Press release

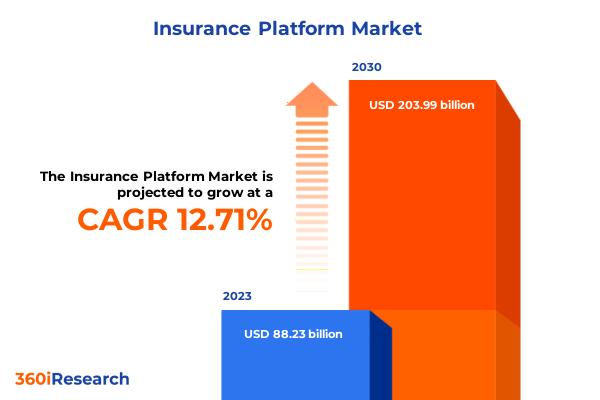

Insurance Platform Market worth $203.99 billion by 2030, growing at a CAGR of 12.71% - Exclusive Report by 360iResearch

The "Insurance Platform Market by Component (Service, Solution), Deployment Model (Cloud, On-premise), Application, Enterprise Size, End User - Global Forecast 2024-2030" report has been added to 360iResearch.com's offering.The Global Insurance Platform Market to grow from USD 88.23 billion in 2023 to USD 203.99 billion by 2030, at a CAGR of 12.71%.

Request a Free Sample Report @ https://www.360iresearch.com/library/intelligence/insurance-platform?utm_source=openpr&utm_medium=referral&utm_campaign=sample

An insurance platform is a unified technological solution or system that facilitates the buying and selling insurance policies while encouraging seamless collaboration, customer engagement, and optimal decision-making processes. This is achieved by integrating various functions, including policy issuance, underwriting, claims management, policy billing, and renewal. The need for rigid security measures to protect sensitive customer data and the increasing demand for digital insurance channels underscores the importance of secure insurance platforms. However, the complexity involved with integrating insurance platforms with legacy systems and increasing cyber threats poses significant barriers to adoption and market penetration. Nevertheless, the proliferating adoption of cloud-based digital solutions presents a compelling opportunity for the insurance platform market to gain a competitive advantage.

In the Americas, insurance platforms exhibit robust growth supported by advanced technological infrastructure, the presence of significant market players, high rates of digital penetration, and well-established regulatory frameworks, influencing the structure and speed of digital innovation in the insurance sector. The Asia-Pacific region is witnessing growth for insurance platforms spurred by rising economic development. Moreover, countries such as China, Japan, India, and South Korea are demonstrating rapid adoption of mobile technologies and a growing preference for online insurance services. In the EMEA region, the adoption of telematics in auto insurance and the use of AI for personalized offerings are key trends driving growth in the European market. In addition, insurtech startups are collaborating with traditional insurance companies, leveraging the region's technological infrastructure to improve products and services.

Market Segmentation & Coverage:

This research report categorizes the Insurance Platform Market in order to forecast the revenues and analyze trends in each of following sub-markets:

Based on Component, market is studied across Service and Solution. The Service is projected to witness significant market share during forecast period.

Based on Deployment Model, market is studied across Cloud and On-premise. The On-premise is projected to witness significant market share during forecast period.

Based on Application, market is studied across Billing & Payments, Claims Management, Customer Relationship Management, Data Analytics, and Underwriting & Rating. The Underwriting & Rating is projected to witness significant market share during forecast period.

Based on Enterprise Size, market is studied across Large Enterprises and Small & Medium sized Enterprises (SMEs)). The Small & Medium sized Enterprises (SMEs)) is projected to witness significant market share during forecast period.

Based on End User, market is studied across Aggregators, Insurance Companies, and Third-Party Administrators & Brokers. The Third-Party Administrators & Brokers is projected to witness significant market share during forecast period.

Based on Region, market is studied across Americas, Asia-Pacific, and Europe, Middle East & Africa. The Americas is further studied across Argentina, Brazil, Canada, Mexico, and United States. The United States is further studied across California, Florida, Illinois, New York, Ohio, Pennsylvania, and Texas. The Asia-Pacific is further studied across Australia, China, India, Indonesia, Japan, Malaysia, Philippines, Singapore, South Korea, Taiwan, Thailand, and Vietnam. The Europe, Middle East & Africa is further studied across Denmark, Egypt, Finland, France, Germany, Israel, Italy, Netherlands, Nigeria, Norway, Poland, Qatar, Russia, Saudi Arabia, South Africa, Spain, Sweden, Switzerland, Turkey, United Arab Emirates, and United Kingdom. The Americas commanded largest market share of 46.22% in 2023, followed by Europe, Middle East & Africa.

