Press release

Asian Insurance Focus: Vietnam & Thailand

Asian Insurance Focus: Vietnam & ThailandNew Delhi, 4th September 2008: Globalization is the key source which is bringing about an "irreversible transformation" in the Asian insurance market. Asia is becoming an important growth engine for global insurers due to the changing socio-economic dynamics. According to a latest research report from HSBC, in order to be long-term winners, life insurance companies in Asia need to diversify their income streams such that at least 25% of earnings are sourced overseas, while maintaining a dominant position in the domestic market.

Many Asian financial services companies have exceeded the overall growth rate for their domestic economies and are therefore looking to expand globally or invest their shares in new markets. Another trend predicted by PwC, was that intra-Asian trade would continue to increase, particularly as the West decreased its investment in this region. The increasing wealth and educational development in Asia, has built a good foundation for the development of financial services.

Vietnam has become one of the fastest-growing economies in the world, averaging around 8% annual gross domestic product (GDP) growth from 1990 to 1997 and 6.5% from 1998-2003. GDP in the country rose 8.5 percent in 2007 and has increased by over 50 percent since 2001. From 2004 to 2007, GDP grew over 8% annually. Vietnam's inflation rate, as measured by the consumer price index, which stood at an annual rate of over 300% in 1987, was below 4% from 1997 (except in 1998 when it rose to 9.2%) until 2003. However, in 2004 the consumer price index increased to 9.5%, dropping in 2006 to 7.5%. It is due to these remarkable developments that Vietnam has caught the attention of foreign insurers looking for an alternative to the twin super economies of India and China.

Thailand is the 2nd largest economy in Southeast Asia, after Indonesia, a position it has held for many years. Thailand ranks midway in the wealth spread in South East Asia as its 4th richest nation per capita, after Singapore, Brunei, and Malaysia. It is also an anchor economy for the neighbouring least developed countries of Laos, Burma, and Cambodia. Its economy is expected to grow by 4.2 % in 2007 from 5 % in 2006. The Thai economy in 2008 is forecasted to grow at 5.6% (in the forecasted range of 5.0-6.0%).

Market Performance:

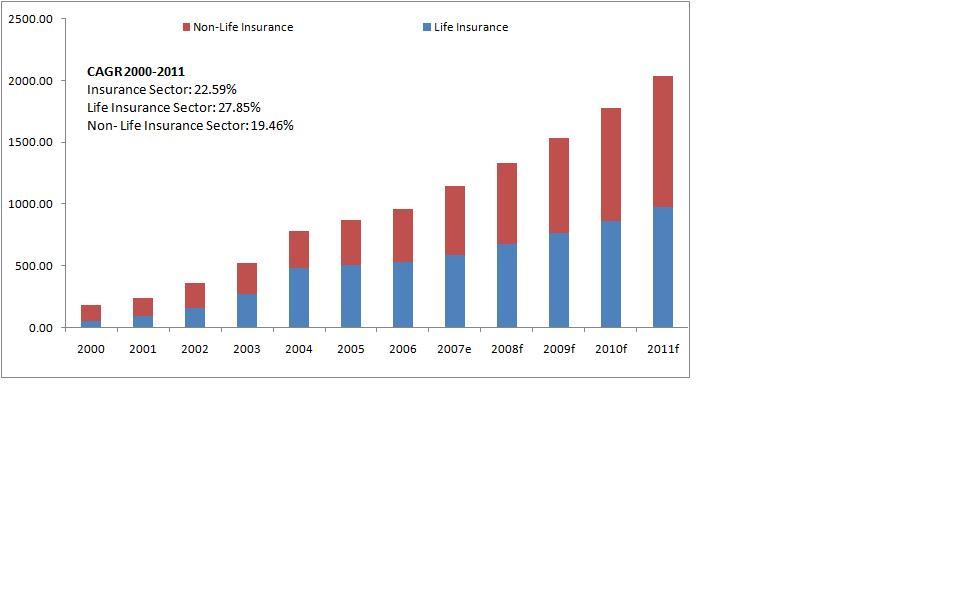

Between 2000 and 2007, Vietnamese life insurance sector increased from $51.12 million to $586.24 million, CAGR growth of 35.65% during this period. The Knowledge Centre forecasts that the life insurance market in Vietnam would grow at a CAGR of 10.71% and an annual average growth rate of 13.21% between 2007 and 2011. From $596.24 million in 2007, the market will increase by approximately $388 million and reach $975.21 million by the end of 2011.

Within a span of 7 years (2000-2007), Thai Insurance Sector has experienced a growth of 191% currently valuated at $9,434.72 million. The Knowledge Centre predicts, the overall market size will increase by 72.5% further and is expected to touch the highs of $13,012.75 million by 2011.

