Press release

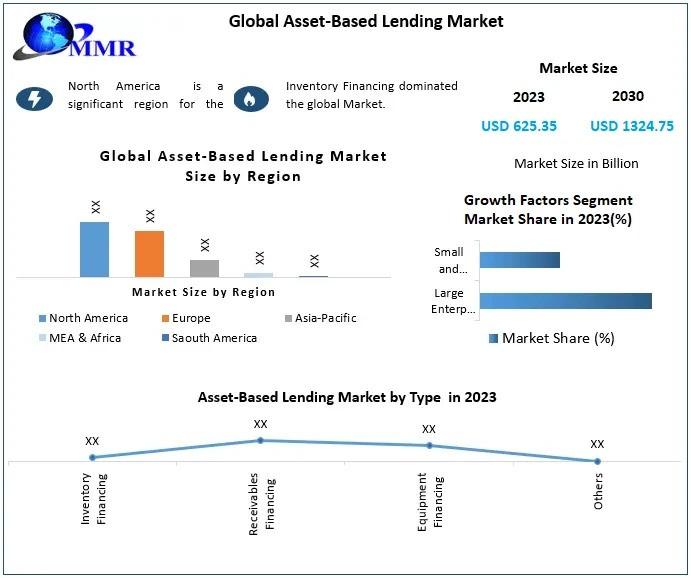

Asset-Based Lending Market Set to Surge at 11.32% CAGR, Anticipating a Staggering USD 1324.75 Billion by 2030"

Asset-Based Lending Market Report Scope and Research Methodology :The Asset-Based Lending Market Report provides a comprehensive and insightful analysis of the industry, offering a detailed scope and employing a rigorous research methodology. The scope of the report encompasses a thorough examination of the current market trends, key players, and factors influencing the growth of the Asset-Based Lending market. This includes an in-depth assessment of various types of Asset-Based Lending, their applications, and regional market dynamics. The report also explores market drivers, challenges, and opportunities, providing a holistic understanding of the market landscape.

In terms of research methodology, the report employs a systematic approach to gather and analyze relevant data. Primary research involves direct interactions with industry experts, key stakeholders, and market participants to obtain valuable insights. Secondary research includes a comprehensive review of existing literature, industry reports, and statistical data to validate and enhance the findings. The combination of primary and secondary research ensures the accuracy and reliability of the information presented in the Asset-Based Lending Market Report, making it a valuable resource for stakeholders, investors, and decision-makers in the healthcare and medical devices industry.

Click here to access the Free Sample Report:https://www.maximizemarketresearch.com/request-sample/189641

Asset-Based Lending Market Dynamics:

The dynamics of the Asset-Based Lending (ABL) market are undergoing a significant transformation, propelled by the increasing demand for flexible financing solutions. In 2023, the market witnessed a robust valuation of USD 625.35 Billion, marking a substantial foundation for future growth. The key drivers behind this expansion include the rising awareness among businesses about the advantages of asset-based lending, such as improved liquidity, operational flexibility, and access to working capital. As companies seek alternatives to traditional financing methods, ABL emerges as a strategic choice, enabling enterprises to leverage their assets effectively for securing loans. The market dynamics are further shaped by the adaptability of asset-based lending to various industries, fostering its adoption across sectors like manufacturing, retail, and services.

Looking ahead, the Asset-Based Lending market is poised for a remarkable journey, with a projected Compound Annual Growth Rate (CAGR) of 11.32% from 2024 to 2030. This forecast signifies the escalating confidence of businesses in the efficacy of ABL and its ability to meet evolving financial needs. The anticipated growth, reaching nearly USD 1324.75 Billion by 2030, reflects a paradigm shift in financing preferences, where asset-based lending continues to gain prominence as a dynamic and responsive solution in the ever-changing global economic landscape. The evolving market dynamics not only indicate the expanding role of ABL in the financial ecosystem but also underscore its potential to drive economic resilience and facilitate sustainable business development.

