Press release

Loan Services Market – A comprehensive study by Key Players: FICS, Fiserv, Mortgage Builder, Nortridge Software

HTF MI recently introduced Global Loan Services Market study with in-depth overview, describing about the Product / Industry Scope and elaborates market outlook and status to 2023. The market Study is segmented by key regions which is accelerating the marketization. At present, the market is developing its presence and some of the key players from the complete study are FICS, Fiserv, Mortgage Builder, Nortridge Software & Shaw Systems Associates etc.Request Sample of Global Loan Services Market Size, Status and Forecast 2018-2025 @: https://www.htfmarketreport.com/sample-report/1322296-global-loan-services-market

Loan servicing is the process by which a company (mortgage bank, servicing firm, etc.) collects interest, principal, and escrow payments from a borrower.

In 2017, the global Loan Services market size was xx million US$ and it is expected to reach xx million US$ by the end of 2025, with a CAGR of xx% during 2018-2025.

This report studies the Global Loan Services market size, industry status and forecast, competition landscape and growth opportunity. This research report categorizes the Global Loan Services market by companies, region, type and end-use industry.

Browse 100+ market data Tables and Figures spread through Pages and in-depth TOC on " Loan Services Market by Type (, Conventional Loans, Conforming Loans, FHA Loans, Private Money Loans & Hard Money Loans), by End-Users/Application (Homeowner, Local Bank & Company), Organization Size, Industry, and Region - Forecast to 2023". Early buyers will receive 10% customization on comprehensive study.

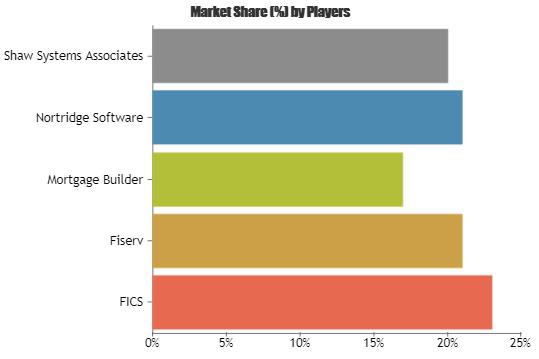

In order to get a deeper view of Market Size, competitive landscape is provided i.e. Revenue (Million USD) by Players (2013-2018), Revenue Market Share (%) by Players (2013-2018) and further a qualitative analysis is made towards market concentration rate, product/service differences, new entrants and the technological trends in future.

Enquire for customization in Report @ https://www.htfmarketreport.com/enquiry-before-buy/1322296-global-loan-services-market

Competitive Analysis:

The key players are highly focusing innovation in production technologies to improve efficiency and shelf life. The best long-term growth opportunities for this sector can be captured by ensuring ongoing process improvements and financial flexibility to invest in the optimal strategies. Company profile section of players such as FICS, Fiserv, Mortgage Builder, Nortridge Software & Shaw Systems Associates includes its basic information like legal name, website, headquarters, its market position, historical background and top 5 closest competitors by Market capitalization / revenue along with contact information. Each player/ manufacturer revenue figures, growth rate and gross profit margin is provided in easy to understand tabular format for past 5 years and a separate section on recent development like mergers, acquisition or any new product/service launch etc.

Market Segments:

The Global Loan Services Market has been divided into type, application, and region.

On The Basis Of Type: , Conventional Loans, Conforming Loans, FHA Loans, Private Money Loans & Hard Money Loans.

On The Basis Of Application: Homeowner, Local Bank & Company

On The Basis Of Region, this report is segmented into following key geographies, with production, consumption, revenue (million USD), and market share, growth rate of Loan Services in these regions, from 2013 to 2023 (forecast), covering

• North America (U.S. & Canada) {Market Revenue (USD Billion), Growth Analysis (%) and Opportunity Analysis}

• Latin America (Brazil, Mexico & Rest of Latin America) {Market Revenue (USD Billion), Growth Share (%) and Opportunity Analysis}

• Europe (The U.K., Germany, France, Italy, Spain, Poland, Sweden & RoE) {Market Revenue (USD Billion), Growth Share (%) and Opportunity Analysis}

• Asia-Pacific (China, India, Japan, Singapore, South Korea, Australia, New Zealand, Rest of Asia) {Market Revenue (USD Billion), Growth Share (%) and Opportunity Analysis}

