Press release

Global Digital Payments Market growing at a CAGR of 14.1% with Size, Upcoming Trends, Scope, key Players- MasterCard, Visa, PayPal, Amazon, Google

Global Digital Payments Market is projected to register a CAGR of 14.1%, during the forecast period (2018 - 2023). Payment by cash is no more in style with the emergence of the digital or cashless payment options. The scope of the report is limited to the services offered by major digital payment enablers. The regions considered in the scope of the report include North America, Europe, and various others. The report studies the increasing digital payment options across various parts of the world.Detailed Sample Copy of Updated Analysis @ https://marketprognosis.com/sample-request/16457

Note: “If this link doesn’t work in Internet Explorer, kindly try copy pasting it in other browsers”.

Digital Payments is the biggest FinTech segment in 2017 due to a high online shopping penetration. Seamless integration of Payment Solutions is also a major driving force in the digital payments market. Consumers, as well as businesses, are interested in faster, safer, and more convenient payment methods. There are different digital payment methods, like bank Cards, Net Banking, e-wallets, Mobile In-store applications, etc. Top three payment methods used across the globe are Credit cards, digital payment systems (PayPal, Apple Pay, etc.), and debit cards. Digital Payments find applications in different sectors, like Retail, Transportation, Entertainment and Media, Banking and Financial sector, etc. To make these digital payments safe for consumers to use. Companies are developing security software that will allow digital payments not vulnerable to threats through wireless networks among individual consumers. Security concerns act as a barrier in the digital payments market. Additional charges for making digital payments from banks also might slow down the growth of the digital payments market.

Asia-Pacific to Show the Highest Growth Rate

In 2017, China is the largest global digital payments market due to its high online shopping volume. The APAC region is expected to display the highest growth rate owing to increasing adoption of internet and rising e-commerce in several countries, like India, Indonesia. Moreover, the Indian government’s strategic plan of making India a cashless economy is offering new opportunities for small players to enable digital payment services.

Key Developments in Market:

November 2017: PayPal is keen on tapping the local market of India by launching a domestic payments option. This strategy of PayPal is expected to increase the competition among the active players, such as Paytm, WhatsApp, and Google's Tez, which works on the government stipulated unified payments interface (UPI) standard

Major Players –

MasterCard, Visa, PayPal, Amazon, Google, amongst others.

Request Discount on this report @https://marketprognosis.com/discount-request/16457

Note: “If this link doesn’t work in Internet Explorer, kindly try copy pasting it in other browsers”.

Smartphones and E-commerce propelling the market

Millennials accounting close to 27% of the global population, have technology as such an integral part of their lifestyle. This population group has been identified to be heavily influenced by technology, while the generation’s buying habits and expectations are based on Instant gratification that smartphones, Internet, and modern conveniences provide. This has paved the way for retailers and other service providers to target customers where they usually dwell, the internet. The internet drove the e-commerce across most of the sectors and regions. The e-commerce market in the world is estimated to reach USD 653 billion in 2018. In 2017 the global e-commerce market is dominated by China with a market size of USD 672 billion while India, Indonesia, and Mexico are emerging markets.

The increasing smartphones are also driving the digital payment market. Nearly 90% of millennials today own and are in close contact with their smartphones throughout the day. Retailers, like Amazon are investing heavily to provide customers convenient ways of shopping by introducing e-wallets where customers can load money and use for their future purchases. With the entire world shifting towards more technologically-driven payment methods, digital currencies, such as Bitcoins, are also emerging. However, this payment method isn't entirely being regulated and recognized as a financial service by governments except for in countries, like Finland.

Changing Consumer Buying Behavior

Since digital payments provide customers with convenience, allows them to track spending, the penetration is increasing over time. Consumer behavior is changing quickly, and businesses find the need to stay on par with changing payment demands. Digital payment services, banks and other enablers, like Venmo, Google Pay, Pay Pal, etc. are offering unmatchable discounts, which result in more consumers switching to digital payments and therefore impacting the global digital payments market.

Many consumers are turning towards these methods in-store payment apps as they allow users to pay for items in the physical store via apps on their mobile phones. PayPal Beacon and Apple’s iBeacon are paving the way. Consumers find these options as a safer and quicker than waiting in line at the store.

As internet allows users to be available on different Social Media platforms, these platforms are also enabling payment options. For example, SnapChat has released SnapCash that lets users exchange cash from one account holder to another instantly. Pinterest is utilizing "Action buttons" within their platform and allow users to add items to their Amazon Wish List or to complete a purchase directly from within the Pinterest site. AI devices, such as an Amazon Echo or Google Home also are expected to allow users to complete payments in future, thus making these devices digital payment enablers.

Enquiry Before Buying@ https://marketprognosis.com/enquiry/16457

Note: “If this link doesn’t work in Internet Explorer, kindly try copy pasting it in other browsers”.

About Market Prognosis

We at Market Prognosis believe in giving a crystal clear view of market dynamics for achieving success in today’s complex and competitive marketplace through our quantitative & qualitative research methods.

We help our clients identify the best market insights and analysis required for their business thus enabling them to take strategic and intelligent decision.

We believe in delivering actionable insights for your business growth and success.

Contact us:

ProgMarkPvt Ltd,

Thane - 421501

India.

