Press release

The case of Robo.cash was shared at the fintech forum FINOPOLIS in Russia

Founder of Robo.cash Sergey Sedov shared the case of launching robotized p2p investing to overcome the funding shortage

Attracting of investments is a key issue for companies which operate as alternative lenders and target expansion. This is confirmed by the example of the international holding Robocash Group, which first credit companies bootstrapped their way to success. On 17-19 October at the Forum for Innovative Financial Technologies FINOPOLIS 2018, Chief Executive Officer of Robocash Group Sergey Sedov shared the case of solving the issue with lack of funding for the group through the investment platform Robo.cash launched in February 2017 to attract private capital from Europe.

According to the report of Sergey Sedov, complete robotization of the investment process with the implied “peer-to-portfolio” model, which allows the user to invest into the portfolio of microfinance companies of the group rather than a separate loan, combined with a buyback guarantee and higher returns on assets turned out to be such an attractive offer for the European investors, that loans from Spain and Kazakhstan on Robo.cash are completely bought out by active users.

Among other topics discussed during the forum, this year was the interaction of the government and business for the development of new services and technologies. With regard to the most promising technologies from a practical point of view in the near future, Sergey mentioned the development of identification systems: “If we think how to improve financial inclusion, then the development of the unified identification can have the greatest impact, like Aadhaar in India. Today, we see that government services in Russia develop in a similar way”.

---

ROBO.CASH is a fully automated P2P-platform with a buyback guarantee on investments operating within the European Union and Switzerland. The investment platform is a part of a financial holding AS Robocash Group uniting non-bank lending companies in Spain (Prestamer.es), Russia (Zaymer.ru, RoboCredit.ru), Kazakhstan (Zaimer.kz, Z-Finance, TezCredit.kz), the Philippines (Robocash.ph), Indonesia (Robocash.id) and Vietnam (Robocash.vn). The group is specialized in short-term consumer lending. For the time of its work, more than 3 million loans have been issued. The stuff number is over 1,250 employees. The financial group has been developing in the market since 2013.

https://robo.cash

https://twitter.com/Robocash1

https://www.linkedin.com/robo.cash

https://www.facebook.com/robocash.invest

FINOPOLIS 2018 is the forum held by the Bank of Russia in partnership with IT and financial market leaders, which is devoted to the discussion and analysis of trends and opportunities for the use of modern digital technologies in the financial sector. The forum annually brings together about 1,500 participants from Russian and foreign companies along with experts and government representatives. FINOPOLIS 2018 took place on 17–19 October in Sochi.

https://finopolis.ru/en/

SIA ROBOCASH

Duntes iela 23A, Rīga, Latvia, LV-1005

Presscontact:

Olga Davydova

Group PR Manager

pr@robo.cash

+371 67 660 860

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release The case of Robo.cash was shared at the fintech forum FINOPOLIS in Russia here

News-ID: 1338366 • Views: …

More Releases from Robocash

Robo.cash marks the milestone of 1 million funded loans

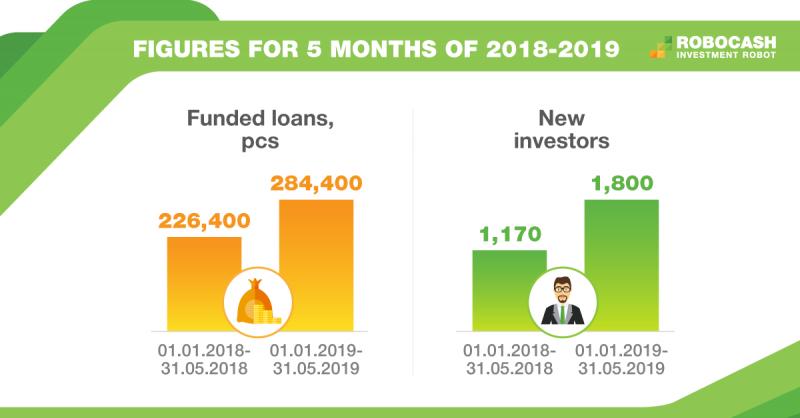

The number of loans financed through the European P2P platform Robo.cash has reached 1 million. For the first five months of 2019, the platform has shown a 26%-increase in the number of funded loans and a 54%-increase in the amount of new investors, compared to the same period last year.

