Press release

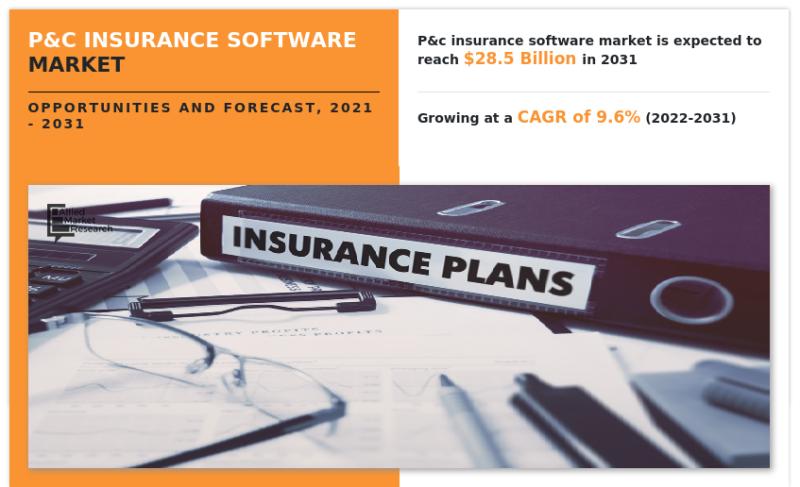

P&C Insurance Software Market to Garner $28.5 Bn, Globally, by 2031 at 9.6% CAGR | Increase in Digital Transforming Among Industries

Allied Market Research recently published a report, titled, "P&C Insurance Software Market by Component (Software, Service), by Deployment Model (On Premise, Cloud), by Application (Claims, Underwriting, Operations, Others): Global Opportunity Analysis and Industry Forecast, 2021-2031". As per the report, the global P&C insurance software industry accounted for $11.6 billion in 2021 and is expected to reach $28.5 billion by 2031, growing at a CAGR of 9.6% from 2022 to 2031. The report provides an in-depth analysis of changing market trends, key investment pockets, top segments, regional landscape, value chain, and competitive scenario.𝐑𝐞𝐪𝐮𝐞𝐬𝐭 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐑𝐞𝐩𝐨𝐫𝐭 𝐒𝐚𝐦𝐩𝐥𝐞 & 𝐓𝐎𝐂:

https://www.alliedmarketresearch.com/request-sample/31774

Major determinants of the market growth

Rise in digital transformation among industries and surge in penetration of internet & mobile devices have boosted the growth of the global P&C insurance software market. Moreover, increase in need for finance among businesses and people to insure property supplemented the market growth. However, strict rules imposed by banks and financial institutions for offering housing finance hinder the market growth. On the contrary, increase in the prices of real estate properties in developing economies and the growth of metropolitan cities are expected to open new opportunities in the future.

Covid-19 scenario:

During the Covid-19 pandemic, the P&C insurance software market suffered significantly due to strict rules of lockdown imposed by several government bodies and shutdown of businesses across the world.

The fact that construction activities were disrupted during the pandemic and people postponed their home purchasing plans due to economic instability hampered the market

The software segment dominated the market

By component, the software segment held the largest share in 2021, accounting for nearly three-fifths of the global P&C insurance software market, due to technological advancement and strategies such as cloud technology to provide the insurance services like sales, policy administration, and claims management. However, the service segment is estimated to register the highest CAGR of 10.9% during the forecast period, owing to rise in adoption of the insurer's needs to manage the entire claim lifecycle by reducing costs, increasing productivity, and by providing various P&C insurance software services.

𝐕𝐢𝐞𝐰 𝐅𝐮𝐥𝐥 𝐑𝐞𝐩𝐨𝐫𝐭:

https://www.alliedmarketresearch.com/p&c-insurance-software-market-A31324

The cloud segment to portray the highest CAGR through 2031

By deployment model, the cloud segment is projected to manifest the highest CAGR of 11.0% from 2022 to 2031, due to number of benefits, such as cost management, resource pooling, and quicker installation, cloud-based solutions are becoming more popular. However, the on-premise segment held the largest share in 2021, contributing to around three-fifths of the global P&C insurance software market, as it allows installation of the software and enables applications to run on existing systems on the premises of organizations, rather than at a distant facility such as server space or cloud.

𝐈𝐧𝐪𝐮𝐢𝐫𝐞 𝐁𝐞𝐟𝐨𝐫𝐞 𝐁𝐮𝐲𝐢𝐧𝐠:

https://www.alliedmarketresearch.com/purchase-enquiry/31774

The claims segment held the largest share

By application, the claims segment dominated the market in terms of revenue in 2021, accounting for nearly two-fifths of the global P&C insurance software market as it helps insurers to manage and evaluate insurance claims such as litigation, negotiation, settlement communications, relevant policy information, and claim assessments. However, the operations segment is projected to showcase the highest CAGR of 11.6% during the forecast period, due to increased demand for P&C insurance software in sales and distribution management.

