Press release

Open Banking Market to Reach $123.7 Billion by 2031 | Insights and Analysis

According to the report published by Allied Market Research, the global open banking market amassed revenue of $13.9 billion in 2020, and is expected to hit $123.7 billion by 2031, registering a CAGR of 22.3% from 2022 to 2031. The market research study provides a detailed analysis of changing industry trends, top-most segments, value chain analysis, key investment business scenarios, regional space, and competitive space.➡️𝐑𝐞𝐪𝐮𝐞𝐬𝐭 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐑𝐞𝐩𝐨𝐫𝐭 𝐒𝐚𝐦𝐩𝐥𝐞 & 𝐓𝐎𝐂 :

https://www.alliedmarketresearch.com/request-sample/3840

The study is a key information source for giant players, entrepreneurs, shareholders, and owners in generating new strategies for the future and taking steps to enhance their market position. The report displays an in-depth quantitative analysis of the market from 2022 to 2031 and guides investors in allocating funds to the rapidly evolving industry.

Covid-19 Scenario

The Covid-19 pandemic created new growth avenues for the global open banking market due to the use and acceptance of open banking application programming interfaces (APIs) by customers for performing payment processes.

Open banking services received a boost during the COVID-19 pandemic as a result of technological breakthroughs.

Banks and fintech firms offered their customers useful and new features in APIs for promoting the use of open banking platforms during the COVID-19 pandemic.

The report offers detailed segmentation of the global open banking market based on financial services, distribution channel, and region. It provides an in-depth analysis of every segment and sub-segment in tables and figures through which consumers can derive a conclusion about market trends and insights. The market report analysis aids organizations, investors, and entrepreneurs in understanding which sub-segments are to be tapped for achieving huge growth in the years ahead.

In terms of financial services, the banking & capital markets segment was the largest in 2020, accounting for nearly half of the overall share of the global open banking market. Moreover, the Payments segment is predicted to dominate the overall market growth in 2031. However, the value-added services segment is set to record the highest CAGR of 27.2% from 2022 to 2031. The report also analysis other segments including Digital Currencies.

➡️𝐑𝐞𝐪𝐮𝐞𝐬𝐭 𝐂𝐮𝐬𝐭𝐨𝐦𝐢𝐳𝐚𝐭𝐢𝐨𝐧 𝐖𝐞 𝐨𝐟𝐟𝐞𝐫 𝐜𝐮𝐬𝐭𝐨𝐦𝐢𝐳𝐞𝐝 𝐫𝐞𝐩𝐨𝐫𝐭 𝐚𝐬 𝐩𝐞𝐫 𝐲𝐨𝐮𝐫 𝐫𝐞𝐪𝐮𝐢𝐫𝐞𝐦𝐞𝐧𝐭 :

https://www.alliedmarketresearch.com/request-for-customization/3840

On basis of the distribution channel, the app market segment held the largest share in 2020, contributing to two-fifths of the overall open banking market share. Moreover, this segment is predicted to account for the highest market share in 2031. Furthermore, the Distributors segment is also anticipated to record the fastest CAGR of 25.9% during the forecast timeframe. The report also includes bank channel and aggregators.

Based on region, Europe contributed toward the highest market share in 2020, accounting for more than two-fifths of the global open banking market share. Furthermore, the Asia-Pacific region is set to contribute majorly toward the global market share in 2031. In addition, the region is predicted to register the fastest CAGR of 27.0% during the forecast timespan. The research also analyzes regions including LAMEA and North America.

Key participants in the global open banking market examined in the research include Banco Bilbao Vizcaya Argentaria, S.A., Crédit Agricole Group, Deposit Solutions, Finestra, Jack Henry & Associates, Inc., Nordigen Solutions, Revolut Ltd., Societe Generale S.A., Tink AB, and Yapily Ltd.

The report evaluates these major players in the global open banking industry. These players have executed a gamut of major business strategies such as the expansion of regional and customer bases, new product launches, strategic alliances, and joint ventures for expanding product lines across global markets. The market research report supports the performance monitoring of each segment, positioning of each product in respective segments, and the impact of new technology and product innovations on the overall market size.