Since the launch in 2017, the European P2P platform Robo.cash has financed 1 million loans for the total amount of…

P2P investors increase the investment size by 30% after the first month

The European P2P platform Robo.cash has analyzed the average investment made within the first months of investing. The results show that the average investment increases by 30% after the first month of investing on the platform and by another 10% - after the second one.

Currently, the fully automated P2P platform Robo.cash has 6,200 registered users, and the average investment on the platform amounts to €2,000. According to a recent analysis…

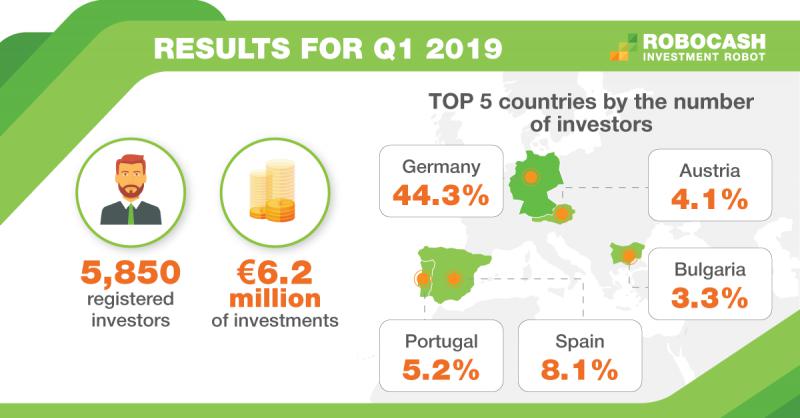

Robo.cash reports its results for Q1 2019

In the first quarter of 2019, the European P2P platform Robo.cash observed a growing number of new investors. Compared to the same period last year, it increased by 50%. As of the end of March 2019, the total number of investors on the platform reached 5,850, which allowed to attract €6.2 million of investments and finance €72 million of loans.

Over the first three months of 2019, Robo.cash was joined by…

More Releases for Robo

Global Robo-Advisory Market, Global Robo-Advisory Industry, Covid-19 Impact Glob …

The Robo-advisory market is expected to grow from USD X.X million in 2020 to USD X.X million by 2026, at a CAGR of X.X% during the forecast period. The Global Robo-Advisory Market report is a comprehensive research that focuses on the overall consumption structure, development trends, sales models and sales of top countries in the global Robo-advisory market. The report focuses on well-known providers in the global Robo-advisory industry, market…

Global Robo-Advisory Market (2015-2023)

Global robo-advisory market

Robo-advisors are independent financial planning services driven by algorithms and supported by a digital platform with no human intervention. They collect information from their customers at first through an online survey to understand their financial situations and ultimate goals. With this information they make portfolios of investments by calculating their risk and returns along with profits for long-term. The global robo-advisory market is expected to grow at an…

Global Robo-advisory Market (2015-2023)

Market Research Report Store offers a latest published report on Robo-advisory Market Analysis and Forecast 2019-2025 delivering key insights and providing a competitive advantage to clients through a detailed report. This report focuses on the key global Robo-advisory players, to define, describe and analyze the value, market share, market competition landscape, SWOT analysis and development plans in next few years.To analyze the Robo-advisory with respect to individual growth trends, future…

Robo Advisors Market - Several banks increasingly partnering with robo advisor v …

Robo advisors refer to digital platforms that provide financial planning advice with the least intervention of human resources. The financial planning advice provided is algorithm-based and automatic. Owing to a vast variety of services provided, at much lesser costs as compared to renowned financial planning advisors, and the rapid improvement in results, the global robo advice market is expanding at a promising pace.

Request a sample copy of the Report @…

Robo-Advisors Market is Primarily Driven By The Low Fee Robo Advisory

Robo advisors are financial adviser class that offers portfolio management or financial advice online with least intervention of human. They offers digital financial advice depending on mathematical algorithms or rules. The algorithms are executed by software and hence financial advice essentially do not require any human advisors. Moreover, the software uses the algorithms to automatically manage, allocate and optimize client’s assets. In 2008, the robo advisors emerged with higher acceleration…

Robo-Advisors: Mapping the Competitive Landscape

Summary

The wealth management industry has long been resilient to the digitization process observed in the wider financial services space. This has started to change, however, with interest in robo-advice platforms increasing in 2015. The automated investment management space is hence becoming ever-more competitive as new entrants launch propositions. Supported by software developers, traditional wealth managers have also started exploring the digital advice market. Competition will thus increase further, although robo-advisors…