Inquire Before Buying @ https://www.360iresearch.com/library/intelligence/insurance-platform?utm_source=openpr&utm_medium=referral&utm_campaign=inquire

FPNV Positioning Matrix:

The FPNV Positioning Matrix is essential for assessing the Insurance Platform Market. It provides a comprehensive evaluation of vendors by examining key metrics within Business Strategy and Product Satisfaction, allowing users to make informed decisions based on their specific needs. This advanced analysis then organizes these vendors into four distinct quadrants, which represent varying levels of success: Forefront (F), Pathfinder (P), Niche (N), or Vital(V).

Market Share Analysis:

The Market Share Analysis offers an insightful look at the current state of vendors in the Insurance Platform Market. By comparing vendor contributions to overall revenue, customer base, and other key metrics, we can give companies a greater understanding of their performance and what they are up against when competing for market share. The analysis also sheds light on just how competitive any given sector is about accumulation, fragmentation dominance, and amalgamation traits over the base year period studied.

Key Company Profiles:

The report delves into recent significant developments in the Insurance Platform Market, highlighting leading vendors and their innovative profiles. These include Adobe Inc., Appian Corporation Inc., Applied Systems, Inc., Britecore by Intuitive Web Solutions, LLC, Cogitate Technology Solutions, Inc., Cognizant Technology Solutions Corporation, Duck Creek Technologies LLC, DXC Technology Company, EIS Group Inc., FINEOS Corporation Ltd, Guidewire Software, Inc., InsuredHQ Limited, International Business Machines Corporation, LTIMindtree Ltd., Microsoft Corporation, Oracle Corporation, Pegasystems Inc., Prima Solutions SAS, Quantemplate Research Limited, Salesforce, Inc., SAP SE, Sapiens International Corporation, Shift Technology SAS, Vertafore, Inc., and Zipari, Inc..

Key Topics Covered:

1. Preface

2. Research Methodology

3. Executive Summary

4. Market Overview

5. Market Insights

6. Insurance Platform Market, by Component

7. Insurance Platform Market, by Deployment Model

8. Insurance Platform Market, by Application

9. Insurance Platform Market, by Enterprise Size

10. Insurance Platform Market, by End User

11. Americas Insurance Platform Market

12. Asia-Pacific Insurance Platform Market

13. Europe, Middle East & Africa Insurance Platform Market

14. Competitive Landscape

15. Competitive Portfolio

The report provides insights on the following pointers:

1. Market Penetration: Provides comprehensive information on the market offered by the key players

2. Market Development: Provides in-depth information about lucrative emerging markets and analyzes penetration across mature segments of the markets

3. Market Diversification: Provides detailed information about new product launches, untapped geographies, recent developments, and investments

4. Competitive Assessment & Intelligence: Provides an exhaustive assessment of market shares, strategies, products, certification, regulatory approvals, patent landscape, and manufacturing capabilities of the leading players

5. Product Development & Innovation: Provides intelligent insights on future technologies, R&D activities, and breakthrough product developments

The report answers questions such as:

1. What is the market size and forecast of the Insurance Platform Market?

2. Which are the products/segments/applications/areas to invest in over the forecast period in the Insurance Platform Market?

3. What is the competitive strategic window for opportunities in the Insurance Platform Market?

4. What are the technology trends and regulatory frameworks in the Insurance Platform Market?

5. What is the market share of the leading vendors in the Insurance Platform Market?

6. What modes and strategic moves are considered suitable for entering the Insurance Platform Market?

Read More @ https://www.360iresearch.com/library/intelligence/insurance-platform?utm_source=openpr&utm_medium=referral&utm_campaign=analyst

Contact 360iResearch

Mr. Ketan Rohom

Sales & Marketing,

Office No. 519, Nyati Empress,

Opposite Phoenix Market City,

Vimannagar, Pune, Maharashtra,

India - 411014.

sales@360iresearch.com

+1-530-264-8485

+91-922-607-7550

About 360iResearch

360iResearch is a market research and business consulting company headquartered in India, with clients and focus markets spanning the globe.

We are a dynamic, nimble company that believes in carving ambitious, purposeful goals and achieving them with the backing of our greatest asset - our people.

