Press release

Money Habitudes: How To Be Rich in Life & Love wins Excellence in Financial Literacy Education Award

The Dibble Institute and LifeWise Strategies announce that their collaboration, Money Habitudes: How To Be Rich in Life & Love, has won this year's Excellence in Financial Literacy Education (EIFLE) Award for Children’s Education Program of the Year in the Financial Responsibility and Decision Making category. Awards were presented at this week's Annual Conference on Financial Education, held in Orlando.The EIFLE financial education award is bestowed by the Institute for Financial Literacy. It acknowledges innovation, dedication, and the commitment of those that support financial literacy education. Money Habitudes: How To Be Rich in Life & Love: A curriculum about money and relationships, introduces teens to the human, emotional side of money. With a behavioral economics approach, the teen financial literacy curriculum is an important precursor to financial literacy courses. The engaging personal finance curriculum helps teens identify their personal finance patterns, how these affect their goals and relationships, and ways to use this financial self-assessment to be more successful.

"Money is such an important issue for teens – both in terms of how they relate to others and how they establish their lifelong saving and spending habits. It's a great honor for our financial education curriculum to be recognized by the Institute for Financial Literacy," noted, Kay Reed, Executive Director of The Dibble Institute.

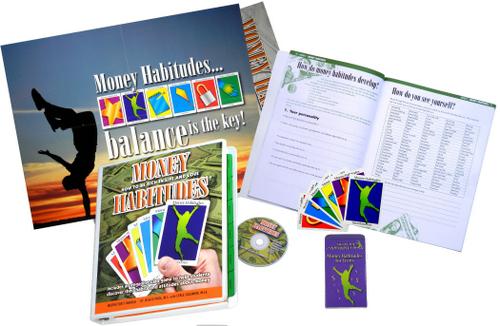

How To Be Rich in Life & Love includes a teacher guide, student workbook journal, CD, posters, and Money Habitudes cards, the foundation of the program. A hands-on teaching tool, Money Habitudes cards are a fun, instructional game that functions as both a financial ice breaker and a money conversation starter. First released in 2003, separate versions of the durable Money Habitudes cards are designed for adults, young adults and teens (high school); an adult version is also available in Spanish. The cards are widely used in programs focused on financial education, asset building, life skills, marriage and relationship education, financial planning, and career counseling.

"It is often very difficult for people to talk about money. The idea behind Money Habitudes was to make talking about money fun and to help people understand their money type in an engaging, nonjudgmental, non-threatening way – whether they are adults or high school students," said Syble Solomon, the creator of Money Habitudes. "It's been very rewarding to partner with The Dibble Institute to help teens learn about money and especially how money messages can affect relationships."

Last year, the financial literacy cards were chosen as The Washington Post's personal finance selection of the month. Previously, Solomon was named Educator of the Year by the Association for Financial Counseling and Planning Education for developing the tool. She also received the Smart Marriages Impact Award from the Coalition for Marriage, Family and Couples Education for effectively bridging the gap between finances and couples communication; money is the number one reason why couples fight.

The financial literacy curriculum can be used on its own or as a supplement to other personal finance and economics curricula such as FDIC's Money Smart and financial capability curricula developed by NEFE, FEFE, etc. How To Be Rich in Life & Love integrates with state and national standards for personal finance education. It is included in the national Jump$tart clearinghouse for financial education resources.

Other winners of the 2012 Excellence in Financial Literacy Education Awards include: Fastweb, Real Money Talk for Women, Cha-Ching: Money Smart Kids, MoneyIsland, and Consolidated Credit Counseling Services. Previous EIFLE Award winners include: Thrivent Financial, Feed The Pig, Pioneer Services, InCharge Education Foundation, Moonjar, Financial Finesse, Susan Beacham and Lynnette Khalfani-Cox, NEFE High School Financial Planning Program, D2D Fund, and Awesome Island.

About The Dibble Institute:

The Dibble Institute for Marriage Education, a nonprofit organization, helps young people learn how to create healthy romantic relationships now and in the future. The institute offers tools for teaching the practical skills essential for enhancing friendships, dating and love. Just as important, it assists teens in creating the personal vision that keeps them on a positive path. Dibble’s research-based, best practices programs are widely used across the country in classrooms, social agencies, after-school programs and other youth settings. Dibble also actively advocates for including relationship education in school curricula. The Institute is nonpartisan and nonsectarian. Funding for its activities comes from sales of educational materials, training and consulting services. It enjoys support from government grants and gifts from foundations, corporations and individuals.

Kay Reed

President and Executive Director

The Dibble Institute

800-695-7975

kayreed@dibbleinstitute.org

P. O. Box 7881

Berkeley, CA 94707-0881

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Money Habitudes: How To Be Rich in Life & Love wins Excellence in Financial Literacy Education Award here

News-ID: 218482 • Views: …

More Releases from LifeWise

Credit curriculum provides a better way to teach classes on credit reports, cred …

LifeWise Strategies announces the release of The Good Credit Game, an innovative curriculum kit for teaching credit classes. The credit curriculum stands out for its emphasis on being fun – both for financial educators and for students learning about credit reports, credit scores and credit cards.

The Good Credit Game addresses the large gap in knowledge about understanding, establishing, using and repairing credit. The FTC found that one in four consumers…

More Releases for Money

Lionlung breath trainer review 2021: Is this product a waste of money?money

LIONLUNG BREATH TRAINER REVIEWS

In as much as shortness of breath is a natural occurrence, it should not be ignored at all. It is something you have to keep paying attention

The truth is that you don’t have to be sick or something to experience shortness of breath. Recent studies show that even healthy individuals can experience this phenomenon. Common cases may be seen in anxiety, when anxiety sets in, it…

Money Management in India

Core Financial Solution (CFS) is committed to providing independent and unbiased financial advice, keeping your interest at the forefront . At CFS, your financial issues are addressed, evaluated, implemented and monitored, all under one roof in a comprehensive, disciplined and coordinated way. We are in your city Jaipur to provide your with Money Management in Jaipur who look after your financial matter.

We provide you money management in Mumbai (Maharashtra)…

Lost Money, Found Money – The Search That Could Make It Happen

For those who have ever found money in the couch, there may be an opportunity to find much more with a new lost money database.

April 12th, 2012 – A new lost money database is doing its part to help states and the Federal government return billions of dollars to millions of U.S. citizens. For those who have ever found money in the couch cushions or on the floorboard of a…

Restaurants – Make money from Facebook

SocialAppsHQ, a fast growing social media platform, released a new app ‘My Restaurant’ specifically designed to help restaurants to directly engage with customers on Facebook. This unprecedented blend of customer engagement and easy to use platform will change the way restaurant stay in touch with their customers and drive sales by new customer acquisitions.

Restaurant business is customer centric where loyalty and brand holds a lot of value. With restaurants mushrooming…

Money Simplified is Back!

PersonalFN has relaunched Money Simplified, one of the best and most favorite financial planning guides on the internet.

Money Simplified is a free E-guide focused on investor education and covers various aspects of personal finance and financial planning. It has been a rich source of well researched information which helps investors to make appropriate investment decisions for managing their money.

The guide was originally started in 2003 and was published…

MRS Money Online Club Offers Dozens Of Ways To Make Money Online

Despite reports of an improving economy, many people are still losing their only source of employment, providing the impetus for many to seek fast money online. For those looking for work from home ideas, the MRS Money Online Club can help individuals liberate themselves from past due bills and other financial worries.

Membership Details http://mrsmoneyonlineclub.com

“Every day, thousands of people from all over the world make the decision that they would…