Get to Know More About This Market Study:https://www.maximizemarketresearch.com/market-report/asset-based-lending-market/189641/

What is Asset-Based Lending Market Segmentation:

by Type

Inventory Financing

Receivables Financing

Equipment Financing

Others

by Interest Rate

Fixed Rate

Floating Rate

by End User

Large Enterprises

Small and Medium-sized Enterprises

Request For Free Inquiry Report:https://www.maximizemarketresearch.com/inquiry-before-buying/189641

Who are Asset-Based Lending Market Key Players:

1.Lloyds Bank

2.Barclays Bank PLC

3. Hilton-Baird Group

4. JPMorgan Chase & Co

5. Berkshire Bank

6.White Oak Financial, LLC

7.Wells Fargo

8. Porter Capital

9.Capital Funding Solutions Inc.

10.SLR Credit Solutions

11.Fifth Third Bank

12.HSBC Holdings plc

12. SunTrust Banks, Inc. (now part of Truist Financial Corporation)

13. Santander Bank, N.A.

14.KeyCorp

15.BB&T Corporation (now part of Truist Financial Corporation)

16. Goldman Sachs Group, Inc.

Request For Free Sample Report :https://www.maximizemarketresearch.com/request-sample/189641

Asset-Based Lending Market Regional Insights:

Regional insights into the Asset-Based Lending (ABL) market reveal a nuanced landscape shaped by diverse economic conditions and regulatory environments. North America stands as a robust hub for asset-based lending, with the United States spearheading market growth. The region's mature financial infrastructure, coupled with a thriving entrepreneurial spirit, fosters a conducive environment for businesses seeking flexible financing options. Furthermore, the North American ABL market benefits from a proactive regulatory framework that encourages the utilization of assets as collateral, contributing to the market's overall stability and growth. As the region continues to witness technological advancements and a dynamic business landscape, the Asset-Based Lending market in North America is poised to capitalize on emerging opportunities and play a pivotal role in shaping the financial landscape.

In contrast, the Asset-Based Lending market in the Asia-Pacific (APAC) region is characterized by rapid expansion and evolving dynamics. Countries like China and India are becoming key players in the ABL landscape, driven by a surge in entrepreneurial activities and an increasing appetite for non-traditional financing solutions. The diverse economies in the region, ranging from developed markets to emerging ones, present unique challenges and opportunities for asset-based lending providers. As businesses in APAC seek agile financial solutions to fuel their growth, the ABL market is witnessing a paradigm shift with a notable increase in adoption. The regional dynamics underscore the global nature of asset-based lending, highlighting its adaptability to varying market conditions and its role in supporting businesses across different stages of development in the Asia-Pacific region.

Table of content for the Asset-Based Lending Market includes:

1. Global Asset-Based Lending Market: Research Methodology

1. Global Asset-Based Lending Market : Executive Summary

• Market Overview and Definitions

• Introduction to the Global Market

• Summary

• Key Findings

• Recommendations for Investors

• Recommendations for Market Leaders

• Recommendations for New Market Entry

3.Global Asset-Based Lending Market: Competitive Analysis

• MMR Competition Matrix

• Market Structure by region

• Competitive Benchmarking of Key Players

• Consolidation in the Market

• M&A by region

• Key Developments by Companies

• Market Drivers

• Market Restraints

• Market Opportunities

• Market Challenges

• Market Dynamics

• PORTERS Five Forces Analysis

• PESTLE

• Regulatory Landscape by region

• North America

• Europe

• Asia Pacific

• Middle East and Africa

• South America

• COVID-19 Impact

4 . Company Profile: Key players

• Company Overview

• Financial Overview

• Global Presence

• Capacity Portfolio

• Business Strategy

• Recent Developments

Key Offerings:

• Past Market Size and Competitive Landscape

• Past Pricing and price curve by region

• Market Size, Share, Size and Forecast by different segment

• Market Dynamics - Growth Drivers, Restraints, Opportunities, and Key Trends by region

• Market Segmentation - A detailed analysis by growth and trend

• Competitive Landscape - Profiles of selected key players by region from a strategic perspective

• Competitive landscape - Market Leaders, Market Followers, Regional player

• Competitive benchmarking of key players by region

• PESTLE Analysis

• PORTER's analysis

• Value chain and supply chain analysis

• Legal Aspects of business by region

• Lucrative business opportunities with SWOT analysis

• Recommendations

More Related Reports:

