Press release

Credit Repair Services Market 2018 | Top Companies Analysis- Lexington Law, com, Sky Blue Credit Repair, The Credit People, Ovation, MyCreditGroup etc. | 2025 Forecast

Global Credit Repair Services Market Research Report 2018 peaks the detailed analysis of industry share, growth factors, development trends, size, majors manufacturers and 2025 forecast. The report also analyze innovative business strategies, value added factors and business opportunities. The Credit Repair Services report introduces market competition situation among the vendors and company profile, revenue, product & services, latest developments and business strategies.Get Sample Copy at https://www.orianresearch.com/request-sample/615080

Development policies and plans are discussed as well as manufacturing processes and cost structures. This report also states import/export, supply and consumption figures as well as cost, price, revenue and gross margin by regions (North America, EU, China, Japan, Southeast Asia, India) and other regions can be added.

Complete report on Credit Repair Services Market spread across 99 pages, top key manufacturers and list of tables and figures. Enquire more @ https://www.orianresearch.com/enquiry-before-buying/615080

Key Companies Analyzed in this Report are:

Lexington Law

com

Sky Blue Credit Repair

The Credit People

Ovation

MyCreditGroup

Veracity Credit Consultants

…

The report focuses on Global Credit Repair Services Market major leading industry players with information such as company profiles, product picture and specification, capacity, production, price, cost, revenue and contact information. Upstream raw materials, equipment and downstream consumers analysis is also carried out. What's more, the Credit Repair Services industry development trends and marketing channels are analyzed. Finally, the feasibility of new investment projects is assessed, and overall research conclusions are offered. In a word, the report provides major statistics on the state of the industry and is a valuable source of guidance and direction for companies and individuals interested in the market.

Market segment by Type, the product can be split into

Type I

Type II

Place a Direct Order Of this Report @ https://www.orianresearch.com/checkout/615080

Major Points Covered in Table of Contents:

1 Industry Overview of Credit Repair Services

2 Global Credit Repair Services Competition Analysis by Players

3 Company (Top Players) Profiles

4 Global Credit Repair Services Market Size by Type and Application (2013-2018)

5 United States Credit Repair Services Development Status and Outlook

6 Europe Credit Repair Services Development Status and Outlook

7 China Credit Repair Services Development Status and Outlook

8 Japan Credit Repair Services Development Status and Outlook

9 Southeast Asia Credit Repair Services Development Status and Outlook

10 India Credit Repair Services Development Status and Outlook

11 Market Forecast by Regions, Type and Application (2018-2025)

12 Credit Repair Services Market Dynamics

13 Market Effect Factors Analysis

14 Research Finding/Conclusion

15 Appendix

About Us

Orian Research is one of the most comprehensive collections of market intelligence reports on the World Wide Web. Our reports repository boasts of over 500000+ industry and country research reports from over 100 top publishers. We continuously update our repository so as to provide our clients easy access to the world's most complete and current database of expert insights on global industries, companies, and products. We also specialize in custom research in situations where our syndicate research offerings do not meet the specific requirements of our esteemed clients.

Contact Us

Ruwin Mendez

Vice President – Global Sales & Partner Relations

Orian Research Consultants

US: +1 (832) 380-8827 | UK: +44 0161-818-8027

Email: info@orianresearch.com

Website: www.orianresearch.com/

Follow Us on LinkedIn: https://www.linkedin.com/company-beta/13281002/

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Credit Repair Services Market 2018 | Top Companies Analysis- Lexington Law, com, Sky Blue Credit Repair, The Credit People, Ovation, MyCreditGroup etc. | 2025 Forecast here

News-ID: 1205769 • Views: …

More Releases from Orian Research

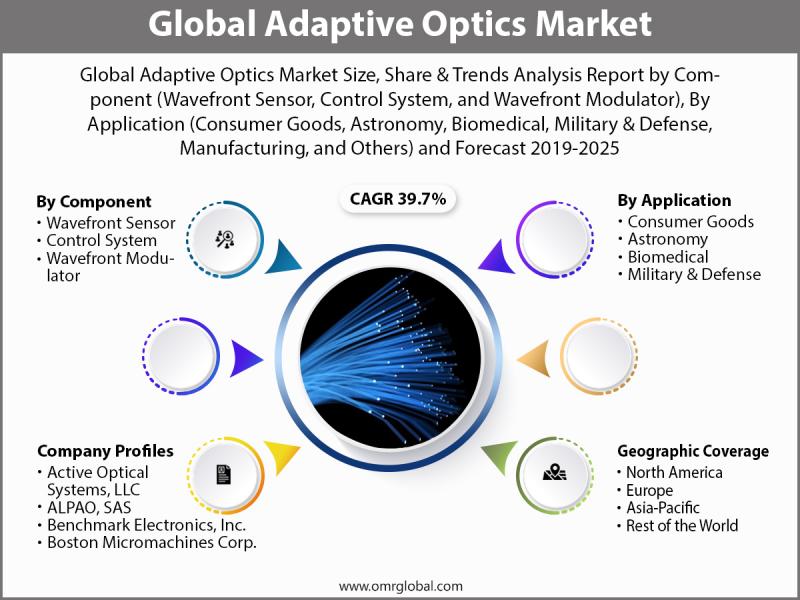

Adaptive Optics Market Size, Competitive Analysis, Share, Forecast- 2019-2025

The global adaptive optics market is projected to grow at a significant CAGR of 39.7% during the forecast period owing to the increasing application of adaptive optics in retinal imaging and ophthalmology to reduce the optical aberrations. The integration of adaptive optics converts an ophthalmoscope into a microscope, allowing visualization of and optical access to individual retinal cells in living human eyes.

