Press release

WLTP seemingly negates the annual August holiday blip for the French True Fleet market

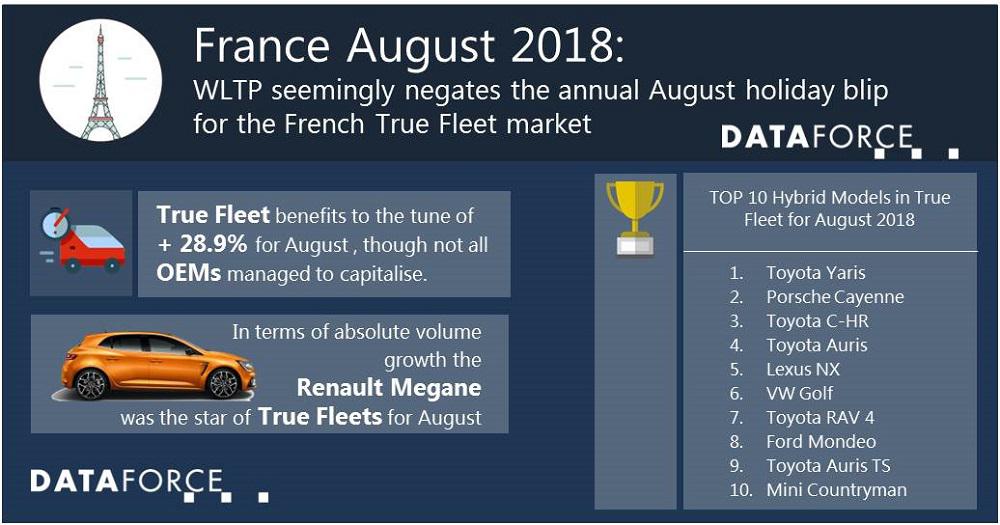

It seems that WLTP may well change the tradition of August being the French market’s weakest month. Given the surge in new car registrations for France (and the rest of the EU) the 28.9% growth for True Fleet will almost certainly have brought forward enough registrations to have one of the remaining months take the mantle of lowest registration month for 2018.Private registrations were up by a similar percentage to True Fleet with a + 26.5% but it was the tactical “Special Channels” that really pushed the Total Market numbers. The combined sub-channels of Dealerships/Manufacturers and Rentals produced a pretty amazing 81.4% growth over August 2017.

Rentals were the biggest sub-channel grower but Dealerships/Manufacturers carried the highest number of registrations. How significant was this increase? Well interestingly “Special Channels’” additional volume for August was just 2,000 registrations shy of the additional volume from True Fleets and Private combined.

Brand performance

While expecting most of the top 10 brands to have benefitted from the True Fleet increase we actually saw a 60/40 split of gains and losses. Though from positions 11 to 20 the August sun shone brightly and we saw only positive results. Renault remained in the #1 spot for the 4th month in a row while also having their biggest growth month in True Fleets since December 2015 with a super solid + 59.5%. A good spread of models helped achieve this with Megane, Scenic, Kadjar, Captur, Talisman and Trafic all hitting triple-digit growth rates.

Peugeot and Citroën took the 2nd and 3rd spots respectively and were the first of the OEMs with negative growth rates, both VW (4th) and Nissan (5th) though capitalised on the market expansion with their Compact SUVs (Tiguan and Qashqai) heavily supporting the volume increase. Next in line were the three German premium brands, Audi surged by 44.4% but this could not be reciprocated by either Mercedes or BMW who both finished in the red.

Ford and Toyota both took their share of the surplus, with the blue oval brand scoring a + 29.9% thanks to the Fiesta, C-Max and the French fleet market’s continuing love for the Mondeo hybrid, while Toyota’s model spread was even.

Diesel hanging in there…just!

So with the boost in registrations from WLTP has Diesel benefitted? To some extent yes but other fuels have reaped more of the reward. With France introducing policy that will re-align the price of Diesel closer to Petrol it is interesting to see that these engine types’ registrations remain high in France but continue to drop in the both the UK & Germany (among others). Year-to-date the fuel is down 1.2% though the volume is very much in line over the same time period from 2016 (and 2017 obviously) whereas diesel is down 28.0% in the UK, 11.1% in Germany and 10.1% in Belgium. In fact, Italy is the only one of the EU-7 countries with a healthy increase of 7.5% for the fuel.

Our educated assumption is that while a higher percentage of diesel fuel costs (80% at present) can be claimed by companies compared to only 20% for petrol (though petrol should reach parity in 2020) that the diesel engine should continue to hold its current levels at least for the current year. 2019 though will certainly be interesting once the next percentage jump for claimable petrol cost comes into play.

DATAFORCE – Focus on Fleets

Dataforce is the leading provider of fleet market data and automotive intelligence solutions in Europe. In addition, the company also provides detailed information on sales opportunities for the automotive industry, together with a wide portfolio of information based on primary market research and consulting services. The company is based in Frankfurt, Germany.