Electronic Health Records Market(EHR) https://www.maximizemarketresearch.com/market-report/global-electronic-health-records-market/17991/

Neuromorphic Chip Market https://www.maximizemarketresearch.com/market-report/neuromorphic-chip-market/14778/

Global Middle Ear Implants Market https://www.maximizemarketresearch.com/market-report/global-middle-ear-implants-market/81847/

Rheumatoid Arthritis Drugs Market https://www.maximizemarketresearch.com/market-report/rheumatoid-arthritis-drugs-market/38331/

Global Cell and Gene Therapy Manufacturing Market https://www.maximizemarketresearch.com/market-report/cell-and-gene-therapy-manufacturing-market/122036/

Global Portable Ultrasound Equipment Market https://www.maximizemarketresearch.com/market-report/global-portable-ultrasound-equipment-market/70249/

Global Hair Removal Devices Market https://www.maximizemarketresearch.com/market-report/global-hair-removal-devices-market/98957/

Global Commercial Bar Refrigeration Equipment Market https://www.maximizemarketresearch.com/market-report/global-commercial-bar-refrigeration-equipment-market/88884/

Pulse Generator Market https://www.maximizemarketresearch.com/market-report/pulse-generator-market/146392/

Global Positive Material Identification Market https://www.maximizemarketresearch.com/market-report/global-positive-material-identification-market/3146/

MAXIMIZE MARKET RESEARCH PVT. LTD.

⮝ 3rd Floor, Navale IT park Phase 2,

Pune Banglore Highway, Narhe

Pune, Maharashtra 411041, India.

✆ +91 9607365656

🖂 sales@maximizemarketresearch.com

🌐 www.maximizemarketresearch.com

About Us

Maximize Market Research is one of the fastest-growing market research and business consulting firms serving clients globally. Our revenue impact and focused growth-driven research initiatives make us a proud partner of majority of the Fortune 500 companies. We have a diversified portfolio and serve a variety of industries such as IT & telecom, chemical, food & beverage, aerospace & defense, healthcare and others.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Asset-Based Lending Market Set to Surge at 11.32% CAGR, Anticipating a Staggering USD 1324.75 Billion by 2030" here

News-ID: 3383850 • Views: …

More Releases from MAXIMIZE MARKET RESEARCH PVT. LTD.

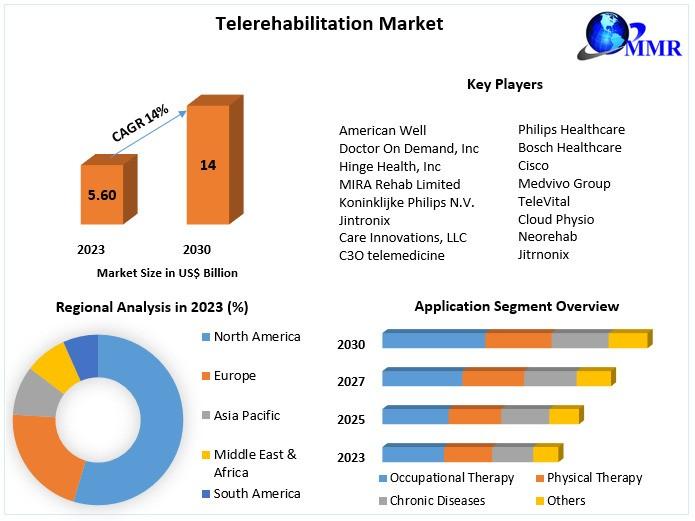

Telerehabilitation Market is expected to grow by 14% from 2024 to 2030, reaching …

Telerehabilitation Market Overview

Maximize Market Research is a Business Consultancy Firm that has published a detailed analysis of the "Telerehabilitation Market". The report includes key business insights, demand analysis, pricing analysis, and competitive landscape. The analysis in the report provides an in-depth aspect at the current status of the Telerehabilitation market, with forecasts outspreading to the year 2030.