Quick on our feet, we have our ear to the ground when it comes to market intelligence and volatility. Our market intelligence is diligent, real-time and tailored to your needs, and arms you with all the insight that empowers strategic decision-making.

Our clientele encompasses about 80% of the Fortune Global 500, and leading consulting and research companies and academic institutions that rely on our expertise in compiling data in niche markets. Our meta-insights are intelligent, impactful and infinite, and translate into actionable data that support your quest for enhanced profitability, tapping into niche markets, and exploring new revenue opportunities.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Insurance Platform Market worth $203.99 billion by 2030, growing at a CAGR of 12.71% - Exclusive Report by 360iResearch here

News-ID: 3403078 • Views: …

More Releases from 360iResearch

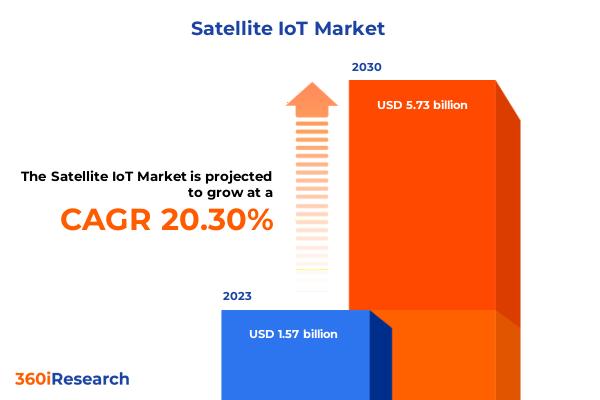

Satellite IoT Market worth $5.73 billion by 2030, growing at a CAGR of 20.30% - …

The "Satellite IoT Market by Service Type (Direct to Satellite Services, Sat-IoT Backhaul Services), Frequency Band (Ka-band, Ku-band, L-band), End-Use - Global Forecast 2024-2030" report has been added to 360iResearch.com's offering.

The Global Satellite IoT Market to grow from USD 1.57 billion in 2023 to USD 5.73 billion by 2030, at a CAGR of 20.30%.

Request a Free Sample Report @ https://www.360iresearch.com/library/intelligence/satellite-iot?utm_source=openpr&utm_medium=referral&utm_campaign=sample

The utilization of satellite IoT is significantly growing across various regions,…

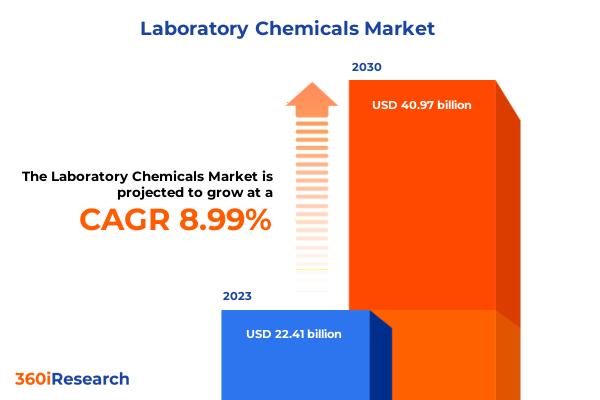

Laboratory Chemicals Market worth $40.97 billion by 2030, growing at a CAGR of 8 …

The "Laboratory Chemicals Market by Type (Biochemistry, Carbohydrate Analysis, Cell/Tissue Culture), Application (Academia/Educational, Government, Healthcare & Pharmaceutical) - Global Forecast 2024-2030" report has been added to 360iResearch.com's offering.

The Global Laboratory Chemicals Market to grow from USD 22.41 billion in 2023 to USD 40.97 billion by 2030, at a CAGR of 8.99%.

Request a Free Sample Report @ https://www.360iresearch.com/library/intelligence/laboratory-chemicals?utm_source=openpr&utm_medium=referral&utm_campaign=sample

Laboratory chemicals include acids, solvents, reagents, and analytical standards for testing and experiments. Laboratory…

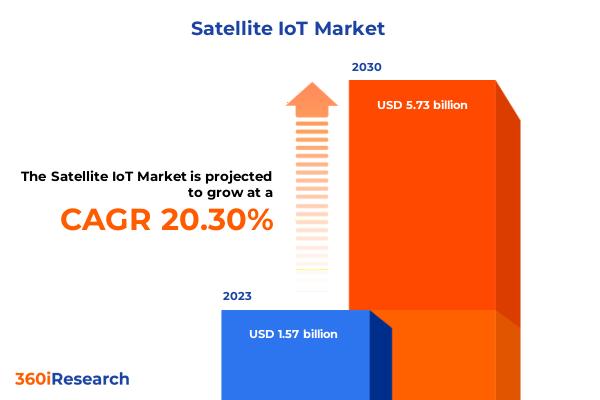

Satellite IoT Market worth $5.73 billion by 2030, growing at a CAGR of 20.30% - …