North America held the lion's share

By region, the global P&C insurance software market across North America dominated in 2021, accounting for nearly two-fifths of the market, due to rise in demand for P&C Insurance Software solutions in the North American region and increase in adoption of digital lending platforms among banking and financial services for improving financing services. However, the market across Asia-Pacific is expected to register the highest CAGR of 11.5% during the forecast period, due to increase in awareness related to the significant advantage of P&C insurance software among the population.

𝐑𝐞𝐪𝐮𝐞𝐬𝐭 𝐂𝐮𝐬𝐭𝐨𝐦𝐢𝐳𝐚𝐭𝐢𝐨𝐧:

https://www.alliedmarketresearch.com/request-for-customization/31774

Major market players

Agency Software Inc.

ClarionDoor

Duck Creek Technologies

Guidewire Software, Inc.

InsuredMine

PCMS Software

Pegasystems Inc.

Quick Silver Systems, Inc.

WTW

Zywave, Inc.

The report analyzes these key players in the global P&C insurance software market. These companies have adopted several strategies such as partnerships, expansion, collaborations, new product launches, and mergers & acquisitions to maintain their foothold in the industry. In addition, the report is essential in determining the business performance, product portfolio, operating segments, and developments of every market player.

Related Reports:

Financial Risk Management Software Market : https://www.alliedmarketresearch.com/financial-risk-management-software-market-A47377

RPA in Insurance Market : https://www.alliedmarketresearch.com/rpa-in-insurance-market-A53549

Pension Administration Software Market : https://www.alliedmarketresearch.com/pension-administration-software-market-A47386

Fingerprint Payment Market : https://www.alliedmarketresearch.com/fingerprint-payment-market-A12966

Exchange Traded Fund Market : https://www.alliedmarketresearch.com/exchange-traded-fund-market-A31686

Blockchain In Retail Banking Market : https://www.alliedmarketresearch.com/blockchain-in-retail-banking-market-A31695

1209 Orange Street,

Corporation Trust Center,

Wilmington, New Castle,

Delaware 19801 USA.

Int'l: +1-503-894-6022

Toll Free: +1-800-792-5285

Fax: +1-800-792-5285

help@alliedmarketresearch.com

About Us:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Wilmington, Delaware. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of "Market Research Reports Insights" and "Business Intelligence Solutions." AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

We are in professional corporate relations with various companies and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Allied Market Research CEO Pawan Kumar is instrumental in inspiring and encouraging everyone associated with the company to maintain high quality of data and help clients in every way possible to achieve success. Each data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release P&C Insurance Software Market to Garner $28.5 Bn, Globally, by 2031 at 9.6% CAGR | Increase in Digital Transforming Among Industries here

News-ID: 3360344 • Views: …

More Releases from www.alliedmarketresearch.com

Personal Loans Market: Surging Towards $719.31 Billion Globally by 2030 with 31. …

Allied Market Research published a report, titled, "Personal Loans Market By Type (P2P Marketplace Lending and Balance Sheet Lending), Age (Less than 30, 30-50, and More than 50), Marital Status (Married, Single, and Others), and Employment Status (Salaried and Business): Global Opportunity Analysis and Industry Forecast, 2021-2030."

➡️𝐑𝐞𝐪𝐮𝐞𝐬𝐭 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐑𝐞𝐩𝐨𝐫𝐭 𝐒𝐚𝐦𝐩𝐥𝐞 & 𝐓𝐎𝐂 :

https://www.alliedmarketresearch.com/request-sample/A07580

According to the report, the global personal loans industry generated $47.79 billion in 2020, and is…

Australian Bank Guarantee Market: Scaling to $645.71 Million by 2030 | DBS Bank, …

According to the report published by Allied Market Research, the Australia bank guarantee market generated $348.16 million in 2020, and is expected to reach $645.71 million by 2030, witnessing a CAGR of 6.4% from 2021 to 2030. The report provides a detailed analysis of changing market dynamics, key segments, top investment pockets, regional scenarios, value chain, and competitive landscape.

