Press release

R2R prophesies the global P2P lending market to expand at a +48% CAGR during the completion of the forecast 2018-2023

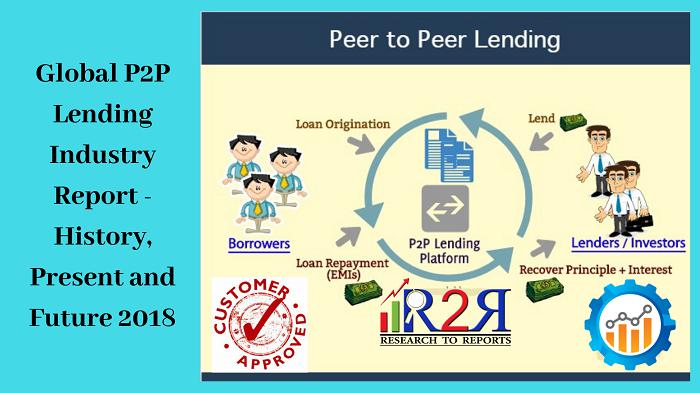

P2P Lending Market research report 2018 examines the market dynamics, competitive landscape and discusses major trends. The report offers the most up-to-date industry data on the actual and potential market situation, segmentation, regional breakdowns and future outlook. The P2P Lending market research includes historic data from 2013-2018 and forecasts up to 2023.A peer-to-peer (p2p) loan is a way to lend money to an individual or business through an online service that connects the lender and the lender. Debt procurement where individuals can borrow or borrow money without using a broker. A peer-to-peer loan removes the intermediary from the process, but has more time, effort, and risk than a typical brick mortar scenario. Changes in the economy, technology, and consumers / investors have increased the legitimacy of P2P networks and marketplaces over the last few years. Starting with the global financial crisis in 2008 and the subsequent regional financial crisis, global banks will reduce cross-border credit especially to SMEs and credit consumers.

Key players profiled in this report include LendingClub Corporation (U.S.), Funding Circle Limited (London), Prosper Marketplace, Inc. (U.S.), Circleback Lending, Inc. (U.S.), Social Finance, Inc. (U.S.), Zopa Limited (London), Avant, Inc. (U.S.), onDeck Capital, Inc.(U.S.), RateSetter (London), Kabbage (U.S.).

Get Sample PDF @ https://www.research2reports.com/sample-report-other-reports/p2p-lending-industry/93378

Market Size & Growth Projections

The market for alternative finance has gained popularity in recent years. Research2Reports suggests that the opportunity in the global p2p market will be worth $897 billion by the year 2025, from $26 bn in 2016. The market is anticipated to rise at a whopping Compound Annual Growth Rate (CAGR) of +48% between 2016 and 2024, while Market Research estimates the global P2P lending market to grow at a CAGR of + 53% during the five-year period between 2018 and 2023.

The Future Of P2P Lending

While P2P platforms continue to face the risks of defaults, fraudulent practices, or borrower’s turning to banks, the growth prospects of this segment remain strong. A well-regulated and transparent p2p platform offers great opportunities as an alternative investment for loan providers, as well as for borrowers. Therefore, the future of P2P lending will be determined by factors such as the rise in interest rates, competition from banks, and the consumer market size.

Key Findings of the Peer to Peer Lending Market

Increase in P2P lending awareness, better interest rates to borrowers and improved returns to lenders have accelerated the growth of the overall peer to peer lending industry.

North America is leading the peer to peer lending market, followed by Asia-Pacific.

Asia- Pacific would witness the highest CAGR of +48% mainly led by China, owing to emergence of a number of small scale peer to peer lending service providers.

Peer to peer lending platforms are most suitable for small scale business and consumer credit loans.

Alternate lending market which includes crowd funding, marketplace lending, hedge funding is to increase during the forecast period due to better services, importance of small scale loans, and greater transparency.

Request to buy this Report @ https://www.research2reports.com/enquiry-before-buy-other-reports/p2p-lending-industry/93378

Research 2 Reports offers premium progressive statistical surveying, market research reports, analysis & forecast data for industries and governments around the globe.