The "Satellite IoT Market by Service Type (Direct to Satellite Services, Sat-IoT Backhaul Services), Frequency Band (Ka-band, Ku-band, L-band), End-Use - Global Forecast 2024-2030" report has been added to 360iResearch.com's offering.

The Global Satellite IoT Market to grow from USD 1.57 billion in 2023 to USD 5.73 billion by 2030, at a CAGR of 20.30%.

Request a Free Sample Report @ https://www.360iresearch.com/library/intelligence/satellite-iot?utm_source=openpr&utm_medium=referral&utm_campaign=sample

The utilization of satellite IoT is significantly growing across various regions,…

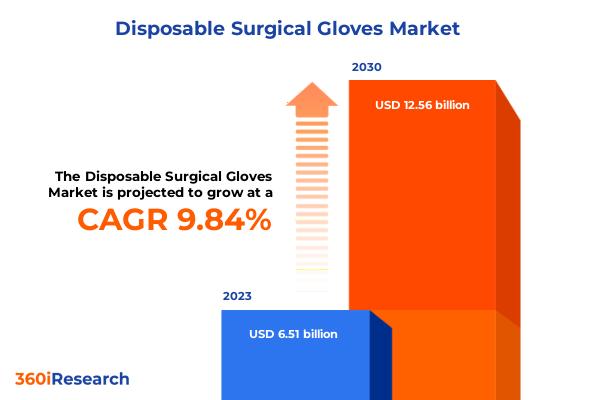

Disposable Surgical Gloves Market worth $12.56 billion by 2030, growing at a CAG …

The "Disposable Surgical Gloves Market by Product (Natural Rubber Gloves, Nitrile Disposable Gloves, Vinyl Disposable Gloves), Form (Powdered Gloves, Powdered-Free Gloves), Distribution Channel, End-Users - Global Forecast 2024-2030" report has been added to 360iResearch.com's offering.

The Global Disposable Surgical Gloves Market to grow from USD 6.51 billion in 2023 to USD 12.56 billion by 2030, at a CAGR of 9.84%.

Request a Free Sample Report @ https://www.360iresearch.com/library/intelligence/disposable-surgical-gloves?utm_source=openpr&utm_medium=referral&utm_campaign=sample

Disposable surgical gloves are used by…

More Releases for Insurance

Household Insurance market by top keyaplayers - Discount Insurance Home Insuran …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance marketgrowth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market have also been included in…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Non-Life Insurance Market :Health Insurance, Property Insurance, Cargo Insurance …

Non-Life Insurance Market Overview:

Summary:Excellence consistency maintains by Garner Insights in Research Report in which studies the global Non-Life Insurance market status and forecast, categorizes and Equipment market value by manufacturers, type, application, and region.

Get Access to Report Sample: http://bit.ly/2Q9Hd8z

Non-Life Insurance market was valued at Million US$ in 2017 and is projected to reach Million US$ by 2025, at a CAGR of during the forecast period. In this study, 2017 has been…

Agricultural Insurance Market 2018-2023: AnHua Agricultural Insurance, Anxin Agr …

A new research study titled, “Global Agricultural Insurance Market” has been added to the comprehensive repository of Orbis Research

Agricultural Insurance Market - Global Status and Trend Report 2018-2023 offer a comprehensive analysis of the Agricultural Insurance industry, standing on the readers’ perspective, delivering detailed market data and penetrating insights. No matter the client is the industry insider, potential entrant or investor, the report will provide useful data and information.

The…

Insurance Market-Saga’s Retail Broking Business Offers Motor Insurance, Pet In …

Orbis Research Market brilliance released a new research report of 33 pages on title ‘Insurance Company Profile: Saga’ with detailed analysis, forecast and strategies.

Insurance Company Profile: Saga", profile provides a comprehensive review of Saga and its UK business. This includes its strategy for growth and focus on digitization as well as its performance in the UK and marketing and distribution strategy.

Request a sample of this report at http://orbisresearch.com/contacts/request-sample/2026595

Saga…