Competitive Landscape:

Some of the largest US, Japanese and French insurers focus exclusively on their home markets. However, multi-national groups who have ‘international’ businesses almost invariably have operations in the Asia-Pacific region, if only because of the size and growth potential of many of the national markets.

Under the Life Insurance Sector, AIG is the biggest in Asia, in terms of country presence and premiums. ING comes second by premiums. However, globally, Prudential tops the list, being the most dependent on the region.

Among the non-life insurance cos., regional player Mitsui Sumitomo, leads the property and casualty side.

Major Driving Factors:

=> Globalization

=> Deregulation which is opening up the markets

=> Opening up of insurance market for foreign investments

=> Cheaper and more effective distribution channels

=> Increasing foreign direct investments

=> Vietnam’s entry into the World Trade Organisation (WTO)

=> Ongoing industry consolidation

=> Increment in the policy holder firms

=> Boost in Merger and Acquisitions activities

=> Changing socio-economic dynamics

=> Market offering wider margins

=> Unique combination of size, age profile and growth prospects

=> Many more..

Major Issues, Trends and Opportunities

=> Lack of good quality, high yield long term investments in local currency

=> Limited availability of products and its limited outreach

=> Local players lack both hard and soft capacity to be competitive

=> Limited understanding of products

=> Continuous increment in intra-Asian trade

=> Need for diversification in the income streams

=> Chance to compete directly with financial services companies

=> Focus on paying out more in claims

=> Drastic increment in marine and cargo insurance sectors

=> Developments in countries, who were closely regulated by their government

=> Lack of proper agent quality

=> Change in the distribution method

=> Difficulties in building networks and brands

=> Risk management concerns in insurance companies

=> Global Expansion

=> Transformation in the organizational system to win customer loyalty

=> Weak equity markets

=> Impact of sub-prime

=> Regulatory and market obstacles in the emerging markets

Topics covered in the report

=> Overview of the Asian Insurance Sector

=> Trends analysis of the Asian economy

=> Asia’s economic presence as compared to other countries

=> Economic performance of Vietnam

=> Past and present scenario of Vietnamese Insurance Market & Future Outlook

=> Driving factors for Vietnamese Insurance Market

=> Trend analysis of Vietnamese economy & macroeconomic factors contributing to the growth of the sector

=> Government strategic initiatives to strengthen Insurance Market

=> Competitive Landscape & Market Share of foreign and domestic players

=> Company profiles of top players

=> Thai economy, its performance, future outlook for 2008-09

=> Government’s economic policies, macroeconomic factors, trends and analysis

=> Market performance and forecast for Thai Insurance Sector between 2000, 2007 and 2011

=> Driving factors for Thai Insurance Market

=> Major Trends analysis of the market

=> Competitive landscape & market share of companies in life and non-life insurance sector

=> Company profiles of top players in life and non-life insurance sector

About ‘The Knowledge Centre’

Established in 2007, “The Knowledge Centre” caters to clients in Financial Services Sector globally. Its expertise lies in knowledge management, business research & management consulting. It conducts surveys across different regions and creates business and market research reports on all the major sectors and sub-sectors of global financial services market.

The Knowledge Centre is a wholly owned subsidiary of the world’s largest executive search firm in financial services. The parent company undertakes search assignments at top levels. It has offices spread across London, New York, Dubai, Delhi, Hong Kong and Tokyo.

To order this report, kindly get in touch with:

Renu Dhyani

PR & Communication Executive

The Knowledge Centre – A Sheffield Haworth Company

Tel: +91-11-40601158 (o); +91-9958790353 (m)

Email: dhyani@sheffieldhaworth.com

Web: http://www.sheffieldhaworth.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Asian Insurance Focus: Vietnam & Thailand here

News-ID: 52805 • Views: …

More Releases from The Knowledge Centre

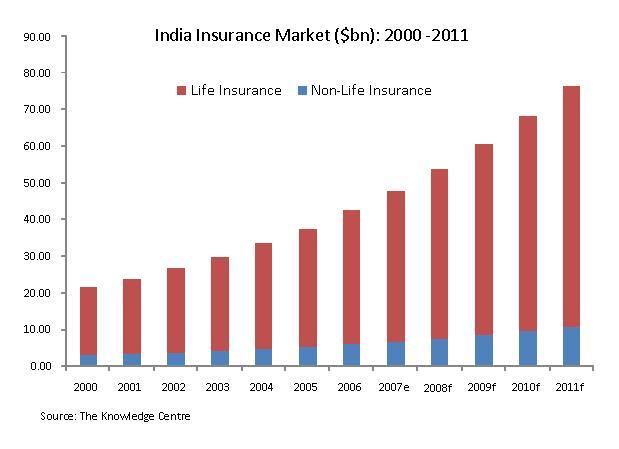

Asian Insurance Focus: India & China

New Delhi, 29th August 2008: Globalization is the key source which is bringing about an "irreversible transformation" in the Asian insurance market. India and China are "dynamically" driving the growth of insurance markets in Asia. This process has been expedited by the "soothing impact" of the Asian financial crisis on reform resistance and its contribution towards acceleration of change, including deregulation, particularly "on the back of gradual opening up of…