➡️𝐈𝐧𝐪𝐮𝐢𝐫𝐞 𝐁𝐞𝐟𝐨𝐫𝐞 𝐁𝐮𝐲𝐢𝐧𝐠:

https://www.alliedmarketresearch.com/purchase-enquiry/3840

Key Benefits for Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the open banking market analysis from 2020 to 2031 to identify the prevailing open banking market opportunity.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the open banking market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as open banking market trends, key players, market segments, application areas, and market growth strategies.

➡️𝐁𝐮𝐲 𝐂𝐨𝐦𝐩𝐥𝐞𝐭𝐞 𝐑𝐞𝐩𝐨𝐫𝐭 𝐚𝐭 𝐃𝐢𝐬𝐜𝐨𝐮𝐧𝐭𝐞𝐝 𝐏𝐫𝐢𝐜𝐞 @

https://www.alliedmarketresearch.com/checkout-final/a1b27a5f982d8f7f06174a131a801832?utm_source=AMR&utm_medium=research&utm_campaign=P19623

Key Market Segments

Financial Services

Banking & Capital Markets

Payments

Digital Currencies

Value Added Services

Distribution Channel

Bank Channel

App market

Distributors

Aggregators

By Region

North America (U.S., Canada)

Europe (United Kingdom, Germany, France, Italy, Spain, Rest of Europe)

Asia-Pacific (China, Japan, India, Australia, South Korea, Rest of Asia-Pacific)

LAMEA (Latin Amercia, Middle East, Africa)

➡️𝐋𝐞𝐚𝐝𝐢𝐧𝐠 𝐑𝐞𝐩𝐨𝐫𝐭𝐬 :

Robotic Process Automation (RPA) in Financial Services Market

https://www.alliedmarketresearch.com/robotic-process-automation-rpa-in-financial-services-market-A06933

Pet Insurance Market https://www.alliedmarketresearch.com/pet-insurance-market

Real Estate Loans Market https://www.alliedmarketresearch.com/real-estate-loans-market-A10048

Personal Loans Market https://www.alliedmarketresearch.com/personal-loans-market-A07580

Asia-Pacific ATM Market https://www.alliedmarketresearch.com/asia-pacific-atm-market

1209 Orange Street,

Corporation Trust Center,

Wilmington, New Castle,

Delaware 19801 USA.

Int'l: +1-503-894-6022

Toll Free: +1-800-792-5285

Fax: +1-800-792-5285

help@alliedmarketresearch.com

About Us:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Wilmington, Delaware. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of "Market Research Reports Insights" and "Business Intelligence Solutions." AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

We are in professional corporate relations with various companies, and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Allied Market Research CEO Pawan Kumar is instrumental in inspiring and encouraging everyone associated with the company to maintain high quality of data and help clients in every way possible to achieve success. Each data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Open Banking Market to Reach $123.7 Billion by 2031 | Insights and Analysis here

News-ID: 3451890 • Views: …

More Releases from www.alliedmarketresearch.com

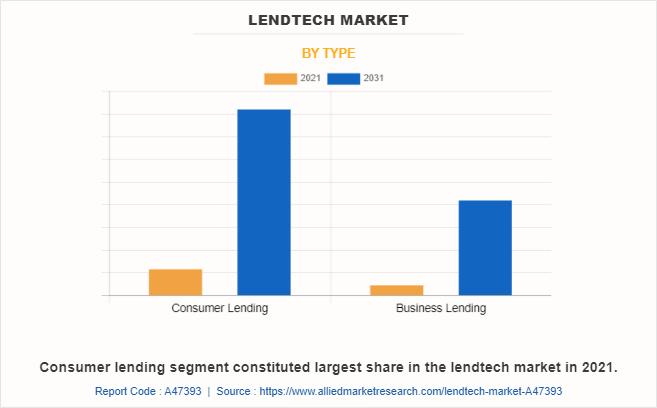

LendTech Market on the Rise: Expected to Hit $61.9 Billion Globally by 2031 at a …