• Middle East & Africa (GCC, South Africa, North Africa, RoMEA) {Market Revenue (USD Billion), Growth Share (%) and Opportunity Analysis}

• Rest of World {Market Revenue (USD Billion), Growth Analysis (%) and Opportunity Analysis}

Buy Single User License of Global Loan Services Market Size, Status and Forecast 2018-2025 @ https://www.htfmarketreport.com/buy-now?format=1&report=1322296

Have a look at some extracts from Table of Content

Introduction about Global Loan Services

Global Loan Services Market Size (Sales) Market Share by Type (Product Category) in 2017

Loan Services Market by Application/End Users

Global Loan Services Sales (Volume) and Market Share Comparison by Applications

(2013-2023) table defined for each application/end-users like [Homeowner, Local Bank & Company]

Global Loan Services Sales and Growth Rate (2013-2023)

Loan Services Competition by Players/Suppliers, Region, Type and Application

Loan Services (Volume, Value and Sales Price) table defined for each geographic region defined.

Global Loan Services Players/Suppliers Profiles and Sales Data

Additionally Company Basic Information, Manufacturing Base and Competitors list is being provided for each listed manufacturers

Market Sales, Revenue, Price and Gross Margin (2013-2018) table for each product type which include , Conventional Loans, Conforming Loans, FHA Loans, Private Money Loans & Hard Money Loans

Loan Services Manufacturing Cost Analysis

Loan Services Key Raw Materials Analysis

Loan Services Chain, Sourcing Strategy and Downstream Buyers, Industrial Chain Analysis

Market Forecast (2018-2023)

........and more in complete table of Contents

Browse for Full Report at: https://www.htfmarketreport.com/reports/1322296-global-loan-services-market

Thanks for reading this article; you can also get individual chapter wise section or region wise report version like North America, Europe or Asia.

About Author:

HTF Market Report is a wholly owned brand of HTF market Intelligence Consulting Private Limited. HTF Market Report global research and market intelligence consulting organization is uniquely positioned to not only identify growth opportunities but to also empower and inspire you to create visionary growth strategies for futures, enabled by our extraordinary depth and breadth of thought leadership, research, tools, events and experience that assist you for making goals into a reality. Our understanding of the interplay between industry convergence, Mega Trends, technologies and market trends provides our clients with new business models and expansion opportunities. We are focused on identifying the “Accurate Forecast” in every industry we cover so our clients can reap the benefits of being early market entrants and can accomplish their “Goals & Objectives”.

Contact US :

Craig Francis (PR & Marketing Manager)

HTF Market Intelligence Consulting Private Limited

Unit No. 429, Parsonage Road Edison, NJ

New Jersey USA – 08837

Phone: +1 (206) 317 1218

sales@htfmarketreport.com

Connect with us at

https://www.linkedin.com/company/13388569/

https://www.facebook.com/htfmarketintelligence/

https://twitter.com/htfmarketreport

https://plus.google.com/u/0/+NidhiBhawsar-SEO_Expert?rel=author

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Loan Services Market – A comprehensive study by Key Players: FICS, Fiserv, Mortgage Builder, Nortridge Software here

News-ID: 1381659 • Views: …

More Releases from HTF Market Intelligence Consulting Pvt. Ltd.

Education Finance Software Market: Regaining Its Glory | PowerSchool Finance, Ty …

The latest analysis of the worldwide education finance software market by HTF MI Research evaluates the market's size, trends, and forecasts through 2033. The education finance software market study includes extensive research data and proofs to give managers, analysts, industry experts, and other key personnel a ready-to-access, self-analyzed study to help understand market trends, growth drivers, opportunities, and upcoming challenges as well as competitors.

Key Players in This Report Include:

Blackbaud, Ellucian,…

Digital Parcel Mapping Systems Market Is Booming Worldwide | Major Giants Hexago …

The latest analysis of the worldwide digital parcel mapping systems market by HTF MI Research evaluates the market's size, trends, and forecasts through 2033. The Digital Parcel Mapping Systems market study includes extensive research data and proofs to give managers, analysts, industry experts, and other key personnel a ready-to-access, self-analyzed study to help understand market trends, growth drivers, opportunities, and upcoming challenges as well as competitors' positions.