➡️𝐃𝐨𝐰𝐧𝐥𝐨𝐚𝐝 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐑𝐞𝐩𝐨𝐫𝐭 𝐒𝐚𝐦𝐩𝐥𝐞 & 𝐓𝐎𝐂 : https://www.alliedmarketresearch.com/request-sample/A13110

Reduction in the chances of…

Empowering Decisions: Predictive Analytics in Banking Market to Hit $5.43 Billio …

Allied Market Research published a report, titled, "Predictive Analytics in Banking Market By Component (Solution and Service), Deployment Model (On-Premise and Cloud), Organization Size (Large Enterprise and SME), Application (Fraud Detection and Prevention, Customer Management, Sales and Marketing, Workforce Management and Others): Global Opportunity Analysis and Industry Forecast, 2019-2026."

➡️𝐃𝐨𝐰𝐧𝐥𝐨𝐚𝐝 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐑𝐞𝐩𝐨𝐫𝐭 𝐒𝐚𝐦𝐩𝐥𝐞 & 𝐓𝐎𝐂 : https://www.alliedmarketresearch.com/request-sample/232

According to the report, global predictive analytics in the banking market garnered $1.20 billion…

Asia-Pacific Wealth Management Market Forecasted to Reach $811.5 Billion by 2030 …

According to the report published by Allied Market Research, the Asia-Pacific wealth management market generated $247.8 billion in 2020, and is projected to reach $811.5 billion by 2030, witnessing a CAGR of 12.7% from 2021 to 2030. The report provides a detailed analysis of changing market dynamics, top segments, value chain, key investment pockets, regional scenario, and competitive landscape.

➡️𝐑𝐞𝐪𝐮𝐞𝐬𝐭 𝐂𝐮𝐬𝐭𝐨𝐦𝐢𝐳𝐚𝐭𝐢𝐨𝐧 𝐖𝐞 𝐨𝐟𝐟𝐞𝐫 𝐜𝐮𝐬𝐭𝐨𝐦𝐢𝐳𝐞𝐝 𝐫𝐞𝐩𝐨𝐫𝐭 𝐚𝐬 𝐩𝐞𝐫 𝐲𝐨𝐮𝐫 𝐫𝐞𝐪𝐮𝐢𝐫𝐞𝐦𝐞𝐧𝐭 : …

More Releases for P&C

Global P&C Insurance Software Market Analysis (2020-2025)

Global Info Research offers a latest published report on P&C Insurance Software Analysis and Forecast 2020-2025 delivering key insights and providing a competitive advantage to clients through a detailed report. This report focuses on the key global P&C Insurance Software Concentrate players, to define, describe and analyze the value, market share, market competition landscape, SWOT analysis and development plans in next few years.

Click to view the full report TOC, figure…

P&C Insurance Software Market Share by 2025: QY Research

Global P&C Insurance Software market report is first of its kind research report that covers the overview, summary, market dynamics, competitive analysis, and leading player’s various strategies to sustain in the global market. This report covers five top regions of the globe and countries within, which shows the status of regional development, consisting of market value, volume, size, and price data. Apart from this, the report also covers detail information…

P&C Insurance Software Market to Witness Robust Expansion by 2024

LP INFORMATION offers a latest published report on P&C Insurance Software Market Analysis and Forecast 2019-2024 delivering key insights and providing a competitive advantage to clients through a detailed report.

According to this study, over the next five years the P&C Insurance Software market will register a xx% CAGR in terms of revenue, the global market size will reach US$ xx million by 2024, from US$ xx million in 2019.…

Global Breathable Film Market 2019 - Mitsui Chemicals, Daedong, Hans Chemical, H …

This new report by Eon Market Research, titled “Global Breathable Film Market 2019 Research Report, 2015 – 2025” offers a comprehensive analysis of Breathable Film industry at a global as well as regional and country level. Key facts analyzed in this report include the Breathable Film market size by players, regions, product types and end industries, history data 2014-2018 and forecast data 2019-2025. This report primarily focuses on the study…

Insurance Brokerage Market Report 2018: Segmentation by Product (Commercial P&C, …

Global Insurance Brokerage market research report provides company profile for Meadowbrook Insurance Group, Jardine Lloyd Thompson Group, BB&T Insurance Services, Wells Fargo Insurance Services, National Financial Partners and Others.

This market study includes data about consumer perspective, comprehensive analysis, statistics, market share, company performances (Stocks), historical analysis 2012 to 2017, market forecast 2018 to 2025 in terms of volume, revenue, YOY growth rate, and CAGR for the year 2018 to…

Global Insurance Software Market Size, Industry, Top Players (Microsoft, Oracle, …

A newly compiled business intelligent report, titled “Global Insurance Software Market Size, Status and Forecast 2025”has been publicized to the vast archive of Market Research Hub (MRH) online repository. The study revolves around the analysis of Insurance Software Market covering key industry developments and market opportunity map during the mentioned forecast period 2025. This report further conveys quantitative & qualitative analysis on the concerned market, providing a 360 view on…