Press release

Digital Banking Market Expected to Grow at CAGR of 8% from 2016 to 2022: Industry Trends and Forecast

Market HighlightsMarket Research Future published a Half Cooked Research Report on Digital Banking Market. The Global Digital Banking Market is majorly driven by factors such as easy access, convenience, fast and efficient operation among others.

The Global Market of Digital Banking around the world is growing rapidly. The Digital Banking Market is expected to grow at CAGR of around 8% between years 2016 to 2022. High technology proliferation and support heavy investment by the companies operating in the technology service are helping in the development of efficient cashless system. Many banks around the world are adopting cashless policies for various areas such as payments, transfers among other things. Increasing use of internet and smartphones to do the banking transaction are result of digital banking which makes the task easy and more transparent.

Digital Banking is also helping the banking system in the management of records, data and retrieval of them. One of the major trends in this field is adoption of cloud for the management of data and use of it. Going digital helps the banks to monitor the each and every customer’s details and records more easily. Communication with customers for any announcement and revive feedback have become easy because of digital banking.

Request a Sample Copy of Report @ https://www.marketresearchfuture.com/sample_request/1986

Whereas factors such as need of technical knowledge, growing security proliferation in BFIS industry among others are some of the restraints which is expected to slow the growth of overall market.

Key Players:

The prominent players in the Digital Banking Market includes- Urban FT, Inc. (U.S.), Misys (U.K.), Kony, Inc. (U.S.), Backbase (Netherlands), Technisys (Subsidiary of FMC Technologies) (U.S), Infosys (Bangalore), Cachet Financial Solutions, Inc. (U.S), Innofis (Spain), Mobilearth (Canada), among other

The other players operating in this market are- Nymbus, NLS Banking, IDEALINVENT Technologies, Capital Banking Solutions and among others.

Taste the market data and market information presented through more than 40 market data tables and 25 figures spread over 110 numbers of pages of the project report. Avail the in-depth table of content TOC & market synopsis on “Global Digital Banking Market Research Report- Forecast to 2022”

Access Report Details @ https://www.marketresearchfuture.com/reports/digital-banking-market

Market Research Future Analysis:

Market Research Future analysis shows that the global market of digital banking is estimated to grow at compound annual growth rate of ~8 % between forecast years. High adoption of cloud based services by the major banks around the world and increasing the number of internet and mobile phone consumers are playing role of major growth factor. In the regional market, North America is leading the market due to the high growth of on cloud adoption in banking and other BFSI industries. Also presence of technology and service providers in U.S. and Canada is giving competitive advantage to North America. Europe and Asia-Pacific digital banking market is expected to grow rapidly due to the green initiative by the government and owing to high number of smartphone users in this region.

About Market Research Future:

At Market Research Future (MRFR), we enable our customers to unravel the complexity of various industries through our Cooked Research Report (CRR), Half-Cooked Research Reports (HCRR), Raw Research Reports (3R), Continuous-Feed Research (CFR), and Market Research & Consulting Services.

MRFR team have supreme objective to provide the optimum quality market research and intelligence services to our clients. Our market research studies by products, services, technologies, applications, end users, and market players for global, regional, and country level market segments, enable our clients to see more, know more, and do more, which help to answer all their most important questions.

In order to stay updated with technology and work process of the industry, MRFR often plans & conducts meet with the industry experts and industrial visits for its research analyst members.

Contact:

Akash Anand,

Market Research Future

Office No. 528, Amanora Chambers

Magarpatta Road, Hadapsar,

Pune - 411028

Maharashtra, India

+1 646 845 9312

Email: akash.anand@marketresearchfuture.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Digital Banking Market Expected to Grow at CAGR of 8% from 2016 to 2022: Industry Trends and Forecast here

News-ID: 413356 • Views: …

More Releases from Market Research Future

Hydrofluoric Acid Market (CAGR) of 4%, Innovation Imperative Future Proofing You …

Hydrofluoric acid (HF) is a crucial chemical compound with a wide range of applications across various industries. Despite its hazardous nature, it plays an essential role in manufacturing processes, especially in the production of fluorine compounds. The global hydrofluoric acid market has been witnessing steady growth, driven by demand from end-user industries such as oil refining, pharmaceuticals, and electronics.

