Press release

FinTech Investment Market Rising Preeminent Technology Trends with Atom Bank, Klarna, OurCrowd

HTF MI recently introduced Global FinTech Investment Market study with in-depth overview, describing about the Product / Industry Scope and elaborates market outlook and status to 2023. The market Study is segmented by key regions which is accelerating the marketization. At present, the market is developing its presence and some of the key players from the complete study are ZhongAn (China), Oscar (USA), Wealthfront (USA), Qufenqi (China), Funding Circle (UK), Kreditech (Germany), Avant (USA), Atom Bank (UK), Klarna (Sweden), OurCrowd (Israel), WeCash, H2 Ventures & KPMG etc.Request Sample of Global FinTech Investment Market Size, Status and Forecast 2025 @: https://www.htfmarketreport.com/sample-report/890809-global-fintech-investment-market-1

In 2017, the global FinTech Investment market size was million US$ and it is expected to reach million US$ by the end of 2025, with a CAGR of during 2018-2025.

Browse 100+ market data Tables and Figures spread through Pages and in-depth TOC on " FinTech Investment Market by Type (Type I & Type II), by End-Users/Application (P2P lending, Online acquiring and mobile wallets, Personal finance management or private financial planning, MSME services, MPOS, MobileFirst banking, Bitcoin, Crowdfunding & Others), Organization Size, Industry, and Region - Forecast to 2023". Early buyers will receive 10% customization on comprehensive study.

In order to get a deeper view of Market Size, competitive landscape is provided i.e. Revenue (Million USD) by Players (2013-2018), Revenue Market Share (%) by Players (2013-2018) and further a qualitative analysis is made towards market concentration rate, product/service differences, new entrants and the technological trends in future.

Enquire for customization in Report @ https://www.htfmarketreport.com/enquiry-before-buy/890809-global-fintech-investment-market-1

Competitive Analysis:

The key players are highly focusing innovation in production technologies to improve efficiency and shelf life. The best long-term growth opportunities for this sector can be captured by ensuring ongoing process improvements and financial flexibility to invest in the optimal strategies. Company profile section of players such as ZhongAn (China), Oscar (USA), Wealthfront (USA), Qufenqi (China), Funding Circle (UK), Kreditech (Germany), Avant (USA), Atom Bank (UK), Klarna (Sweden), OurCrowd (Israel), WeCash, H2 Ventures & KPMG includes its basic information like legal name, website, headquarters, its market position, historical background and top 5 closest competitors by Market capitalization / revenue along with contact information. Each player/ manufacturer revenue figures, growth rate and gross profit margin is provided in easy to understand tabular format for past 5 years and a separate section on recent development like mergers, acquisition or any new product/service launch etc.

Market Segments:

The Global FinTech Investment Market has been divided into type, application, and region.

On The Basis Of Type: Type I & Type II.

On The Basis Of Application: P2P lending, Online acquiring and mobile wallets, Personal finance management or private financial planning, MSME services, MPOS, MobileFirst banking, Bitcoin, Crowdfunding & Others

On The Basis Of Region, this report is segmented into following key geographies, with production, consumption, revenue (million USD), and market share, growth rate of FinTech Investment in these regions, from 2013 to 2023 (forecast), covering

• North America (U.S. & Canada) {Market Revenue (USD Billion), Growth Analysis (%) and Opportunity Analysis}

• Latin America (Brazil, Mexico & Rest of Latin America) {Market Revenue (USD Billion), Growth Share (%) and Opportunity Analysis}

• Europe (The U.K., Germany, France, Italy, Spain, Poland, Sweden & RoE) {Market Revenue (USD Billion), Growth Share (%) and Opportunity Analysis}

• Asia-Pacific (China, India, Japan, Singapore, South Korea, Australia, New Zealand, Rest of Asia) {Market Revenue (USD Billion), Growth Share (%) and Opportunity Analysis}

• Middle East & Africa (GCC, South Africa, North Africa, RoMEA) {Market Revenue (USD Billion), Growth Share (%) and Opportunity Analysis}

• Rest of World {Market Revenue (USD Billion), Growth Analysis (%) and Opportunity Analysis}

