Press release

M-Commerce Payments Market - Estimates it to reach a valuation of US$7.55 bn by the end of 2022

Global M-Commerce Payments Market: SnapshotOwing to the growing ubiquity of smartphones, the prosperity of the m-commerce payments is almost certain, with the demand projected to increment at an exceptional CAGR of 46.9% during the forecast period of 2017 to 2022. Sheer ease of usability that m-commerce brings to the users is the most powerful driver of this market, although the slow adoptability has been a little hindrance. Nevertheless, a number of companies are now offering in-app payments, enhancing security of the transactions and personal details, and promoting sales via “buy button” on social media platforms. In addition to that, since m-commerce enables the merchants to analyze the buying habit of individual customer and make lucrative offers to increment sales, growing number of vendors of various fields are expected to adopt m-commerce payment methods.

Download TOC of Research Report@ https://www.transparencymarketresearch.com/report-toc/30728

Peer-to-Peer Most Preferred Mode of Payment Segment

On the basis of mode of payment, the global m-commerce payments market has been segmented into peer-to-peer transfer payments, near field communication m-commerce payments, and barcode m-commerce payments. In 2017, the peer-to-peer transfer payments segment accounted for US$2.68 bn or 45.1% of the overall demand, and by 2022, the figures are projected to reach US$4.97 bn or 46.2%, respectively. The demand for P2P transfer payments is anticipated to expand at a CAGR of 40.0%, and this absolute growth is larger than that of any other segment.

Based on end-use industry, the global m-commerce payments market has been bifurcated into retail m-commerce, hospitality and tourism, IT and telecommunication, banking, financial services and insurance (BFSI), media and entertainment, healthcare, airline, and others. Device-wise, the market for m-commerce payments has been categorized into smart devices, feature phones, and other electronic devices. On the basis of transaction, the market for m-commerce payments has been classified into mobile retailing, mobile booking or ticketing, mobile banking, mobile billing, and other modes of transactions.

Asia Pacific Projected for Most Robust Growth Rate

Geographically, the report takes stock of the potential of m-commerce payments market in the country of Japan as well as in the regions of North America, Latin America, Europe, Asia Pacific except Japan (APEJ), and the Middle East and Africa (MEA). Among these, North America constitutes the most profitable regional market for the vendors operating in the m-commerce payments market, expanding the demand at an above-average CAGR of 47.4% during the forecast period of 2017 to 2022. In terms of revenue, the North America m-commerce payments market is estimated to be worth US$2.47 bn by 2022. High adoptability of new technology, ubiquity of electronic devices, healthy e-commerce sector, and greater buying power of the citizens of developed countries such as the U.S. and Canada are some of the factors favoring the North America m-commerce payments market.

While Europe currently is the second most lucrative region in the m-commerce payments market, and is projected to increment the demand at a healthy CAGR of 44.0%, the APEJ region is anticipated to exhibit the most promising growth rate of 51.4% during the forecast period of 2017 to 2022. India and China are two of the world’s most populous countries and governments in both these countries are pushing for cashless transactions in order to maintain parity. Various merchants in these APEJ countries are adopting new technology and are experiencing increased sales. The m-commerce payments market valuation of this region is estimated to reach US$ 189,506.4 mn by 2022.

Browse Report@ https://www.transparencymarketresearch.com/m-commerce-payments-market.html

Apple Inc., Alphabet Inc., Mastercard Incorporated, ACI Worldwide, Inc., DH Corporation, Fidelity National Information Services, Inc., Fiserv, Inc., Paypal Holdings, Inc., Square, Inc., Visa, Inc., Jack Henry & Associates Inc., and Samsung Electronics Company Limited are some of the key companies currently operating in the global m-commerce payments market.

About Us:-

Transparency Market Research (TMR) is a next-generation provider of syndicated research, customized research, and consulting services. TMR’s global and regional market intelligence coverage includes industries such as pharmaceutical, chemicals and materials, technology and media, food and beverages, and consumer goods, among others. Each TMR research report provides clients with a 360-degree view of the market with statistical forecasts, competitive landscape, detailed segmentation, key trends, and strategic recommendations.