Immediate Delivery Available, Buy Now :https://www.maximizemarketresearch.com/request-sample/167363

Telerehabilitation Market Scope and Methodology:

The report discusses the strategy…

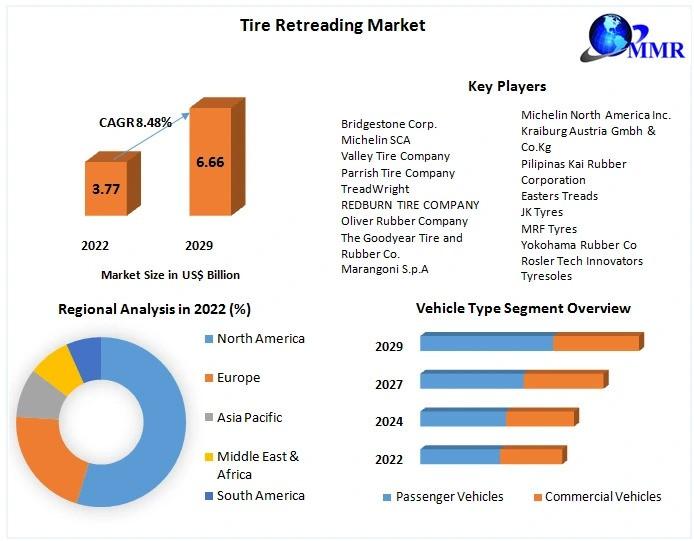

Tire Retreading Market Valued at $4.08 Billion in 2023, Set to Grow at 8.48% CAG …

Tire Retreading Market Overview

Maximize Market Research, a Tire Retreading business research firm has published a report on the "Tire Retreading Market". Which provides Industry Analysis (Market Performance, Segments, Price Analysis, and Outlook) and detailed Process Flow (Product Overview, Unit Operations, Raw Materials, and Quality Assurance).

Get to Know More About This Market Study:https://www.maximizemarketresearch.com/market-report/global-tire-retreading-market/81491/

Tire Retreading Market Report Scope and Research Methodology

The Tire Retreading market report thoroughly analyses the worldwide industry and…

Wireless Security Camera Market is expected to grow at 12.5% of CAGR through 202 …

Wireless Security Camera Market Overview

Maximize Market Research is a Business Consultancy Firm that has published a detailed analysis of the "Wireless Security Camera Market". The report includes key business insights, demand analysis, pricing analysis, and competitive landscape. The analysis in the report provides an in-depth aspect at the current status of the Wireless Security Camera market, with forecasts outspreading to the year 2030.

Immediate Delivery Available, Buy Now :https://www.maximizemarketresearch.com/request-sample/166957

Wireless Security Camera…

Private Tutoring Market Expected to Reach $152.91 Billion by 2030, Growing at 8. …

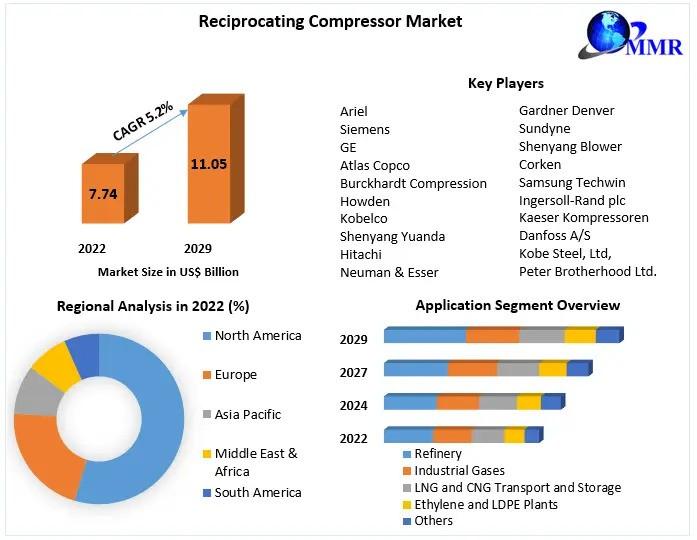

Reciprocating Compressor Market Overview

Maximize Market Research, a Reciprocating Compressor business research firm has published a report on the "Reciprocating Compressor Market". Which provides Industry Analysis (Market Performance, Segments, Price Analysis, and Outlook) and detailed Process Flow (Product Overview, Unit Operations, Raw Materials, and Quality Assurance).

