Press release

The UK True Fleet back in the black with a surplus of 1.4% in July

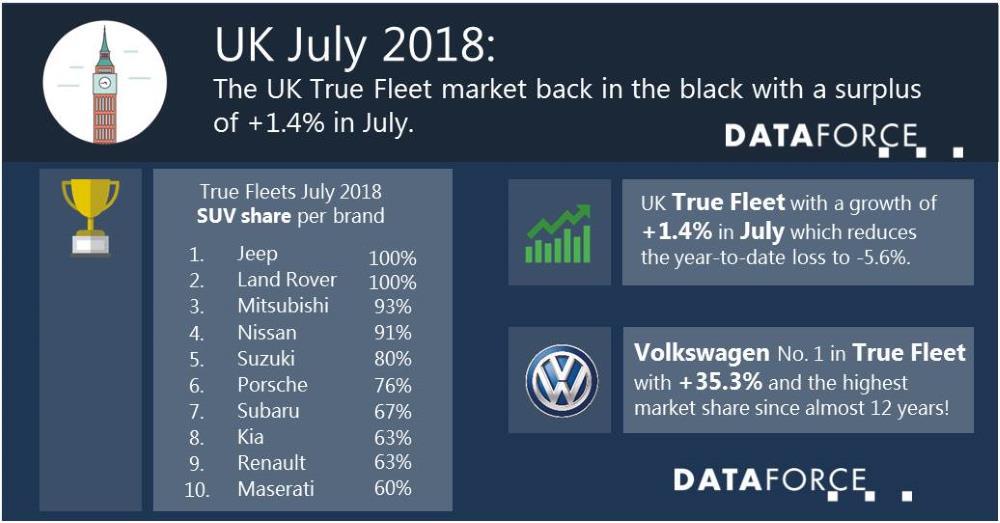

While in June the UK True Fleet Market finished in the red by only 29 registrations July showed a growth of +1.4%. This positive result helped to reduce the year-to-date loss to “only” 5.6%. No reason yet for overwhelming enthusiasm (especially if you consider the buoyant development in the other big European Markets) but certainly an encouraging trend taking into account that the YTD decrease was still -12.7% in March. The Private Market scored a marginal growth of 0.1% over July 2017 and Special Channels increased by 2.8% thanks to the self-registrations on Dealerships and Manufacturers. The Total Market overall almost reached 164,000 registrations for July which equates to a +1.2%.Brand performance

Within the top 10 we saw 50% of the brands with positive numbers and 50% with, let’s say challenging results. Volkswagen showed a remarkably good performance with +35.3% and a market share of 12.8% which is the highest since August 2006! The main pillars for the success of the brand from Wolfsburg were the Golf, the all-new T-Roc (already in the top 10 of Small SUV) and especially the Tiguan which achieved an all-time high in market share in July. Vauxhall (Opel) in 2nd, Ford and Mercedes all had to suffer while Audi (5th, +4.9%) and BMW (6th, +9.4%) both achieved a more than solid increase although this didn’t result in gaining positions in the ranking. Nissan retained their 7th position while SEAT had an impressive +30.8% jumping from rank number 12 into 8th position. A similar improvement was achieved by Peugeot climbing up the ladder by three positions into rank number 10 behind Kia. And the biggest volume growth in absolute figures within Peugeot came - surprise, surprise - not from an SUV but from the Compact Car 308.

Segment performance

The biggest absolute rises in July both by volume and by percentage growth came unsurprisingly from the group of Compact and Small SUV respectively. With 22.8% the share of the SUV Compact segment reached a high never seen before in the British True Fleet Market. Strongest player in July (and year-to-date as well) was the Nissan Qashqai followed by Volkswagen Tiguan and Ford Kuga. With the Grandland X from Vauxhall in 6th place and the Karoq from Škoda (10th) there were two new entries in the top 10.

Within the Small SUV the best newcomer was even able to jump into second place behind the segment leader Vauxhall Mokka. And this is the SEAT Arona. Obviously, this is the right product at the right time for the brand from Martorell. In July the Arona was No. 2 within the model range of SEAT behind the Leon and even their No. 1 for “True Private”.

SEAT is actually a good example for the increasing relevance of SUVs; not “only” in general but also within the OEMs. Until August 2016 the SUV share at SEAT was exactly zero. This has changed dramatically with the introduction of Ateca and Arona: in July the share was no less than 37% in the True Fleet Market!

Across the top 25 brands in July SUVs accounted for 40.9% registrations compared to 32.9% in July last year. And you might be surprised how many manufacturers turned into “SUV brands” in the meantime. Or did you expect a share of more than 40% at Vauxhall? Or 59% and 63% at Peugeot and Renault respectively? Another example is Jaguar where almost every second car registered on fleet customers in this month was an SUV (E-Pace, F-Pace). There are only very few OEMs where it was the other way round, i.e. that recorded a decline in their SUV share. Nissan is one of them due to a declining volume of the Juke, a model which will be replaced next year and is therefore getting closer to the end of its lifecycle. But despite this situation their SUV share was still 91% and only beaten by SUV specialists such as Mitsubishi, Jeep or Land Rover.

