Press release

Trade Finance Market Statistics: The Biggest Trend to Watch Out For 2017-2026 by Regions, Types, Applications and Key Players (BNP Paribas SA, Citigroup Inc., HSBC Holdings plc, JPMorgan Chase & Co, Mitsubishi Corporation, ANZ Bank, Morgan Stanley, etc.)

FactMR Report examines global Trade Finance market for the forecast period 2017–2026. The prime purpose of the report is to find opportunities and trends in the market and provide insights pertaining to segments of the Trade Finance market. To understand trends and opportunities in Trade Finance Market, the report is divided into various segments on the basis of trade activity, end user, type of transaction and region. The report analyzes global Trade Finance Market in terms of value (US$).Trade finance is the financing of international and domestic trade flows, in which, trading intermediaries such as banks and other financial institutions facilitate different transactions between the buyer and the seller. Trade finance reduces the risk involved in an international & domestic trade transaction. Trade Finance is one of the factors for enormous growth of international trade.

You can Get Free Sample Report about Market Here - https://www.factmr.com/connectus/sample?flag=RC&rep_id=400

Global Trade Finance market is anticipated to witness significant revenue growth over the forecast period. The shift in strategy on the part of world's largest banks in one of the biggest driver in Trade Finance market. Increasing global import and export is also a key driver for trade finance market. Digitalization and utilization of new technologies such as Blockchain will improve efficiency and reduce the cost for Trade Finance Market. Also, the cost or complexity requirements related to AML, KYC, and sanctions acts as a barrier to Trade Finance Market.

Report starts with a market overview and provides market definition and analysis about drivers, restraints, and key trends. The section that follows includes analysis of global Trade Finance market by trade activity, end user, type of transaction, and region. These sections evaluate the global Trade Finance market on the basis of various factors covering present scenario and future prospects. The report also provides region-wise data of local and international companies.

In addition, it is imperative to note that in an ever-fluctuating global economy, we not only conduct forecasts in terms of CAGR but also analyze on the basis of key parameters such as year-on-year (Y-o-Y) growth to understand the predictability of the market and to identify the right opportunities.

The global Trade Finance market is segmented as follows:

On the basis of Trade Activity the market is segmented into the following:

Factoring

Export Credit

Insurance

Other Activities

You can Browse Complete Market Report In-Depth Here - https://www.factmr.com/report/400/trade-finance-market

Regions covered in the report are as follows:

North America

Latin America

Europe

Japan

Asia Pacific excluding Japan

Middle East & Africa

In the final section of the report, a competitive landscape has been included to provide report audiences with a dashboard view. Detailed profiles of the providers are also included in the scope of the report to evaluate their long-term and short-term strategies, key offerings and recent developments in the Trade Finance. Key players in the global trade Finance include BNP Paribas SA, Citigroup Inc., HSBC Holdings plc, JPMorgan Chase & Co, Mitsubishi Corporation, ANZ Bank, Morgan Stanley, NewMarket Latin America Inc., Banco Santander S.A, Commerzbank AG, and SunTrust Bank Holding Company, UniCredit S.p.A, Wells Fargo & Company.

Table of Content:

Global Economic Outlook

Global Trade Finance Market - Executive Summary

Global Trade Finance Market Overview

3.1. Introduction

3.1.1. Global Trade Finance Market Taxonomy

3.1.2. Global Trade Finance Market Definition

3.2. Global Trade Finance Market Size (US$ Mn) and Forecast, 2012-2026

3.2.1. Global Trade Finance Market Y-o-Y Growth

3.3. Global Trade Finance Market Dynamics

3.4. Global Trade Finance Market Outlook

3.5. Investment Feasibility Matrix

3.6. Market Attractiveness

3.7. Key Participants Market Presence (Intensity Map) By Region

Global Trade Finance Market Analysis and Forecast 2012-2026

4.1. Global Trade Finance Market Size and Forecast By Trade Activity, 2012-2026

4.1.1. Factoring Market Size and Forecast, 2012-2026

4.1.1.1. Revenue (US$ Mn) Comparison, By Region

4.1.1.2. Market Share Comparison, By Region

Continued…………………….

You can Buy This Market Report from Here - https://www.factmr.com/checkout/400/S

About FactMR

FactMR is a fast-growing market research firm that offers the most comprehensive suite of syndicated and customized global market research reports. We believe transformative intelligence can educate and inspire businesses to make smarter decisions. We know the limitations of the one-size-fits-all approach; that's why we publish multi-industry global, regional, and country-specific research reports.

Contact Us -

FactMR

Suite 9884

27 Upper Pembroke Street, Dublin 2, Ireland

Telephone @ +353-1-6111-593

Email: sales@factmr.com

Website: https://www.factmr.com/

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Trade Finance Market Statistics: The Biggest Trend to Watch Out For 2017-2026 by Regions, Types, Applications and Key Players (BNP Paribas SA, Citigroup Inc., HSBC Holdings plc, JPMorgan Chase & Co, Mitsubishi Corporation, ANZ Bank, Morgan Stanley, etc.) here

News-ID: 1226849 • Views: …

More Releases from Fact.MR

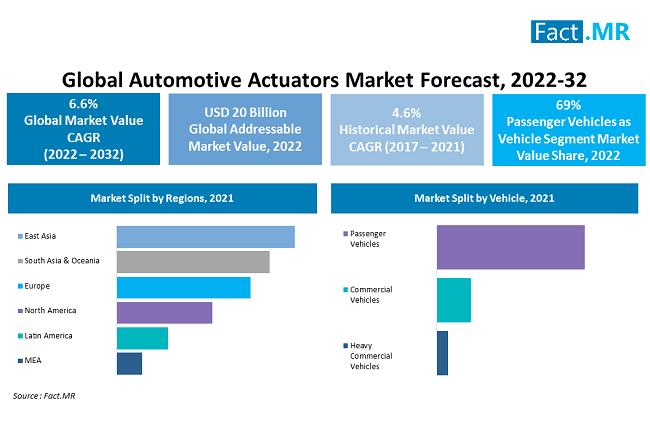

Automotive Actuators Market to Cross US$ 38.3 Billion at 6.6% CAGR by 2032, Stat …

According to research insights, the automotive actuators market is expected to register 6.8% CAGR during the forecast period 2018-2027. This impressive growth is highly motivated by increased traction from the air conditioning system application. Furthermore, active innovations across HVAC system targeted towards supreme efficiency is expected to steer growth in several top-listed regional markets.

