Press release

Core Banking Solution Market Growth by 2027 | HCL Technologies Limited, Temenos Group AG, Capgemini, Infrasoft Technologies Ltd., IBM Corporation, Nelito Systems Ltd., COBISCORP

In its recent report titled ”Core Banking Solution Market: Global Industry Analysis 2012 – 2016 and Opportunity Assessment 2017 – 2027′, Future Market Insights has comprehensively assessed the core banking service market that is on track to witness a robust CAGR of 5.1% for the forecast period.Component – Software Dominates Services Component in Core Banking Solution Market

The software component is larger than its service counterpart in the core banking solution market and is expected to gain significant BPS over the duration of the study. The software segment may well be worth US$ 65 billion by the year 2027 and see steady revenue growth throughout the decade.

A Sample of this Report is Available upon Request @ https://www.futuremarketinsights.com/reports/sample/rep-gb-3395

Region – North America Critical in Core Banking Solution Market

North America is the largest region in the core banking solution market and is on track to retain this position for the foreseeable future. However, Western Europe is poised to gain a massive 250 BPS till the end of 2027, making the developed world the hub of the core banking solution market. The North America core banking solution market is anticipated to cross US$ 6 billion by 2027 with the US accounting for approx. US$ 3.9 billion. However, Canada is poised to record a higher CAGR during this time making it a lucrative opportunity for key stakeholders in the core banking solution market.

End Users – Banks Have Maximum Need of Core Banking Solutions

Banks have the largest share in the core banking solution market and are likely to remain so for some time. Banks have a market attractiveness index of 5.0 by end user, substantially more than that of financial institutions in the core banking solution market. The bank segment is predicted to grow with the highest CAGR of 5.6% from 2017 to 2027. Branch less banking is a new trend that should benefit the core banking solution market as it allows banks cater to the requirements of their customers in far-off rural areas who are unable to access physical banks. This is particularly relevant in underserved emerging economies such as APEJ and Latin America.

Competition Dashboard in the Core Banking Solution Market

Future Market Insights has profiled some of the players in the core banking solution market. The companies are SAP SE, Oracle Corporation, Infosys Limited, FIS (Fidelity Information Services), Tata Consultancy Services Private Limited, Misys, HCL Technologies Limited, Temenos Group AG, Capgemini, Infrasoft Technologies Ltd., IBM Corporation, Nelito Systems Ltd., COBISCORP, and Wipro Limited.

Access Report with Table of Contents @ https://www.futuremarketinsights.com/askus/rep-gb-3395

Key Takeaways

Key stakeholders in the core banking solution market would do well to focus their attention on emerging economies such as India whose governments are aggressively courting foreign direct investment and offering ample untapped opportunities. Increasing the footprint by expanding in emerging economies is naturally increasing the bank’s customer base and core banking solution vendors must provide accurate and fully featured products that enable banks to handle skyrocketing customer data coupled with banking operations. Furthermore, financial institutions and large banks have flown the globalization wave and now offer 24/7 availability to their customers. Core banking solution providers can be beneficiaries of this by delivering one-stop centralized solutions that monitor the bank’s global network along with ensuring anytime, anywhere customer accessibility.

REPORT OVERVIEW @ https://www.futuremarketinsights.com/reports/core-banking-solutions-market

About Us

Future Market Insights is the premier provider of market intelligence and consulting services, serving clients in over 150 countries. FMI is headquartered in London, the global financial capital, and has delivery centres in the U.S. and India.

FMI’s research and consulting services help businesses around the globe navigate the challenges in a rapidly evolving marketplace with confidence and clarity. Our customised and syndicated market research reports deliver actionable insights that drive sustainable growth. We continuously track emerging trends and events in a broad range of end industries to ensure our clients prepare for the evolving needs of their consumers.

Contact Us

U.S. Office

616 Corporate Way, Suite 2-9018,

Valley Cottage, NY 10989,

United States

T: +1-347-918-3531

F: +1-845-579-5705

Email: sales@futuremarketinsights.com

Web: https://www.futuremarketinsights.com/

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Core Banking Solution Market Growth by 2027 | HCL Technologies Limited, Temenos Group AG, Capgemini, Infrasoft Technologies Ltd., IBM Corporation, Nelito Systems Ltd., COBISCORP here

News-ID: 1357617 • Views: …

More Releases from Future Market Insights

Global Lithium Ion Battery Separator Market Projected to Reach US$ 3,256.7 Milli …

The lithium-ion battery separator is a critical component in lithium-ion batteries, responsible for preventing short circuits and ensuring safe and efficient battery performance. It acts as a physical barrier between the positive and negative electrodes, allowing lithium ions to pass through while blocking the flow of electrons. With advancements in separator technology, these separators play a key role in enhancing battery capacity, cycle life, and overall safety in various applications,…

Industrial Drums Market on a Trajectory to Reach US$ 17.6 Billion by 2027, Bolst …

The Industrial Drums Market is experiencing a steady and promising trajectory, with an estimated value of US$ 12.5 billion in 2022, projected to escalate to US$ 17.6 billion by 2027 at a commendable Compound Annual Growth Rate (CAGR) of 7.1%. This growth is substantiated by a 6.6% CAGR in volume during 2022-27, as per Future Market Insights. Anticipated to expand 1.5 times within this period, the market presents alluring prospects for industry…

Supermarkets, Convenience Stores, and Eco-friendly Choices Fuel the Expansion of …

The metal cans market is predicted to grow at a CAGR of 5% over the forecast period, according to research by Future Market Insights. The industry's estimated value is expected to increase from US$ 56 Bn in 2023 to US$ 91.1 Bn by 2033.