Contact No:+1 973 241 5193

Email: sales@marketprognosis.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Global Digital Payments Market growing at a CAGR of 14.1% with Size, Upcoming Trends, Scope, key Players- MasterCard, Visa, PayPal, Amazon, Google here

News-ID: 1238227 • Views: …

More Releases from Market Prognosis

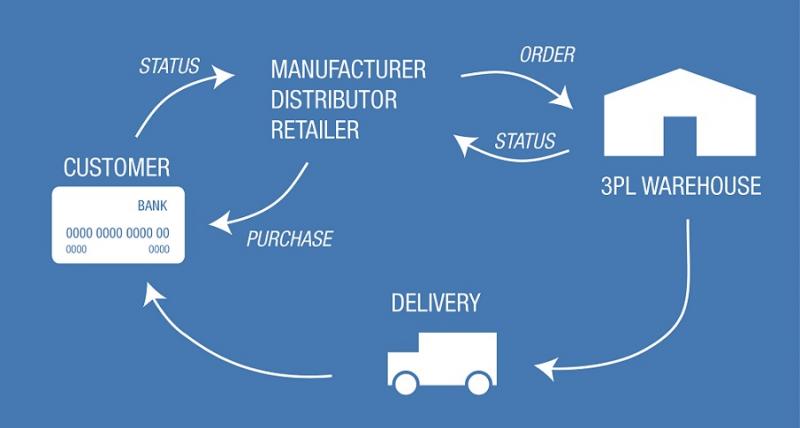

Third-Party Logistics (3PL) Market Latest Study Focuses On Current, Future Innov …

The report covers a forecast and an analysis of the Third-Party Logistics (3PL) Market on a global and regional level. The study provides historical data for 2018, 2019, and 2020 along with a forecast from 2019 to 2026 based on revenue and volume.

Overview of the Global Third-Party Logistics (3PL) Market:

The report spread across 90 pages is an overview of the Global Third-Party Logistics (3PL) Market. These report study based on the Third-Party…

Ride-Hailing Market: An Insight on the Important Factors and Trends Influencing …

The report covers a forecast and an analysis of the Ride-Hailing Market on a global and regional level. The study provides historical data for 2018, 2019, and 2020 along with a forecast from 2019 to 2026 based on revenue and volume.

Overview of the Global Ride-Hailing Market:

The report spread across 90 pages is an overview of the Global Ride-Hailing Market. These report study based on the Ride-Hailing Market. It is a complete overview…

COVID-19 Impact on Professional Indemnity Insurance Market 2021-2026: Industry I …

The report covers a forecast and an analysis of the Professional Indemnity Insurance Market on a global and regional level. The study provides historical data for 2018, 2019, and 2020 along with a forecast from 2019 to 2026 based on revenue and volume.

Overview of the Global Professional Indemnity Insurance Market:

The report spread across 90 pages is an overview of the Global Professional Indemnity Insurance Market. These report study based on the Professional…

Modular Construction Market Future Growth Explored in Latest Research Report by …

The report covers a forecast and an analysis of the Modular Construction Market on a global and regional level. The study provides historical data for 2018, 2019, and 2020 along with a forecast from 2019 to 2026 based on revenue and volume.

Overview of the Global Modular Construction Market:

The report spread across 90 pages is an overview of the Global Modular Construction Market. These report study based on the Modular Construction Market. It…

More Releases for Pay

Mobile Payment Services Market 2022-2027: Onset of Advanced Technologies to Upsu …

The most recent research report on the Global Mobile Payment Services Market offers the collective study on the COVID-19 epidemic in order to give the latest data on the key attributes of the Mobile Payment Services market. This intelligence report comprises analysis on the basis of current situations, historical data and future projections. The study comprises several market estimates correlated to market size, revenue, production, CAGR, consumption, gross margin in…

Samsung Pay Market is Booming Worldwide with Samsung Pay, Apple Pay, Google Pay

HTF Market Intelligence released a new research report of 23 pages on title 'Samsung Pay - Competitor Profile' with detailed analysis, forecast and strategies. The study covers key regions that includes North America, LATAM, United States, GCC, Southeast Asia, Europe, APAC, United Kingdom, India or China etc and important players such as Samsung Pay, Apple Pay, Google Pay, Alipay, Tenpay, Samsung Electronics, Visa, Mastercard.

Request a sample report @ https://www.htfmarketreport.com/sample-report/3587660-samsung-pay-competitor-profile

Summary

Samsung…

Mobile Payment Market may see a big Move: Apple Pay, Samsung Pay, Amazon Pay

A new business intelligence report released by HTF MI with title "Global Mobile Payment Market Report 2020" is designed covering micro level of analysis by manufacturers and key business segments. The Global Mobile Payment Market survey analysis offers energetic visions to conclude and study market size, market hopes, and competitive surroundings. The research is derived through primary and secondary statistics sources and it comprises both qualitative and quantitative detailing. Some…

Electronic Payment Market Growth Insights to 2024 by Leading Players like Alipay …

Electronic Payment is a payment solution which is made through digital modes with no hard cash. In digital payment, both payer and payee use digital modes to send and receive money. Digital payment include payment gateway solutions, payment processing solutions, payment wallet solutions, payment security and fraud management solutions, and POS solutions.

Scope of the Report:

The global Electronic Payment market is valued at xx million USD in 2018 and is expected…

Payment Landscape Market to 2024 By Key Players - Samsung Pay, Google Pay, Apple …

For people who are keen on the Payment Landscape Industry the Global Payment Landscape Market Trends, Competitive Analysis and Forecast Report 2019-2024 would be an useful report to refer to as it is an exhaustive study on the present market scenario of this industry. The report also gives a special insight into the growing United States, Europe, APAC, Middle East and Africa market of this industry. The report summarizes key…

Payments Landscape in Australia Market Expected to Generate High Revenue in Futu …

Global Payments Landscape in Australia market report offers in-depth knowledge and analysis results and knowledge concerning Payments Landscape in Australia market share, growth factors, size, key drivers, restraints, opportunities, and trends valid by a mixture of specialists with correct data of the precise trade and Payments Landscape in Australia market further as region-wise analysis experience. The Payments Landscape in Australia report contains historical, current, and projected revenues for every sector,…