Contact Us:-

State Tower,

90 State Street,

Suite 700,

Albany NY - 12207

United States

Tel: +1-518-618-1030

Email: sales@transparencymarketresearch.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release M-Commerce Payments Market - Estimates it to reach a valuation of US$7.55 bn by the end of 2022 here

News-ID: 722903 • Views: …

More Releases from Transparency Market Research

Solid Tires Market Expected to Witness Impressive Growth at a 8.1% CAGR by 2031

The latest research study released by Transparency Market Research on "Solid Tires Market Forecast to 2023-2031 ″ research provides accurate economic, global, and country-level predictions and analyses.

Solid Tires market is estimated to attain a valuation of US$ 760.0 Mn by the end of 2031, states a study by Transparency Market Research (TMR). Besides, the report notes that the market is prognosticated to expand at a CAGR of 8.1% during…

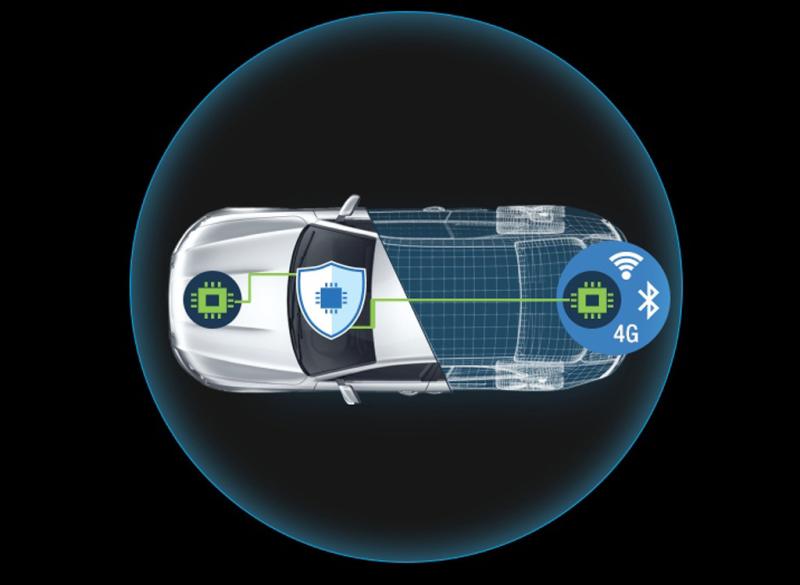

Automotive Cyber security Market Sales Estimated to Hit USD 10.5 Billion by 2031 …

The latest research study released by Transparency Market Research on "𝐀𝐮𝐭𝐨𝐦𝐨𝐭𝐢𝐯𝐞 𝐂𝐲𝐛𝐞𝐫 𝐬𝐞𝐜𝐮𝐫𝐢𝐭𝐲 𝐌𝐚𝐫𝐤𝐞𝐭 𝐅𝐨𝐫𝐞𝐜𝐚𝐬𝐭 𝐭𝐨 𝟐𝟎𝟐𝟑-𝟐𝟎𝟑𝟏 ″ research provides accurate economic, global, and country-level predictions and analyses. It provides a comprehensive perspective of the competitive market as well as an in-depth supply chain analysis to assist businesses in identifying major changes in industry practices. The market report also examines the current state of the Automotive Cyber security industry, as…

Ready-mix Concrete Market to Witness Exponential Growth with a CAGR of 6.1% from …

The latest research study released by Transparency Market Research on "𝐑𝐞𝐚𝐝𝐲-𝐦𝐢𝐱 𝐂𝐨𝐧𝐜𝐫𝐞𝐭𝐞 𝐌𝐚𝐫𝐤𝐞𝐭 𝐅𝐨𝐫𝐞𝐜𝐚𝐬𝐭 𝐭𝐨 𝟐𝟎𝟐𝟑-𝟐𝟎𝟑𝟏 ″ research provides accurate economic, global, and country-level predictions and analyses. It provides a comprehensive perspective of the competitive market as well as an in-depth supply chain analysis to assist businesses in identifying major changes in industry practices. The market report also examines the current state of the Ready-mix Concrete industry, as well as…