Phone Number: 020 - 2612 6969

Email: info@research2reports.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release R2R prophesies the global P2P lending market to expand at a +48% CAGR during the completion of the forecast 2018-2023 here

News-ID: 1265449 • Views: …

More Releases from Research2reports

AI Software Market - Segmented by Application, Component, Deployment, End User, …

AI software is used mainly for voice processing, text processing, and image processing, the report found. In 2018, text processing was the most commonly used application, at 49.74%. This is expected to change however, and image processing is expected to occupy more of a share as it improves, according to the release.

Global AI Software Market projected to grow at CAGR of +17% from 2018 to 2023

Global AI Software Market research…

Global Mobile Analytics Market to grow at a CAGR of +24% over the forecast year …

Mobile analytics aims at analysing the mobile website traffic and mobile apps, which are similar to traditional analytics. It involves the use of data collected from visitors accessing a website or an app using their mobile devices. Mobile analytics help determine the best mobile marketing campaigns for a business and also the aspects of the websites and apps that are most suitable for handling mobile traffic. This analysis includes mobile…

Global UX Software Market by Top Key vendors Smartlook, Adobe, Timblee, Uizard, …

The latest research by research2reports Global UX Software Market Report includes a comprehensive survey of the UX software global market, including all aspects that impact the growth of the UX software market. The report acknowledges the need to constantly update in a highly competitive marketplace and provides comprehensive data for strategy and decision making to drive market growth and profitability. The base year considered in this study is 2013 and…

Virtual Machine Software Market to witness steady growth during the forecast per …

Virtual machine is a software program on the computer which acts as virtual computers. It runs on the pre-installed operating system or host operating system of the computer and gets access of virtual hardware such as virtual CPU, virtual memory, network interface and other devices and work as a guest operating system. This guest or secondary operating system runs in a small window just like any other application do run…

More Releases for P2P

Global and United States P2P Content Delivery Network (P2P CDN) Market Trends | …

The Global and United States P2P Content Delivery Network (P2P CDN) research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Global and United States P2P Content Delivery Network (P2P CDN) market based on accurate estimations. Furthermore, the report offers actionable insights into the…

P2P Content Delivery Network (P2P CDN) Market Is Booming Worldwide | Alibaba Gro …

P2P Content Delivery Network (P2P CDN) Market: The extensive research on P2P Content Delivery Network (P2P CDN) Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on P2P Content Delivery Network (P2P CDN) Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research…

P2P Content Delivery Network (P2P CDN) Market to see Booming Worldwide | Major G …

A Qualitative Research Study accomplished by HTF MI Titled on Global P2P Content Delivery Network (P2P CDN) Industry Market Report-Development Trends, Threats, Opportunities and Competitive Landscape in 2020 with detailed information of Product Types [Video & Non-video], Applications [Media and Entertainment, Gaming, Retail and eCommerce, Education, Healthcare & Others] & Key Players Such as Streamroot, Alibaba Group, Viblast, Globecast, Edgemesh, Peer5, Akamai, Qumu Corporation & CDNvideo etc. The Study provides…

P2P Lending: Responding to Disruption

ReportsWeb.com published “Retail Banking Market” from its database. The report covers the market landscape and its growth prospects over the coming years. The report also includes a discussion of the key vendors operating in this market.

Verdict Financial's P2P Lending: Responding to Disruption report is a comprehensive analysis of the rise of Peer-to-Peer consumer lending and its impact upon retail banks' borrowers. The report details the impact of P2P lenders upon…

P2P Lending Research, Growth, News & Application

The concept of P2P lending started in around 2005, but growth was initially very slow and it took time for people to understand the deliverables and advantages of social lending. The P2P lending market experienced a remarkable boom in 2007, when a range of websites came into the picture and lifted the community lending business. P2P lending is often said to be more economically efficient because it eliminates the middleman,…

United States P2P Lending Market 2017 : Lending Club, Borrower, P2P Credit, Pros …

United States P2P Lending Market 2016-2017

A market study based on the " P2P Lending Market " across the globe, recently added to the repository of Market Research, is titled ‘United States P2P Lending Market 2017’. The research report analyses the historical as well as present performance of the United States P2P Lending industry, and makes predictions on the future status of P2P Lending market on the basis of this analysis.

Get…