying, grinding, or chemical processes, resulting in highly potent forms…

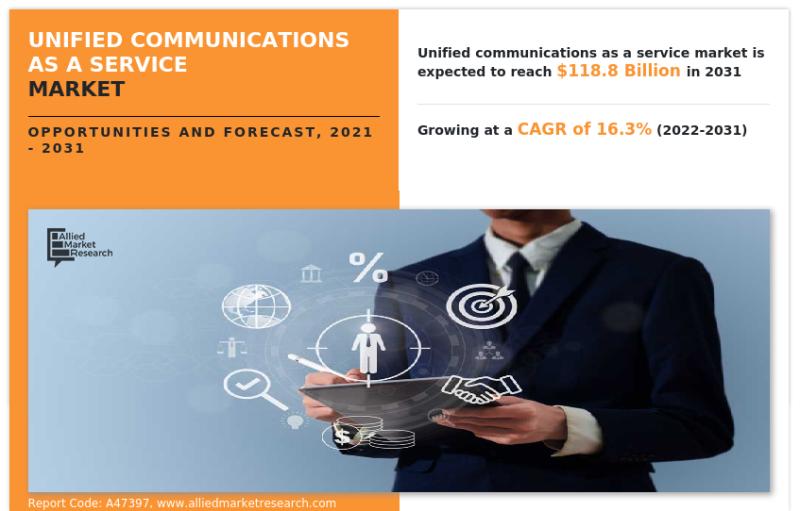

Unified Communications as a Service Market Expected to Reach USD 118.8 Billion b …

Allied Market Research published a new report, titled, " The Unified Communications as a Service Market Expected to Reach USD 118.8 Billion by 2031, Key Factors behind Market's Exponential Growth." The report offers an extensive analysis of key growth strategies, drivers, opportunities, key segment, Porter's Five Forces analysis, and competitive landscape. This study is a helpful source of information for market players, investors, VPs, stakeholders, and new entrants to gain…

More Releases for Insurance

Household Insurance market by top keyaplayers - Discount Insurance Home Insuran …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance marketgrowth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market have also been included in…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Non-Life Insurance Market :Health Insurance, Property Insurance, Cargo Insurance …

Non-Life Insurance Market Overview:

Summary:Excellence consistency maintains by Garner Insights in Research Report in which studies the global Non-Life Insurance market status and forecast, categorizes and Equipment market value by manufacturers, type, application, and region.

Get Access to Report Sample: http://bit.ly/2Q9Hd8z

Non-Life Insurance market was valued at Million US$ in 2017 and is projected to reach Million US$ by 2025, at a CAGR of during the forecast period. In this study, 2017 has been…

Agricultural Insurance Market 2018-2023: AnHua Agricultural Insurance, Anxin Agr …

A new research study titled, “Global Agricultural Insurance Market” has been added to the comprehensive repository of Orbis Research

Agricultural Insurance Market - Global Status and Trend Report 2018-2023 offer a comprehensive analysis of the Agricultural Insurance industry, standing on the readers’ perspective, delivering detailed market data and penetrating insights. No matter the client is the industry insider, potential entrant or investor, the report will provide useful data and information.

The…

Insurance Market-Saga’s Retail Broking Business Offers Motor Insurance, Pet In …

Orbis Research Market brilliance released a new research report of 33 pages on title ‘Insurance Company Profile: Saga’ with detailed analysis, forecast and strategies.

Insurance Company Profile: Saga", profile provides a comprehensive review of Saga and its UK business. This includes its strategy for growth and focus on digitization as well as its performance in the UK and marketing and distribution strategy.

Request a sample of this report at http://orbisresearch.com/contacts/request-sample/2026595

Saga…