Allied Market Research published a report, titled, "LendTech Market by Component (Solution and Services), Deployment Mode (On-Premises and Cloud), Type (Consumer Lending and Business Lending), Organization Size (Large Enterprises and Small and Medium-sized Enterprises), and End User (Banks, Insurance Companies, Credit Unions and NBFCs) And Region (North America, Europe, Asia-Pacific, and LAMEA): Global Opportunity Analysis and Industry Forecast, 2022-2031"

➡️𝐁𝐮𝐲 𝐂𝐨𝐦𝐩𝐥𝐞𝐭𝐞 𝐑𝐞𝐩𝐨𝐫𝐭 𝐚𝐭 𝐃𝐢𝐬𝐜𝐨𝐮𝐧𝐭𝐞𝐝 𝐏𝐫𝐢𝐜𝐞 @ https://www.alliedmarketresearch.com/checkout-final/e9cfd6561c2455a97d15b253328e9309?utm_source=AMR&utm_medium=research&utm_campaign=P19623

According to the report,…

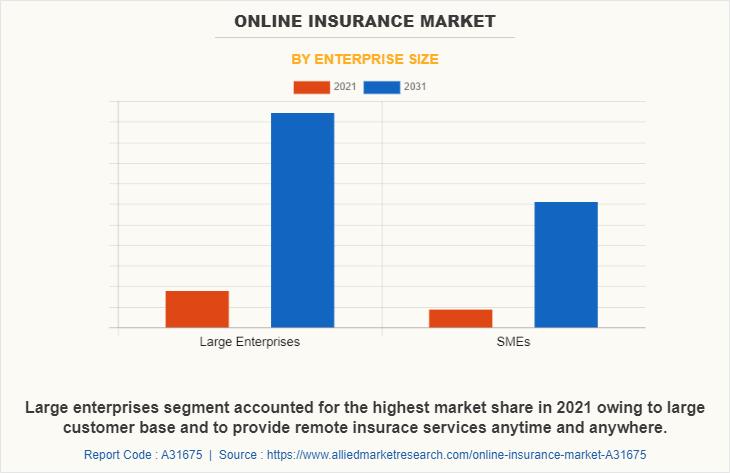

Online Insurance Market Set to Soar: Projected to Hit $330.1 Billion by 2031 | a …

According to the report published by Allied Market Research, the global online insurance market generated $53.2 billion in 2021, and is projected to reach $330.1 billion by 2031, growing at a CAGR of 20.2% from 2022 to 2031.

➡️𝐁𝐮𝐲 𝐂𝐨𝐦𝐩𝐥𝐞𝐭𝐞 𝐑𝐞𝐩𝐨𝐫𝐭 𝐚𝐭 𝐃𝐢𝐬𝐜𝐨𝐮𝐧𝐭𝐞𝐝 𝐏𝐫𝐢𝐜𝐞 @

https://www.alliedmarketresearch.com/checkout-final/37f5061b3aae7b2dcea8ce34b1176b6c?utm_source=AMR&utm_medium=research&utm_campaign=P19623

The report offers a detailed analysis of the top winning strategies, evolving market trends, market size and estimations, value chain, key investment pockets, drivers & opportunities,…

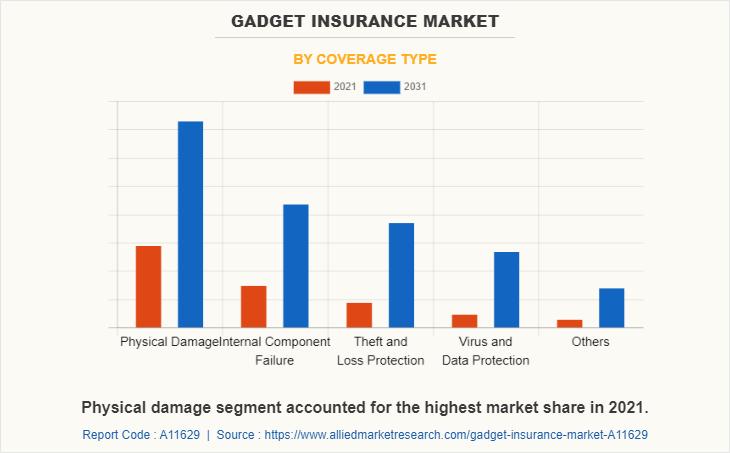

Gadget Insurance Boom: Market to Skyrocket to $193.5 Billion Globally by 2031 at …