Key Players in This…

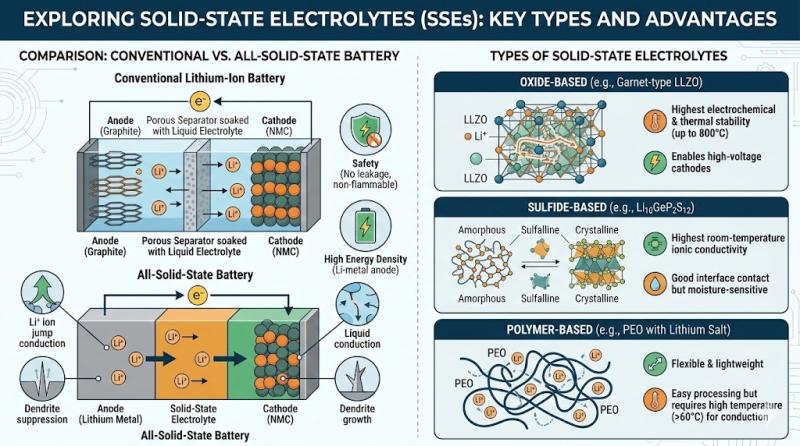

Solid-State Electrolytes Market Likely to Boost Future Growth by 2033 | QuantumS …

HTF Market Intelligence published a new research document of 150+pages on Solid-State Electrolytes Market Insights, to 2033" with self-explained Tables and charts in presentable format. In the Study you will find new evolving Trends, Drivers, Restraints, Opportunities generated by targeting market associated stakeholders. The growth of the Solid-State Electrolytes market was mainly driven by the increasing R&D spending by leading and emerging player, however latest scenario and economic slowdown have…

Marine Mining Technology Market Current Status and Future Prospects | Odyssey Ma …

The latest study released on the Global Marine Mining Technology Market by HTF MI Research evaluates market size, trend, and forecast to 2033. The Marine Mining Technology study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analysed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about the competitors.

Consider…

More Releases for Loan

Travel Loan Personal Loan Guide To Finance Domestic And International Trips Easi …

Image: https://www.abnewswire.com/upload/2026/02/71bfa2bd36a80322c40217cb0777143c.jpg

Travel opens up new worlds, fresh perspectives, and unforgettable memories. Whether it is a peaceful beach escape, a mountain adventure, or an international holiday, planning the perfect trip often requires careful budgeting. This is where a travel loan can help you turn your plans into reality without financial stress. As a type of personal loan, it offers flexible funding, easy repayment, and quick access to money, making travel planning…

Navigating the Loan Landscape with Retail Loan Origination Systems

In the world of finance, obtaining a loan is a common practice for individuals looking to buy a home, start a business, or meet various financial needs. Behind the scenes, a crucial player in this process is the Retail Loan Origination System (RLOS). In simple terms, an RLOS is the engine that powers the loan application journey, making it smoother and more efficient for both borrowers and lenders.

Click Here for…

Loan Brokers Market Report 2024 - Loan Brokers Market Trends And Growth

"The Business Research Company recently released a comprehensive report on the Global Loan Brokers Market Size and Trends Analysis with Forecast 2024-2033. This latest market research report offers a wealth of valuable insights and data, including global market size, regional shares, and competitor market share. Additionally, it covers current trends, future opportunities, and essential data for success in the industry.

Ready to Dive into Something Exciting? Get Your Free Exclusive Sample…

Loan Brokers Market Report 2024 - Loan Brokers Market Trends And Growth

"The Business Research Company recently released a comprehensive report on the Global Loan Brokers Market Size and Trends Analysis with Forecast 2024-2033. This latest market research report offers a wealth of valuable insights and data, including global market size, regional shares, and competitor market share. Additionally, it covers current trends, future opportunities, and essential data for success in the industry.

Ready to Dive into Something Exciting? Get Your Free Exclusive Sample…

Business Loan - What is a Business Loan?

Business Loans are funds available to all types of businesses from banks, non-banking financial companies (NBFCs), or other financial institutions. Business Loans can be tailor-made to meet the specific needs of growing small and large businesses. These loans offer your business the opportunity to scale up and give it the cutting-edge necessary for success in today's competitive world.

Business Loans for the micro-small-medium enterprise (MSME) sector in India are particularly…

Business Loan - Apply Business Loan With Lowest EMI–loanbaba.com

Business loan is the perfect loan option for established entrepreneurs. Typically, it helps in expanding the business. Any idea or plans the business owner may have for the business, he or she can apply business loan with lowest EMI to execute them. But before getting the loan, there are few important steps that need to be followed by the borrower. Step one involves putting together the necessary paperwork. Submission of…