Richard Worrow

Dataforce Verlagsgesellschaft für Business Informationen mbH

Hamburger Allee 14

60486 Frankfurt am Main

Germany

Phone: +49 69 95930-253

Fax: +49 69 95930-333

Email: richard.worrow@dataforce.de

www.dataforce.de

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release WLTP seemingly negates the annual August holiday blip for the French True Fleet market here

News-ID: 1257185 • Views: …

More Releases from Dataforce Verlagsgesellschaft für Business Informationen mbH

What is the Dataforce Sales channel outlook for 2021?

Following a contraction of around 26% in 2020 things can only get better. But how fast will the recovery be and what is the outlook for the channels?

Slow start, rev up

We expect the first half year of 2021 to remain rather challenging. Strict Containment measures will probably need to be maintained into spring, which will weigh down economic sentiment. At the same time, early 2021 may not be the best…

Generation change at Dataforce: Marc A. Odinius now sole owner and Managing Dire …

The long-standing Managing Director Marc Odinius has acquired all shares of the Dataforce Verlagsgesellschaft für Business Informationen mbH and is now Managing Director and sole owner of the Company.

Mission of Dataforce

As to the mission of the automotive data- and market-research company, with 87 Employees, counting 27 different nationalities who reside in Frankfurt, Rome and Beijing, Odinius stated: Dataforce is always in search of unique information which will make the automotive…

UK True Fleet continues to contract, finishing Q2 without a positive month

Now with the first half of the year having gone by in a blur of negative growth we can only hope that the second half will bring some more positive momentum especially around the plate change month in September. UK True Fleet produced a - 7.2% in June which leaves the channel down 6.2% year-to-date (YTD). The Private Market was also in the red with a 4.8% which…

Swiss car market turns into the red on sharp contraction in June

In June 2019 new passenger car registrations in Switzerland were down sharply on the same month last year. Nearly 28,000 registered passenger cars represent an overall market decline of 11.2%. Registrations of light commercial vehicles fell even more sharply (11.9%).

Weak June causes passenger car market to fall below previous year's level

Both the Private Market ( 13.9%) and the commercial market ( 8.4%) can look back on a weak…

More Releases for August

The Decor Kart Announces ‘End of Season Sale’ from 12th August to 30th Augus …

During the End of Season Sale, the online Decor retailer will be providing flat 40% off on all the home Decor products.

• Sale Starts 12th August 9pm.

• Discount covers everything online and in-stores.

• Save big on home Decor, kitchen Decor, wall Decor and collections.

Delhi, August 10, 2021.The Decor Kart today announced ‘End of Season Sale’ starting from 12th August 9 p.m. with 40% off on every product displayed online and…

Edible Flakes Market Statistics 2019-2024 | General Mills, Nestlé, August Oetke …

Global Market Insights, Inc. has added a new report on Edible Flakes Market that provides a comprehensive review of this industry with respect to the driving forces influencing the market size. Comprising the current and future trends defining the dynamics of this industry vertical, this report also incorporates the regional landscape of market in tandem with its competitive terrain.

Edible flakes market is divided into product and distribution channels. Based on…

Edible Flakes Market Growth Trends & Competitive Analysis by 2024 | General Mill …

An analysis of Edible Flakes Market has been provided in the latest report introduced by Global Market Insights, Inc. that primarily focuses on the market trends, demand spectrum, and prospects of this industry over the forecast period. Furthermore, the report provides a detailed statistical overview in terms of trends outlining the geographical opportunities and contributions by prominent industry share contenders.

Increasing popularity of ready-to-eat food products will primarily boost the…

Pregnancy and Health - US - August 2017

"The Report Pregnancy and Health - US - August 2017 provides information on pricing, market analysis, shares, forecast, and company profiles for key industry participants. - MarketResearchReports.biz"

View Sample PDF : https://www.marketresearchreports.biz/reports/1312617/pregnancy-and-health-us-august-2017-market-research-reports.pdf

The US continues to experience low birth rates. Despite this, pregnancy specific products that address the nutritional and physical needs of pregnant women continue to roll out. Pregnancy related attitudes and ailments will drive the need for functional products that…

Tobacco Insights: August 2017

The Report Tobacco Insights: August 2017 provides information on pricing, market analysis, shares, forecast, and company profiles for key industry participants. - MarketResearchReports.biz"

"Tobacco Insights: August 2017", is a monthly report by GlobalData which provides extensive and highly detailed information on the changing production and consumption patterns of the tobacco industry globally, encompassing new laws and regulations, company news, and changes in consumer behavior. It covers recent activities of the manufacturers…

Summer-Accrochage July – August 2016

GALERIE FLUEGEL-RONCAK, with a strong focus on Contemporary Art and Pop Art, will show various artworks of its classic collection of POP ART by Andy Warhol, Roy Lichtenstein, Keith Haring, Tom Wesselmann, Alex Katz, Mel Ramos and Julian Opie.

On view will be original prints, drawings, paintings and sculptures.

After the huge success of Christo`s „Floating Piers“ in June 2016 at Lago d'Iseo in northern Italy, we also have artwork by Christo…