Global Opportunity Analysis and Industry Forecast, 2021-2031". According to the report, the global gadget insurance market generated $59.4 billion in 2021, and is projected to reach $193.5 billion by 2031, growing at a CAGR of 12.9% from 2022 to 2031.

➡️𝐑𝐞𝐪𝐮𝐞𝐬𝐭 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐑𝐞𝐩𝐨𝐫𝐭 𝐒𝐚𝐦𝐩𝐥𝐞 & 𝐓𝐎𝐂 : https://www.alliedmarketresearch.com/request-sample/A11629

Drivers, Restraints, and Opportunities

Increase in cases of accidental damage, phone thefts, virus infection, & device malfunction, rise in the adoption of high-quality…

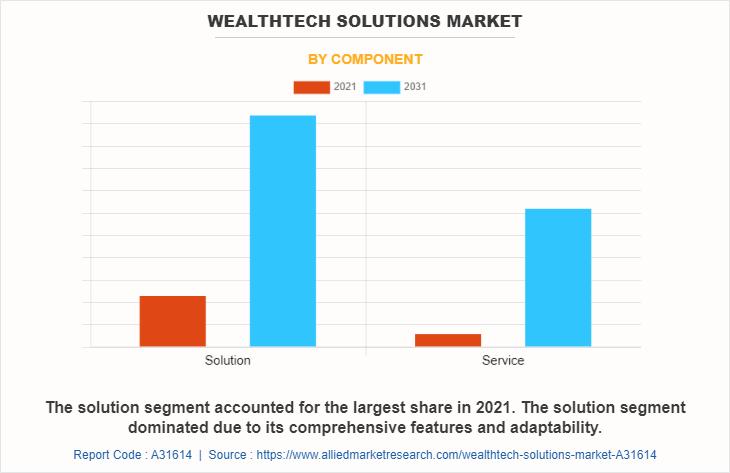

WealthTech Solutions Skyrocket: Market Projected to Hit $18.6 Billion by 2031 | …

According to the report published by Allied Market Research, the global wealthtech solutions market generated $4.8 billion in 2021, and is projected to reach $18.6 billion by 2031, growing at a CAGR of 14.8% from 2022 to 2031. The report offers a detailed analysis of the top winning strategies, evolving market trends, market size and estimations, value chain, key investment pockets, drivers & opportunities, competitive landscape, and regional landscape.

➡️𝐁𝐮𝐲…

More Releases for Bank

Mortgage-Backed Security Market 2022: Industry Manufacturers Forecasts- Construc …

The Mortgage-Backed Security research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Mortgage-Backed Security market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers formulate effective…

Doorstep Banking Services Market Challenges and Opportunities in Banking Service …

Doorstep banking is a facility provided so that user don't have to visit bank branches for routine banking activities like cash deposit, cash withdrawal, cheque deposit, or making a demand draft. The bank extends these facilities at user work place by appointing a service provider on your behalf.

This service was earlier available only to senior citizens but it is available to everyone with nominal fee charges, depending on the type…

What's driving the Neo and Challenger Bank Market trends? Key Players are Hello …

This Global Neo and Challenger Bank market report studies the industry based on one or more segments covering key players, types, applications, products, technology, end-users, and regions for historical data as well as provides forecasts for next few years.

The global Neo and Challenger Bank market is highly competitive and fragmented due to the presence of numerous small vendors in the market. Atom Bank, WeBank (Tencent Holdings Limited), N26, Starling Bank…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank o …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance, regulatory, and other…