Buy Single User License of Global FinTech Investment Market Size, Status and Forecast 2025 @ https://www.htfmarketreport.com/buy-now?format=1&report=890809

Have a look at some extracts from Table of Content

Introduction about Global FinTech Investment

Global FinTech Investment Market Size (Sales) Market Share by Type (Product Category) in 2017

FinTech Investment Market by Application/End Users

Global FinTech Investment Sales (Volume) and Market Share Comparison by Applications

(2013-2023) table defined for each application/end-users like [P2P lending, Online acquiring and mobile wallets, Personal finance management or private financial planning, MSME services, MPOS, MobileFirst banking, Bitcoin, Crowdfunding & Others]

Global FinTech Investment Sales and Growth Rate (2013-2023)

FinTech Investment Competition by Players/Suppliers, Region, Type and Application

FinTech Investment (Volume, Value and Sales Price) table defined for each geographic region defined.

Global FinTech Investment Players/Suppliers Profiles and Sales Data

Additionally Company Basic Information, Manufacturing Base and Competitors list is being provided for each listed manufacturers

Market Sales, Revenue, Price and Gross Margin (2013-2018) table for each product type which include Type I & Type II

FinTech Investment Manufacturing Cost Analysis

FinTech Investment Key Raw Materials Analysis

FinTech Investment Chain, Sourcing Strategy and Downstream Buyers, Industrial Chain Analysis

Market Forecast (2018-2023)

........and more in complete table of Contents

Browse for Full Report at: https://www.htfmarketreport.com/reports/890809-global-fintech-investment-market-1

Thanks for reading this article; you can also get individual chapter wise section or region wise report version like North America, Europe or Asia.

HTF Market Report is a wholly owned brand of HTF market Intelligence Consulting Private Limited. HTF Market Report global research and market intelligence consulting organization is uniquely positioned to not only identify growth opportunities but to also empower and inspire you to create visionary growth strategies for futures, enabled by our extraordinary depth and breadth of thought leadership, research, tools, events and experience that assist you for making goals into a reality. Our understanding of the interplay between industry convergence, Mega Trends, technologies and market trends provides our clients with new business models and expansion opportunities. We are focused on identifying the “Accurate Forecast” in every industry we cover so our clients can reap the benefits of being early market entrants and can accomplish their “Goals & Objectives”.

Craig Francis (PR & Marketing Manager)

HTF Market Intelligence Consulting Private Limited

Unit No. 429, Parsonage Road Edison, NJ

New Jersey USA – 08837

Phone: +1 (206) 317 1218

sales@htfmarketreport.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release FinTech Investment Market Rising Preeminent Technology Trends with Atom Bank, Klarna, OurCrowd here

News-ID: 1137110 • Views: …

More Releases from HTF Market Intelligence Consulting Pvt. Ltd.

Blockchain Technology in Energy Market to Witness Huge Growth by 2030: WePower, …

The latest survey on Blockchain Technology in Energy Market is conducted to provide hidden gems performance analysis of Blockchain Technology in Energy to better demonstrate competitive environment. The study is a mix of quantitative market stats and qualitative analytical information to uncover market size revenue breakdown by key business segments and end-use applications. The report bridges the historical data from 2019 to 2023 and forecasted till 2030. The outbreak of…

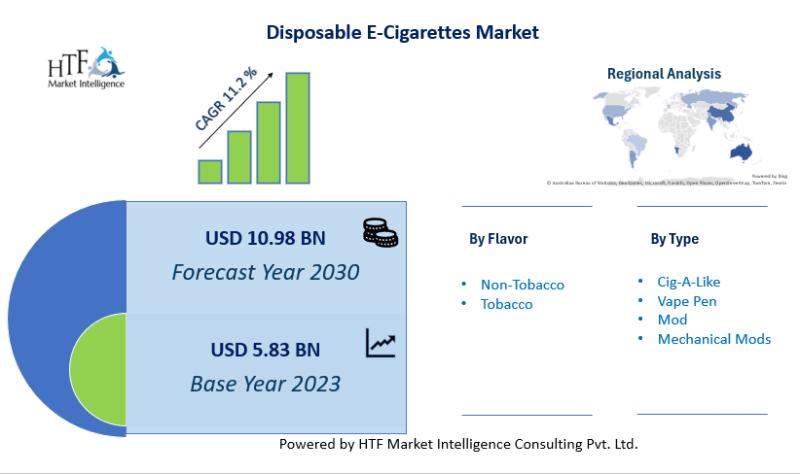

Disposable E-Cigarettes Market SWOT Analysis by Key Players- NJOY, YouMe, JAC Va …