Get to Know More About This Market Study:https://www.maximizemarketresearch.com/market-report/global-reciprocating-compressor-market/57089/

Reciprocating Compressor Market Report Scope and Research Methodology

The Reciprocating Compressor market report thoroughly analyses the worldwide industry and…

More Releases for Lending

P2p Lending Market | Industry Overview 2021 | Worldwide Companies- CircleBack Le …

P2p Lending Market report will provide one with overall market analysis, statistics, various trends, drivers, opportunities, restraints, and every minute data relating to the Synthetic Fibers market necessary for forecasting its revenue, factors propelling & growth. The P2p Lending market study provides unique guidance in thoughtful details regarding the development factors and has used a top-down and bottom-up approach to keep it error-free and accurate. Our expert analysts have used…

Peer-to-peer Lending – Growing Popularity and Emerging Trends in the Market | …

Global Peer-to-peer Lending Market Size, Status and Forecast 2018-2025 is latest research study released by HTF MI evaluating the market, highlighting opportunities, risk side analysis, and leveraged with strategic and tactical decision-making support. The study provides information on market trends and development, drivers, capacities, technologies, and on the changing investment structure of the Global Peer-to-peer Lending Market. Some of the key players profiled in the study are CircleBack Lending, Lending…

P2P Lending Market is Thriving Worldwide | CircleBack Lending, Lending Club, Pee …

Global P2P Lending Market Size, Status and Forecast 2025 is latest research study released by HTF MI evaluating the market, highlighting opportunities, risk side analysis, and leveraged with strategic and tactical decision-making support. The study provides information on market trends and development, drivers, capacities, technologies, and on the changing investment structure of the Global P2P Lending Market. Some of the key players profiled in the study are CircleBack Lending, Lending…

P2P Lending 2018 Global Market Key Players – CircleBack Lending, Lending Club, …

P2P Lending Market 2018

Wiseguyreports.Com Adds “P2P Lending – Global Market Demand, Growth, Opportunities, Manufacturers, Analysis of Top Key Players and Forecast to 2025” To Its Research Database.

Description:

This report studies the global P2P Lending market, analyzes and researches the P2P Lending development status and forecast in United States, EU, Japan, China, India and Southeast Asia. This report focuses on the top players in global market, like

CircleBack Lending

Lending Club

Peerform

Prosper

Upstart

Funding Circle

PwC

SoFi

LendingTree

GuidetoLenders

EvenFinacial

Creditease

Request for Sample Report@ https://www.wiseguyreports.com/sample-request/2842620-global-p2p-lending-market-size-status-and-forecast-2025

Market segment by Regions/Countries,…

Global Peer-to-peer Lending Market 2018: Key Players – CircleBack Lending, Len …

Summary

WiseGuyReports.com adds “Peer-to-peer Lending Market 2018 Global Analysis, Growth, Trends and Opportunities Research Report Forecasting to 2023” reports to its database.

This report provides in depth study of “Peer-to-peer Lending Market” using SWOT analysis i.e. Strength, Weakness, Opportunities and Threat to the organization. The Peer-to-peer Lending Market report also provides an in-depth survey of key players in the market which is based on the various objectives of an organization such as…

P2P Lending 2018 Global Market Key Players – CircleBack Lending, Lending Club, …

P2P Lending Market 2018

Wiseguyreports.Com Adds “P2P Lending – Global Market Demand, Growth, Opportunities, Manufacturers, Analysis of Top Key Players and Forecast to 2025” To Its Research Database.

Description:

This report studies the global P2P Lending market, analyzes and researches the P2P Lending development status and forecast in United States, EU, Japan, China, India and Southeast Asia. This report focuses on the top players in global market, like

CircleBack Lending

Lending Club

Peerform

Prosper

Upstart

Funding Circle

PwC

SoFi

LendingTree

GuidetoLenders

EvenFinacial

Creditease

Request for Sample Report@ https://www.wiseguyreports.com/sample-request/2842620-global-p2p-lending-market-size-status-and-forecast-2025

Market segment by Regions/Countries,…