Thailand Insurance Sector

New Delhi, 30th May, 2008 - Thailand is the 2nd largest economy in Southeast Asia, after Indonesia. It ranks midway in the wealth spread in South East Asia and is the 4th richest nation per capita, after Singapore, Brunei, and Malaysia. The Thai economy in 2008 is forecasted to grow at 5.6% (in the forecasted range of 5.0-6.0%). This figure is an improvement on 4.8% growth in the previous year…

Vietnam Insurance Sector - Untapped Potential

Vietnam Insurance Sector: Untapped Potential

New Delhi, 9th May 2008: In recent years, there has been a significant economic growth in Vietnam of approximately 7.5% per annum. This growth is attributable to the recently adopted strategic and long-term initiatives by the Vietnamese government. These steps have streamlined and improved the economic infrastructure of the country by offering more incentives for foreign investors and implementing a 10 year socio-economic development plan etc.…

India: The Next Insurance Giant

New Delhi, May 6th 2008: Indian economy is the 12th largest in the world, with a GDP of $1.25 trillion and 3rd largest in terms of purchasing power parity. With factors like a stable 8-9 per cent annual growth, rising foreign exchange reserves, a booming capital market and a rapidly expanding FDI inflows, it is on the fulcrum of an ever increasing growth curve.

Insurance is one major sector which has…

More Releases for Asia

South East Asia Business Jet Market And Top Key Players are Asia Corporate Jet, …

By 2022, the South East Asia Business Jet Markets estimated to reach US$ XX Mn, up from US$ XX Mn in 2016, growing at a CAGR of XX% during the forecast period. The Global Business Jet Market, currently at 21 million USD, contributes the highest share in the market and is poised to grow at the fastest rate in the future. The three broad categories of business jets are Small,…

RAMPF Korea – Producing in Asia for Asia

Joint Venture for the Asian markets – The international RAMPF Group has realigned the cooperation with its long-standing partner Orient Dosiertechnik from Korea with the founding of RAMPF Korea Co., Ltd. The new company based in Hwaseong City is developing and producing mixing and dispensing systems specifically for the Asian markets.

Within the framework of the new joint venture based in Hwaseong City, mixing and dispensing systems are being developed and…

LIXIL Asia Presents Asia Pacific Property Awards

Through its power brands GROHE and American Standard, LIXIL Asia signs a three-year deal to become the Headline Sponsor of the Asia Pacific Property Awards from 2019 until 2022.

23rd January 2019: The International Property Awards, first established in 1993, are open to residential and commercial property professionals from around the globe. They celebrate the highest levels of achievement by companies operating within the architecture, interior design, real estate and property…

PEOPLEWAVE WINS ASIA TECH PODCAST PITCHDECK ASIA 2019 AWARDS

15 January 2019, Singapore – Peoplewave, Asia’s leading data-driven HR technology company, won the Asia Tech Podcast (ATP) Pitchdeck Asia 2019 Awards, being awarded “Startup Most Likely to Succeed in 2019".

The 2019 Pitchdeck Asia Awards is an opportunity for the Asian Startup Ecosystem to shine a spotlight on some of its best startups. The awards were decided by a public vote. More than 7,200 votes were cast by registered LinkedIn…

Undersea Defence Technology Asia, UDT Asia 2011

Latest Military Diving Technologies featured in UDT Asia

Equipping Asia’s navies with the latest diving technology for asymmetric warfare and

operations

SINGAPORE, 17 October 2011 - Naval diving and underwater special operations is a field that is

seeing increased attention and investment amongst navies in Asia. Units such as the Indonesian Navy‟s KOPASKA, the Republic of Singapore Navy‟s Naval Diving Unit (NDU), the Royal Malaysian Navy‟s PASKAL are increasingly utilising specialised equipment for conducting…

Asia Diligence – Specialist Investigative Due Diligence for Asia & Beyond

Asia Diligence today announced the opening of its European Customer Services office in the United Kingdom. The office is to be managed by Steve Fowler and will focus on providing services to Asia Diligence’s European customers. Asia Diligence is also planning to open a US office in the near future, which will provide customer service to its US and North American clients.

Asked to comment on the move, Luke Palmer, the…