Press release

Online Banking Market Growth by top key players - ACI Worldwide, Microsoft Corporation , Cor Financial Solutions Ltd.

According to a new report published by Allied Market Research, titled, Online Banking Market by Banking Type, and Solution Type,: Global Opportunity Analysis and Industry Forecast, 2017-2023, the online banking market size was valued at $7,305 million in 2016, and is estimated to reach $29,976 million by 2023, registering a CAGR of 22.6% from 2017 to 2023. In 2017, online retail banking dominated the overall online banking market.Access full summary at: https://www.alliedmarketresearch.com/online-banking-market

Europe is the market leader and accounts for nearly 31% share of the global market in 2017, closely followed by North America. In addition, Asia-Pacific is estimated to grow at the highest CAGR of 26.1% during the forecast period due to rise in internet users, and increase in consumer base due to higher population size.

The online banking market share is on an increase in the developing economies of Asia-Pacific due to higher penetration of internet, and increased smartphone usage. Threat to security and service issues associated with online banking hinder the market growth.

The key driver of the global online banking market is associated with higher interest rates given in online banking compared with traditional banks and ease of usage. Also growth in use of smart phones, mobile banking, and e-commerce further fuels the market growth. Furthermore, majority of global players are increasingly competing for market share by improvising their services and coming up with better interest rates.

Key Findings of the Online Banking Market:

•Europe leads the global online banking market, closely followed by the North America.

•Asia-Pacific is growing with the highest CAGR of 26.1%, mainly because its population size and growing economy.

•The retail banking type segment accounted for the highest market share with nearly 52% in 2016; however, the corporate banking type is anticipated to witness highest demand during the forecast period.

•The transactional service type is expected to show better growth rate as compared to specialty stores and footwear stores.

Do Purchase Report Click Here: https://www.alliedmarketresearch.com/purchase-enquiry/2283

Asia-Pacific is anticipated to dominate the market later in the analysis period, due to the increase in internet penetration, smartphone usage, and higher population size. Also, Asia-Pacific is expected to witness the highest growth rate, owing to the presence of emerging countries, such as China and Japan.

The key players profiled in this report include ACI Worldwide (U.S.), Microsoft Corporation (U.S.), Fiserv, Inc. (U.S.), Tata Consultancy Services (India), Cor Financial Solutions Ltd. (UK), Oracle Corporation (U.S.), Temenos Group AG, Rockall Technologies (Ireland), EdgeVerve Systems Limited (India), and Capital Banking Solutions (U.S.).

Access Sample Report: https://www.alliedmarketresearch.com/request-sample/2283

The global online banking market is segmented on the basis of banking type, service type, and geography. Based on banking type, it is classified into retail banking, corporate banking, and investment banking. Based on solution type, it is divided into payments, processing services, customer & channel management, risk Management, and others. Geographically, it is analyzed across North America (U.S., Canada, and Mexico), Europe (Netherland, France, UK, Sweden, and rest of Europe), Asia-Pacific (South Korea, Australia, Singapore, China, India, and Rest of Asia-Pacific), and LAMEA (Latin America, Middle-East, and Africa). Key players profiled in the report include ACI Worldwide (U.S.), Microsoft Corporation (U.S.), Fiserv, Inc. (U.S.), Tata Consultancy Services (India), Cor Financial Solutions Ltd. (UK), Oracle Corporation (U.S.), Temenos Group AG (Switzerland), Rockall Technologies (Ireland), EdgeVerve Systems Limited (India), and Capital Banking Solutions (U.S.)

Key Benefits

•A comprehensive analysis of the current trends and future estimations is provided.

•The report elucidates key drivers, restraints, and opportunities and a detailed impact analysis from 2017 to 2023.

•Porter’s Five Forces model of the industry illustrates the potency of the buyers and suppliers in the market.

•A quantitative analysis of the current scenario and the forecast period highlights the financial competency of the market.

•The report provides a detailed analysis of the market with respect to banking type, service type, and geography.

Allied Market Research, a market research and advisory company of Allied Analytics LLP, provides business insights and market research reports to large as well as small & medium enterprises. The company assists its clients to strategize business policies and achieve sustainable growth in their respective market domain.

Allied Market Research provides one stop solution from the beginning of data collection to investment advice. The analysts at Allied Market Research dig out factors that help clients to understand the significance and impact of market dynamics. The company amplies client’s insight on the factors, such as strategies, future estimations, growth or fall forecasting, opportunity analysis, and consumer surveys among others. As follows, the company offers consistent business intelligent support to aid the clients to turn into prominent business firm.

5933 NE Win Sivers Drive #205, Portland, OR 97220 United States

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Online Banking Market Growth by top key players - ACI Worldwide, Microsoft Corporation , Cor Financial Solutions Ltd. here

News-ID: 1289850 • Views: …

More Releases from Allied Market Research

Fashion Events Market Size Worth USD $61.5 Billion by 2032, Growth Rate (CAGR) o …

According to a new report published by Allied Market Research, titled, "Fashion Events Market Size, Share, Competitive Landscape and Trend Analysis Report by Type, by Revenue Source, by Organizer: Global Opportunity Analysis and Industry Forecast, 2023-2032" The report provides a detailed analysis of the top investment pockets, top winning strategies, drivers & opportunities, market size & estimations, competitive landscape, and changing market trends. The global fashion events market size was…

Sustainable Tourism Market Size Worth USD $11.4 Trillion by 2032, Growth Rate (C …