The Hydrodesulfurization Catalysts Market is projected to register a CAGR of over…

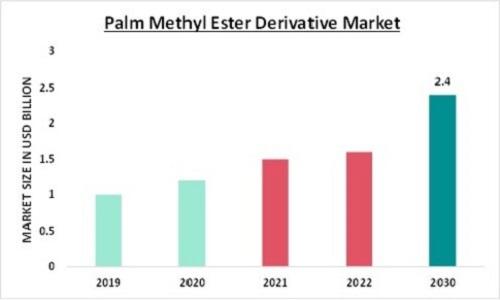

Palm Methyl Ester Derivative Market Size Projected to Grow at 5.92% CAGR, Reachi …

In recent years, the global market for palm methyl ester derivatives has witnessed significant growth, driven by various factors including environmental concerns, technological advancements, and the increasing demand for sustainable alternatives in various industries. Palm methyl ester derivatives, derived from palm oil, have emerged as versatile ingredients with applications spanning across sectors such as cosmetics, pharmaceuticals, lubricants, and more.

The Palm Methyl Ester Derivative Market Size was valued at USD 1.5…

Asia-Pacific Ceramic Tiles Market to Register Highest CAGR Growth of 7.50% by 20 …

The Asia-Pacific ceramic tiles market has been witnessing robust growth, driven by various factors such as increasing investments in residential and commercial construction, renovation activities, and the growing preference for aesthetically pleasing and durable flooring solutions. Countries like China, India, Japan, and South Korea have been leading the market growth, supported by strong manufacturing capabilities, technological advancements, and evolving consumer preferences.

Asia-Pacific Ceramic Tiles Market Size was valued at USD 141.2…

APAC Wallpaper Market to Register Highest CAGR Growth of 8% by 2032: Analysis by …

The APAC wallpaper market has witnessed significant growth in recent years, driven by factors such as rising disposable incomes, expanding construction activities, and growing awareness regarding interior decor. Countries like China, India, Japan, South Korea, and Australia have emerged as key contributors to the region's wallpaper market. Additionally, the increasing adoption of innovative wallpaper designs and patterns is fueling market growth further.

APAC Wallpaper Market Size was valued at USD 0.55…

More Releases for Banking

Online Banking Market by Banking Type - Retail Banking, Corporate Banking, and I …

The Online Banking Market size is expected to reach $29,976 million in 2023 from $7,305 million in 2016, growing at a CAGR of 22.6% from 2017 to 2023. Digital banking includes all kinds of online/internet transactions done for various purposes. It is the incorporation of new technologies, to deliver enhanced customer services.

Customer convenience, higher interest rates, and technologically advanced interface majorly drive the market. High security risk of customer’s data…

Mobile Banking Market Is Booming Worldwide | HSBC Mobile Banking, ICICI Bank Mob …

HTF MI recently introduced Global Mobile Banking Market study with in-depth overview, describing about the Product / Industry Scope and elaborates market outlook and status to 2023. The market Study is segmented by key regions which is accelerating the marketization. At present, the market is developing its presence and some of the key players from the complete study are HSBC Mobile Banking, ICICI Bank Mobile Banking, U.S. Bank, Santander Mobile…

Online Banking Market Report 2018: Segmentation by Banking Type (Retail Banking, …

Global Online Banking market research report provides company profile for ACI Worldwide (U.S.), Microsoft Corporation (U.S.), Fiserv, Inc. (U.S.), Tata Consultancy Services (India), Cor Financial Solutions Ltd. (UK), Oracle Corporation (U.S.) and Others.

This market study includes data about consumer perspective, comprehensive analysis, statistics, market share, company performances (Stocks), historical analysis 2012 to 2017, market forecast 2018 to 2025 in terms of volume, revenue, YOY growth rate, and CAGR for…

Digital Banking Market Research Report 2017: Internet Banking, Digital Payments, …

In this report, the global Digital Banking market is valued at USD XX million in 2016 and is expected to reach USD XX million by the end of 2022, growing at a CAGR of XX% between 2016 and 2022.

Geographically, this report is segmented into several key Regions, with production, consumption, revenue (million USD), market share and growth rate of Digital Banking in these regions, from 2012 to 2022 (forecast), covering

United…

Online banking market by Banking Type (Retail Banking, Corporate Banking, and In …

Online banking market size was valued at +$7,304 million in 2016, and is estimated to reach +$29,975 million by 2023, registering a CAGR of +22.5% from 2017 to 2023. In 2017, Digital banking includes all kinds of online/internet transactions done for various purposes. It is the incorporation of new technologies, to deliver enhanced customer services. online retail banking dominated the overall online banking market. The report categorizes the market in…

Global Core Banking Solution Market: Branch Less Banking to Impact Core Banking …

New research report offers a comprehensive analysis of the “Core Banking Solution Market: Banks End User Segment to Lead in Terms of Value Share Throughout the Forecast Period: Global Industry Analysis 2012 - 2016 and Opportunity Assessment 2017 – 2027”.The main objective of this report is to deliver insightful information and clear-cut facts pertaining to the growth trajectories of the market.

Request for Sample Report @ https://www.mrrse.com/sample/4004

Branch Less Banking to Impact…