𝐑𝐞𝐪𝐮𝐞𝐬𝐭 𝐒𝐚𝐦𝐩𝐥𝐞 𝐑𝐞𝐩𝐨𝐫𝐭-

https://www.factmr.com/connectus/sample?flag=S&rep_id=297

𝐂𝐨𝐦𝐩𝐚𝐜𝐭 𝐏𝐚𝐬𝐬𝐞𝐧𝐠𝐞𝐫 𝐂𝐚𝐫𝐬 𝐃𝐞𝐥𝐢𝐯𝐞𝐫 𝐇𝐢𝐠𝐡𝐞𝐫 𝐒𝐚𝐥𝐞𝐬 𝐟𝐨𝐫 𝐀𝐮𝐭𝐨𝐦𝐨𝐭𝐢𝐯𝐞 𝐀𝐜𝐭𝐮𝐚𝐭𝐨𝐫𝐬

The rising demand for compact passenger cars…

Hemodynamic Monitoring System Market to Hit US$ 2,731.1 Million at a CAGR of 5.3 …

The hemodynamic monitoring systems market is expected to grow at a compound annual growth rate of 5.3% and reach US$2,731.1 million by 2034. In 2024, it is anticipated that the market will be worth US$ 1,634.8 million.

The key drivers of this expansion are the increasing prevalence of respiratory, cardiovascular, and chronic obstructive pulmonary illnesses (COPD), as well as the development of novel minimally invasive and non-invasive technologies. Hemodynamic monitoring instruments…

Biobanking Market Growing at 6.6% CAGR to Touch US$ US$ 89.5 Billion Valuation b …

The global biobanking market (バイオバンキング市場) is projected to grow at a strong compound annual growth rate of 6.6% by 2023 to 2033, reaching a sales valuation of US$ 89.5 billion. Globally, China, the UK, and the US are the key markets that biobanking enterprises need to be aware of.

By storing and preserving biological samples like blood, tissues, and nucleic acids, biobanking plays a crucial part in improving biomedical and translational…

Allergy Care Market Predicted to Reach US$ 40 Billion by 2032, Growing at 6.1% C …

With a compound annual growth rate (CAGR) of 6.1%, the global allergy care market is expected to reach a value of over USD 40 billion by 2032, from an estimated USD 22 billion in 2022. In 2022, the global market for allergy care will make up less than 1% of the entire healthcare business.

It is projected that the market for allergy treatments would expand quickly throughout the forecast period. According…

More Releases for Trade

The future of international trade and worldwide network: Global Trade Plaza

The future of international trade and worldwide network: Global Trade Plaza

A radical change to support continuous growth in supply traffic.

Connecting all manufacturers, suppliers, traders, exporters, and importers.

Open the door to the future of safe international trade.

B2B marketplace Global Trade Plaza wants to redefine the supply chain. The growth due to digitalization has touched multiple fields, but couldn't do much for the intercountry supply. We are here with…

US-China trade war shifting cement seaborne trade flows

In 2018, the total number of active cement carriers surpassed 360 units, with the total dead weight tonnage topping 2.7 million, the highest figure recorded since 2010.

According to CW Research’s 2019 update of the World Cement, Clinker & Slag Sea-Based Trade Report, the upward trend was underpinned by a growing demand for cement carriers in key domestic trade markets.

Specialized cement carriers move about 25 million tons of cement per…

Suisse Trade – Holding Trade Seminar in Tokyo in December 2016

Suisse Trade is a full-fledged Forex trading firm that is renowned worldwide for rendering clients with the best assistance in commodity and Forex based trading. The company has been consistently successful in presenting clients with the most formidable instruments to trade in currency and commodities markets. The tasks undertaken by the company also involve spot and cash trades, limited risk options on futures as well as contracts. It has always…

Trade Show Exhibit Designer Skyline Exhibits Awarded 100th Patent For Trade Show …

ST. PAUL, MN – When Skyline Exhibits was recently granted a patent for its new DesignView® Exhibit System, it was a special occasion. The patent marked the 100th time Skyline has been recognized for invention. “It’s an honor,” stated Bill Dierberger, president of Skyline Exhibits. “So many Skyline people have worked so hard to create new and better products over the years. This milestone is a result of that…

Trade Mark Act

Neoinfo Solutions Pvt. LTD is an IT based company with its main office located in Jaipur(rajasthan). Our expertise lies in the domain of Website Designing development portal development,maintenance software consulting, designing development , implimentation, training and maitenance.In the journey of achieving our combined business and social goals we have kept in mind and have always strictly followed all our data security policies to ensure that all informations of our clients…

Trade mark Act

Neoinfo Solutions Pvt. LTD is an IT based company with its main office located in Jaipur(rajasthan). Our expertise lies in the domain of Website Designing development portal development,maintenance software consulting, designing development , implimentation, training and maitenance.In the journey of achieving our combined business and social goals we have kept in mind and have always strictly followed all our data security policies to ensure that all informations of our clients…