According to a new report published by Allied Market Research, titled, "Sustainable Tourism Market" The report provides a detailed analysis of the top investment pockets, top winning strategies, drivers & opportunities, market size & estimations, competitive landscape, and changing market trends. In 2023, the coastal tourism segment occupied the largest market share as it is one of the most popular types of sustainable tourism locations in the world due to…

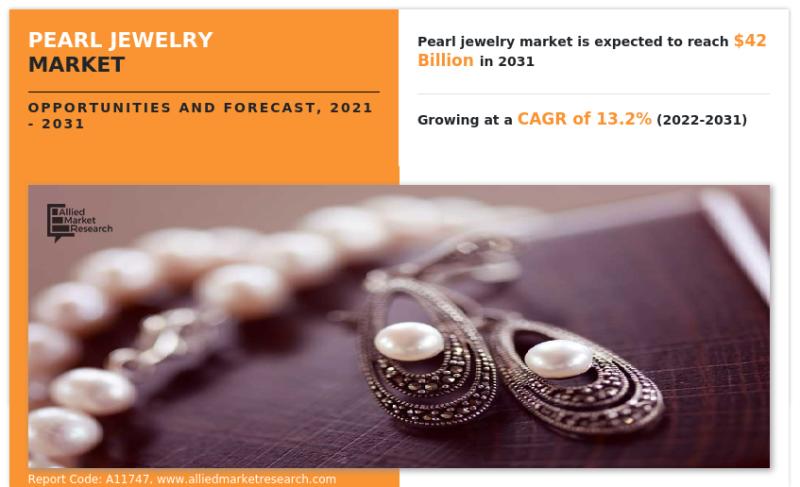

Pearl Jewelry Market Size to Hit US$ 42 Billion by 2031, Growing Almost 13.2% CA …

According to a new report published by Allied Market Research, titled, "Pearl Jewelry Market by Type, by Material, by Pearl Nature, by Pearl Source, by Distribution Channel: Global Opportunity Analysis and Industry Forecast, 2022-2031" The report provides a detailed analysis of the top investment pockets, top winning strategies, drivers & opportunities, market size & estimations, competitive landscape, and changing market trends. The global pearl jewelry market was valued at $12.8…

Lottery Market Projected to Acquire $430.4 Billion by 2031, Strong Growth at 3.8 …

According to a new report published by Allied Market Research, titled, "Lottery Market by Type, by Application: Global Opportunity Analysis and Industry Forecast, 2021-2031". The report provides a detailed analysis of the top investment pockets, top winning strategies, drivers & opportunities, market size & estimations, competitive landscape, and changing market trends. The global lottery market was valued at $300.6 billion in 2021, and is projected to reach $430.4 billion by…

More Releases for Banking

Online Banking Market by Banking Type - Retail Banking, Corporate Banking, and I …

The Online Banking Market size is expected to reach $29,976 million in 2023 from $7,305 million in 2016, growing at a CAGR of 22.6% from 2017 to 2023. Digital banking includes all kinds of online/internet transactions done for various purposes. It is the incorporation of new technologies, to deliver enhanced customer services.

Customer convenience, higher interest rates, and technologically advanced interface majorly drive the market. High security risk of customer’s data…

Mobile Banking Market Is Booming Worldwide | HSBC Mobile Banking, ICICI Bank Mob …

HTF MI recently introduced Global Mobile Banking Market study with in-depth overview, describing about the Product / Industry Scope and elaborates market outlook and status to 2023. The market Study is segmented by key regions which is accelerating the marketization. At present, the market is developing its presence and some of the key players from the complete study are HSBC Mobile Banking, ICICI Bank Mobile Banking, U.S. Bank, Santander Mobile…

Online Banking Market Report 2018: Segmentation by Banking Type (Retail Banking, …

Global Online Banking market research report provides company profile for ACI Worldwide (U.S.), Microsoft Corporation (U.S.), Fiserv, Inc. (U.S.), Tata Consultancy Services (India), Cor Financial Solutions Ltd. (UK), Oracle Corporation (U.S.) and Others.

This market study includes data about consumer perspective, comprehensive analysis, statistics, market share, company performances (Stocks), historical analysis 2012 to 2017, market forecast 2018 to 2025 in terms of volume, revenue, YOY growth rate, and CAGR for…

Digital Banking Market Research Report 2017: Internet Banking, Digital Payments, …

In this report, the global Digital Banking market is valued at USD XX million in 2016 and is expected to reach USD XX million by the end of 2022, growing at a CAGR of XX% between 2016 and 2022.

Geographically, this report is segmented into several key Regions, with production, consumption, revenue (million USD), market share and growth rate of Digital Banking in these regions, from 2012 to 2022 (forecast), covering

United…

Online banking market by Banking Type (Retail Banking, Corporate Banking, and In …

Online banking market size was valued at +$7,304 million in 2016, and is estimated to reach +$29,975 million by 2023, registering a CAGR of +22.5% from 2017 to 2023. In 2017, Digital banking includes all kinds of online/internet transactions done for various purposes. It is the incorporation of new technologies, to deliver enhanced customer services. online retail banking dominated the overall online banking market. The report categorizes the market in…

Global Core Banking Solution Market: Branch Less Banking to Impact Core Banking …

New research report offers a comprehensive analysis of the “Core Banking Solution Market: Banks End User Segment to Lead in Terms of Value Share Throughout the Forecast Period: Global Industry Analysis 2012 - 2016 and Opportunity Assessment 2017 – 2027”.The main objective of this report is to deliver insightful information and clear-cut facts pertaining to the growth trajectories of the market.

Request for Sample Report @ https://www.mrrse.com/sample/4004

Branch Less Banking to Impact…