(666 words; 3,785 characters)

Publication by indication of source (DATAFORCE) and author (as listed below) only

DATAFORCE – Focus on Fleets

Dataforce is the leading provider of fleet market data and automotive intelligence solutions in Europe. In addition, the company also provides detailed information on sales opportunities for the automotive industry, together with a wide portfolio of information based on primary market research and consulting services. The company is based in Frankfurt, Germany.

Michael Gergen

Dataforce Verlagsgesellschaft für Business Informationen mbH

Hamburger Allee 14

60486 Frankfurt am Main

Germany

Phone: +49 69 95930-231

Fax: +49 69 95930-333

Email: michael.gergen@dataforce.de

www.dataforce.de

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release The UK True Fleet back in the black with a surplus of 1.4% in July here

News-ID: 1176119 • Views: …

More Releases from Dataforce Verlagsgesellschaft für Business Informationen mbH

What is the Dataforce Sales channel outlook for 2021?

Following a contraction of around 26% in 2020 things can only get better. But how fast will the recovery be and what is the outlook for the channels?

Slow start, rev up

We expect the first half year of 2021 to remain rather challenging. Strict Containment measures will probably need to be maintained into spring, which will weigh down economic sentiment. At the same time, early 2021 may not be the best…

Generation change at Dataforce: Marc A. Odinius now sole owner and Managing Dire …

The long-standing Managing Director Marc Odinius has acquired all shares of the Dataforce Verlagsgesellschaft für Business Informationen mbH and is now Managing Director and sole owner of the Company.

Mission of Dataforce

As to the mission of the automotive data- and market-research company, with 87 Employees, counting 27 different nationalities who reside in Frankfurt, Rome and Beijing, Odinius stated: Dataforce is always in search of unique information which will make the automotive…

UK True Fleet continues to contract, finishing Q2 without a positive month

Now with the first half of the year having gone by in a blur of negative growth we can only hope that the second half will bring some more positive momentum especially around the plate change month in September. UK True Fleet produced a - 7.2% in June which leaves the channel down 6.2% year-to-date (YTD). The Private Market was also in the red with a 4.8% which…

Swiss car market turns into the red on sharp contraction in June

In June 2019 new passenger car registrations in Switzerland were down sharply on the same month last year. Nearly 28,000 registered passenger cars represent an overall market decline of 11.2%. Registrations of light commercial vehicles fell even more sharply (11.9%).

Weak June causes passenger car market to fall below previous year's level

Both the Private Market ( 13.9%) and the commercial market ( 8.4%) can look back on a weak…

More Releases for July

Sealegs July Update - Alpha & Omega

Kia Ora Sealegs Enthusiasts,

I truly can't believe we're more than halfway through the new year. Being halfway is a great time to show my age and reflect on childhood Latin lessons and introduce the concept of our "Alpha and Omega". Other than "a great love" a sentiment all of us at Sealegs have for our product the "Alpha" our smallest model, the 3.8m Electric Tender and the 'Omega' 12m Cabin…

Real Estate Investment Outlook July 2019

LOS ANGELES, CA. The speeding up in GDP growth in the US last year was mainly induced by fiscal policy because of corporate tax cuts. Most of these windfall profits have been used to buy back equities instead of increasing capital expenditure, which will have a negative effect on the real estate industry

According to the Bureau of Economic Statistics, buyback programs increased from around 90 billion US dollars at the…

July 27, 2018 Global Chemotherapy Market.pdf

Chemotherapy is a type of cancer treatment which involves the use of one or more chemotherapeutic agents such as anti-cancer drugs. The treatment prevents the cancer cells division and growth of cancer cells by killing the dividing cells. It is used for the treatment of various types of cancer such as lung cancer, breast cancer, leukemia, myeloma, sarcoma, lymphoma, ovarian cancer, and others. The chemotherapy drugs can be administered directly…

Summer-Accrochage July – August 2016

GALERIE FLUEGEL-RONCAK, with a strong focus on Contemporary Art and Pop Art, will show various artworks of its classic collection of POP ART by Andy Warhol, Roy Lichtenstein, Keith Haring, Tom Wesselmann, Alex Katz, Mel Ramos and Julian Opie.

On view will be original prints, drawings, paintings and sculptures.

After the huge success of Christo`s „Floating Piers“ in June 2016 at Lago d'Iseo in northern Italy, we also have artwork by Christo…

Webinars: Current dates in July

The International Material Data System (IMDS) is a computer-based material data system used by automotive OEMs to manage environmentally relevant aspects of the different parts used in vehicles in the form of material data sheets. IMDS enables to easily enter, display and pass on material data over the entire supply chain. The requirements for IMDS continue to rise and an up-to-date IMDS knowledge is essential. At the same time, many…

asos.com launches July/August trends

New Equators End, Surreal Life and Unplugged collections on site now

London: Fashion e-tailer, asos.com showcases 3 womenswear fashion-led trends for July and August, all mixing distinct silhouettes with vibrant colour and striking prints.

“Equators End” unveils ‘70s safari glamour, taking inspiration from Northern Africa and Savannah wildlife to create a sultry summer look with an exaggerated colour palette and unique print motifs. The look is a real retro take on tribal…