The market for metal cans has been driven by the heightened demand for the product in food and beverages industry. Metal cans helps prolong shelf-life of perishable…

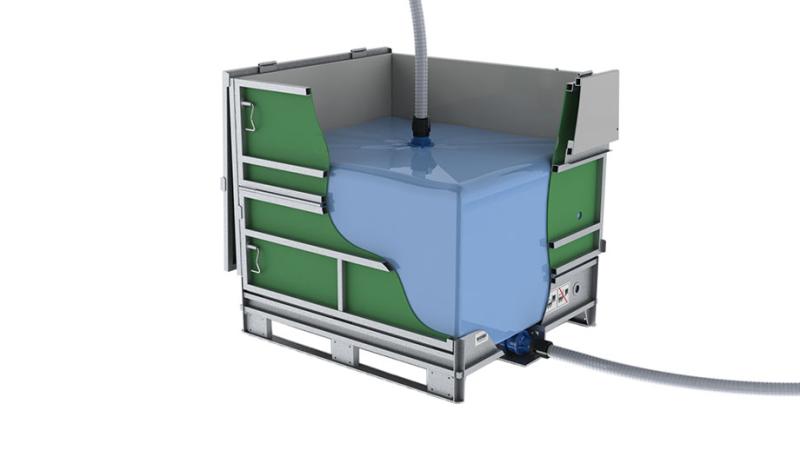

Folding IBCs Market Poised for Growth: Expected to Reach US$ 528 Million by 2027 …

The folding intermediate bulk containers (IBCs) market is on a growth trajectory, with an estimated value of US$ 418 million in 2022, projected to reach US$ 528 million by 2027, showcasing a Compound Annual Growth Rate (CAGR) of 4.8%. Remarkably, the China folding IBCs market defied initial pandemic-related skepticism and is anticipated to grow by 6.9% year on year in 2022. Despite global challenges, China's folding IBCs market is poised to contribute…

More Releases for Core

Balsa Core Core Composites Market: Competitive Dynamics & Global Outlook 2020-20 …

Global Info Research offers a latest published report on Balsa Core Core Composites Analysis and Forecast 2020-2025 delivering key insights and providing a competitive advantage to clients through a detailed report. This report focuses on the key global Balsa Core Core Composites Concentrate players, to define, describe and analyze the value, market share, market competition landscape, SWOT analysis and development plans in next few years.

Click to view the full report…

Global Balsa Core Materials Market Research Report to 2025 | Top Players are-Air …

The global market status for Balsa Core Materials is precisely examined through a smart research report added to the broad database managed by Market Research Hub (MRH). This study is titled “Global Balsa Core Materials Market Insights, Forecast to 2025”, which tends to deliver in-depth knowledge associated to the Balsa Core Materials market for the present and forecasted period until 2025. Furthermore, the report examines the target market based on…

Global Foam Core Material Market 2018 - Carbon-Core, CoreLite, Diab, Evonik, Gur …

Apex Market Reports, recently published a detailed market research study focused on the “Foam Core Material Market” across the global, regional and country level. The report provides 360° analysis of “Foam Core Material Market” from view of manufacturers, regions, product types and end industries. The research report analyses and provides the historical data along with current performance of the global PP Pipe industry, and estimates the future trend of Foam…

Quad-Core vs. Hexa-Core for Scanners and Handheld Terminals

DENSO, part of the Toyota group and inventor of the QR Code, describes why a sports car is not always faster than a hatchback.

Multi-core processors offer different advantages for mobile data collection. / Maximised processor performance due to microprocessors with more than one complete main processor core. / Cheaper due to one processor base. / Hexa-core processors are not necessarily preferable to quad-core processors. / External factors, for example…

Balsa Core Materials Market 2017 -DIAB, Gurit, CoreLite, Bcomp Ltd, Carbon-Core …

Apex Research, recently published a detailed market research study focused on the "Balsa Core Materials Market" across the global, regional and country level. The report provides 360° analysis of "Balsa Core Materials Market" from view of manufacturers, regions, product types and end industries. The research report analyses and provides the historical data along with current performance of the global Balsa Core Materials industry, and estimates the future trend of Balsa…

What is Core Banking Solution and Kimaya's Core Banking Expert Software ?

The banking sector witnessed some drastic changes in the last few years and the entire process became highly advanced. Banks have redefined their business goals and they introduced some innovative methods to interact with the customers. The key here is to serve people well and reduce their worries. Banks offer a plethora of other products and they are not only confined to financial transactions. The operations have become streamlined and…