Mining Automation Market to Surge at 6.4% CAGR, Hitting US$ 7.3 Bn by 2031, Acco …

The latest research study released by Transparency Market Research on "𝐌𝐢𝐧𝐢𝐧𝐠 𝐀𝐮𝐭𝐨𝐦𝐚𝐭𝐢𝐨𝐧 𝐌𝐚𝐫𝐤𝐞𝐭 𝐅𝐨𝐫𝐞𝐜𝐚𝐬𝐭 𝐭𝐨 𝟐𝟎𝟐𝟑-𝟐𝟎𝟑𝟏 ″ research provides accurate economic, global, and country-level predictions and analyses. It provides a comprehensive perspective of the competitive market as well as an in-depth supply chain analysis to assist businesses in identifying major changes in industry practices. The market report also examines the current state of the Mining Automation industry, as well as…

More Releases for Payment

Digital Payment Market by Component (Solutions (Payment Processing, Payment Gate …

Magarpatta SEZ, Pune, “ReportsnReports”, one of the world’s prominent market research firms has released a new report on Global Digital Payment Market. The report contains crucial insights on the market which will support the clients to make the right business decisions. This research will help both existing and new aspirants for Digital Payment Market to figure out and study market needs, market size, and competition. The report talks about the…

Online Payment Gateway Market Analysis By 2028 | Amazon.com, Avenues India Pvt. …

Future Market Insights (FMI) has recently published a new research report on the online payment gateway market titled “Online Payment Gateway Market: Global Industry Analysis (2013-2017) and Opportunity Assessment (2018-2028).” The report states that the growing prevalence of third party payment processes is expected to have a positive impact on the growth of the global market. Websites have always been a good source for channel merchants for generating revenue. Concentrating…

Payment Card Industry 2025 by Product (Contactless Payment, Card Contact Payment …

ReportsWeb.com has announced the addition of the “Global Payment Card Market Professional Survey Report 2018” ,provides a vital recent industry data which covers in general market situation along with future scenario for industry around the Globe.

Key Players -

MasterCard, Visa, American Express, Banco Itau, Bank of America Merrill Lynch, Bank of Brazil, Bank of East Asia, Chase Commercial Banking, Diner's Club, Hang Seng Bank, Hyundai, JP Morgan, SimplyCash, Sumitomo…

Payment Security Software Market 2018- Digital Transformation in Payment Methods …

Market Highlights

“The increasing number of cashless transactions is the main factor behind the rising demand for payment security software across the world,” says a FGR analyst. With the ongoing digital transformation, the payment market is witnessing a significant change in the pattern of financial transactions, which is shifting towards cashless increasingly.

The digitization across industries is leading to high investments in the development and the deployment of new technologies, encouraging…

Payment Gateway Industry Worth US$ 86.9 Billion By 2025 - Hosted Payment Gateway …

The merchants all over the globe are avidly willing to expand their businesses cross-border by adaption of a logical approach, by partnering with the payment gateways. With the help of this partnership, these merchants gain the advantage of tapping the opportunities created by the globalization of e-commerce. Majority of merchants today, are eyeing up global expansion and wish to grow at a faster pace, however, the last thing they would…

Contactless Payment Observe Huge Demand in Australia Payment Market

Pune, India, 04 December 2017: WiseGuyReports announced addition of new report, titled “Payments in Australia 2017: What Consumers Want”.

A 'payment system' is new technology that allows consumers, businesses, and many organizations to transfer money to a financial institution and vice versa. This includes Payment Instructions - Cash, Card, Check and Electronic Funds Transfer which customers use to pay - and generally unseen arrangements ensure that the funds move from one…