To learn more about this report request a…

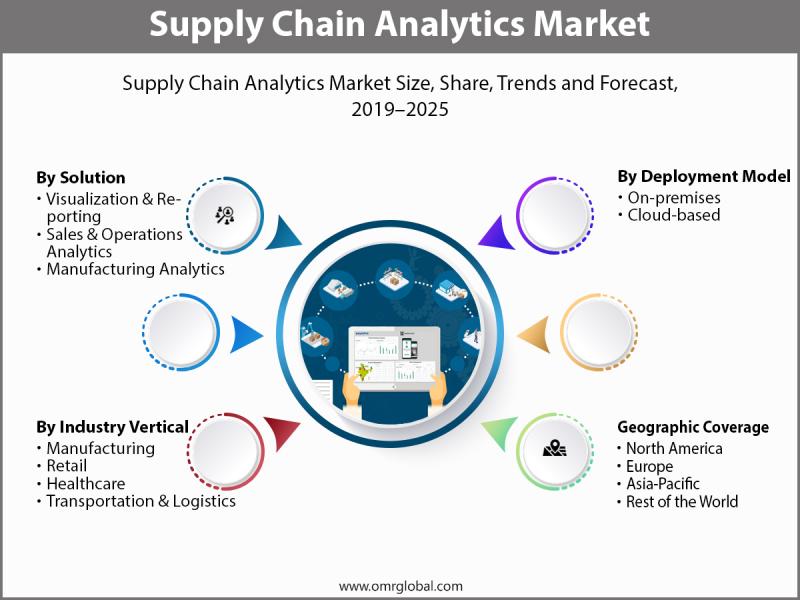

Supply Chain Analytics Market Size, Competitive Analysis, Share, Forecast- 2019- …

The Global Supply Chain Analytics Market is estimated to grow at a significant CAGR during the forecast period 2019- 2025. The impact of e-commerce on retailers and manufacturers is driving a revolution in many sectors and business organization. This has led to the introduction of supply chain analytics solution, which offers mathematics, statistics, predictive modeling and machine-learning techniques to find meaningful patterns and knowledge regarding order, shipment and transactional data.…

Laparoscopic Instruments Market Size, Competitive Analysis, Share, Forecast- 201 …

The laparoscopic or minimally invasive surgery uses a special surgical instrument known as laparoscope to look inside the body and carry out certain procedures. The laparoscopic instruments market is projected to witness a steady growth rate during the forecast period 2018-2023. The rise in preference of minimal invasive method over invasive surgeries, the high prevalence of lifestyle-oriented diseases, high global expenditure on the laparoscopic market, increasing healthcare market in emerging…

Fertility Drug Market Size, Competitive Analysis, Share, Forecast- 2018-2023

Infertility is one of the major issue now a day due to change in life style & cultural shift. There are various fertility drugs available in market for infertility related problems. Fertility drugs enhance the reproductive ability by improving quality of egg or sperms by increasing the levels of certain hormones in human body. The major factors that are responsible for the growth of fertility drug market are Change in…

More Releases for Credit

Credit Scores, Credit Reports & Credit Check Services Market May See Big Move | …

Global Credit Scores, Credit Reports & Credit Check Services Market Report 2020 by Key Players, Types, Applications, Countries, Market Size, Forecast to 2026 (Based on 2020 COVID-19 Worldwide Spread) is latest research study released by HTF MI evaluating the market risk side analysis, highlighting opportunities and leveraged with strategic and tactical decision-making support. The report provides information on market trends and development, growth drivers, technologies, and the changing investment structure…

Credit Scores, Credit Reports & Credit Check Services Market to Watch: Spotlight …

The latest report released on Global Credit Scores, Credit Reports & Credit Check Services Market analyses areas where there is still room for improvement. Irrespective of industry, organization size or geographic location, the Credit Scores, Credit Reports & Credit Check Services Market study suggests that advanced technologies are playing a bigger role than ever before. The assessment provides trend, growth factors and estimates for Global Credit Scores, Credit Reports &…

Credit Scores, Credit Reports & Credit Check Services Market Watch: : Spotlight …

The Credit Scores, Credit Reports & Credit Check Services Market study is a perfect mix of qualitative and quantitative information and to get better understanding on how stats relates to growth, market sizing and share, the study is started with market overview and further detailed commentary is showcased on changing market dynamics that includes Influencing trends by regions, growth drivers, long term opportunities and short term challenges that industry players…

Global Credit Scores, Credit Reports & Credit Check Services Market In-Depth Stu …

Global Credit Scores, Credit Reports & Credit Check Services Market 2020 is a brief evaluation of the market offered by Marketquest.biz that contains a deep inspection of the current and futuristic market trends and aspects that are performing a substantial role in the market. The report includes expert and inside and out examination on essential factors such as global Credit Scores, Credit Reports & Credit Check Services industry size, regional…

Credit Scores, Credit Reports & Credit Check Services Market: Global Industry Le …

Developments, product launches, joint ventures, merges and accusations are the moves that the top players in Credit Scores, Credit Reports & Credit Check Services Market are making which in turn affect the sales, import, export, revenue and CAGR values.

The Credit Scores, Credit Reports & Credit Check Services Market report executes the great study of Price and Gross Margin, Capacity, Production, Revenue, Current Credit Scores, Credit Reports & Credit Check Services…

Global Credit Insurance Market Research Report 2018 -2025: Credit Life Insurance …

Credit insurance is an insurance policy and a risk management product offered by government agencies and private insurance companies. It helps in protecting the business against both commercial and political risks. It improves the quality of the business and helps in growing profitably and minimizing the risk of unexpected customer failures. It gives the confidence to spread trade credit to new customers.

Improved efficiency of credit insurance in financial sector such…