The latest survey on Disposable E-Cigarettes Market is conducted to provide hidden gems performance analysis of Disposable E-Cigarettes to better demonstrate competitive environment. The study is a mix of quantitative market stats and qualitative analytical information to uncover market size revenue breakdown by key business segments and end-use applications. The report bridges the historical data from 2019 to 2023 and forecasted till 2030. The outbreak of the latest scenario in…

North America Luxury Tourism Market Comprehensive Study Explores Huge Growth in …

The latest study released on the North America Luxury Tourism Market by HTF MI Research evaluates market size, trend, and forecast to 2030. The North America Luxury Tourism market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analysed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about…

Automotive LiDAR Market May See a Big Move: Major Giants Velodyne Lidar, Ouster, …

The Automotive LiDAR Market has witnessed continuous growth in the past few years and is projected to grow at a good pace during the forecast period of 2024-2030. The exploration provides a 360° view and insights, highlighting major outcomes of Automotive LiDAR industry. These insights help business decision-makers to formulate better business plans and make informed decisions to improve profitability. Additionally, the study helps venture or emerging players in understanding…

More Releases for FinTech

Artificial Intelligence in Fintech Market

AI is expanding the development of Fintech Companies and taking care of human issues, by increasing efficiency. AI helps Fintech companies in resolving human problems, by enhancing efficiency. AI improves results by applying various methods derived from the various aspects of Human Intelligence at a beyond human scale.

In the finance industry, AI is used to examine cash accounts, credit accounts, and investment accounts to look at a person's overall…

BW Festival Of Fintech: A Comprehensive Fintech Colloquy

Business World’s Festival of Fintech is a two-day informative summit that will inform, illustrate and recognize the changes in the dynamic Fintech industry.

Business World brings forth Festival of Fintech, an exclusive conclave on Fintech innovation and growth on the 12th and 13th of February, 2021. The event will include expert panels and an industry award ceremony that recognizes excellence in all the ambits of the Fintech field.

The…

Fintech Investment Market: Here’s Why 2020 Could Be Another Strong Year for Fi …

Global Fintech Investment Market research report presents a comprehensive overview, market shares, and growth opportunities of Fintech Investment market by product type, application, key manufacturers and key regions and countries. This report offers comprehensive analysis on global Fintech Investment market along with, market trends, drivers, and restraints of the Fintech Investment market. This report includes a detailed competitive scenario and product portfolio of key vendors ZhongAn (China), Oscar, Wealth front,…

Fintech Company Cloudasset wins the “Most Revolutionary Fintech of The Year 20 …

Nordic Future Digital Finance Forum’s 8th edition was held in Valkoinen Sali, Helsinki on 22-23 October.

The two-day event brought together hundreds of professionals from all around Europe including Fintechs, banks, investors and regulators. As part of the event Helsinki Fintech Farm organised the Revolutionary Fintech of the Year final with the objective of identifying the most innovative and scalable company of 2019.

The search for candidates started in August…

Bouchard Fintech

Information provided by Bouchard Fintech

The US, at least this current administration, has mystified its European Union business and political partners. The EU represents one of the very largest economies on the planet. The EU is also very much a trusted ally of the US. The EU market continues to be a fertile ground for US exports. So, it was quite a surprise that the US seemed to be picking a…

Rising Digital Connectivity and Cheaper FinTech Services to Drive the US FinTech …

Digital connectivity, faster payment options, lower customer acquisition costs through referrals on the social networks have all contributed to the growth and innovation in the FinTech in the US.

The FinTech market has increased in terms of the transactional value from 2010 to 2015 at a CAGR of 24.5% during 2010-2015.

Digital payment segment (consisting of digital commerce, mobile wallets and P2P money transfers) was by far the most revenue…